In a recent webinar by Dr. Sohini Chowdhury and David Fieldhouse with Moody’s Analytics, they examined the impact of COVID-19 on credit union delinquency in the coming months ahead as the nation tries to dig itself out of the economic devastation created by it.

Below are some insights from the webinar;

- Moody’s Analytics expects that auto and unsecured loan balances at credit unions will decline. However, it is expected that mortgage balances will continue to grow.

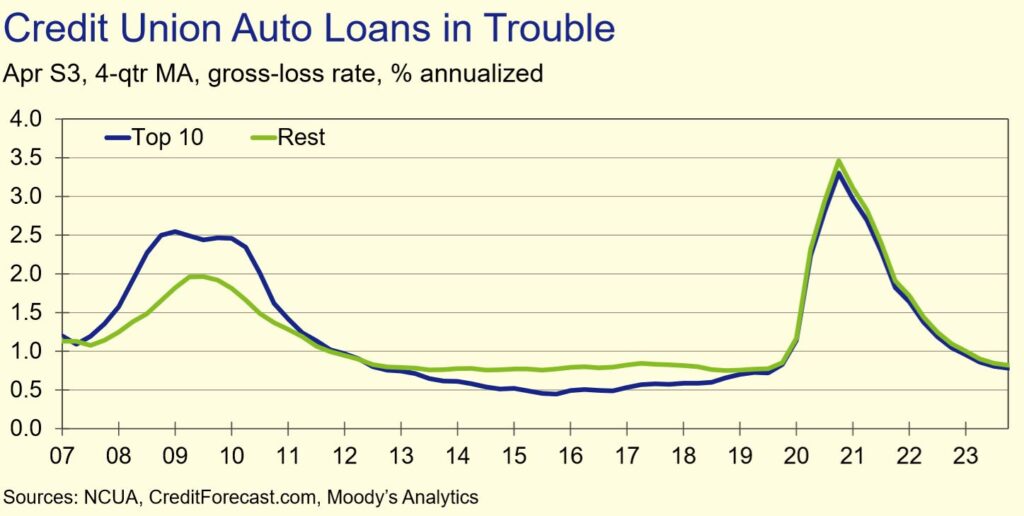

- Consumer loan default rates will trail the initial unemployment claims by six months to a year. This would result in a loss rate peak toward the end of this year or in the first half of next year.

- Credit Union Auto loans are an area of major concern. It is expected that the gross loss rates will peak at around 3.5%, which will be higher than the loss rates experienced during the “Great Recession”.

- According to the webinar, loss rates on credit cards will be in unchartered territory and will come quickly, especially at the largest credit unions.

Facebook Comments