Note: The article was written by ALS Resolvion with the input and data provided by the American Recovery Association.

Over the past year, there has been a great deal of discussion about the fees related to the removal and storage of personal property. The issue has resulted in significant changes by most lenders as to how personal property fees are handled. As one of the leading nationwide repossession management companies, we have dealt with the matter across many different lenders, and from our perspective, we often find that the issues associated with handling personal property fees are often misunderstood and underestimated. The remainder of this article will focus on shedding light on the matter.

What is Considered Personal Property?

Anything within a vehicle that is not attached to the vehicle, is defined as personal property. This includes clothes, shoes, bags and excludes custom vehicle equipment, stereo systems, etc.

Removal of Personal Property

After a vehicle repossession occurs, personal property remains in the vehicle and is transported to the agent’s secured facility for removal. Under state and local statutes, repossession agents are then required to follow a series of steps to ensure that proper measures are carried out. This includes creating a detailed inventory/personal property report of all property removed from the vehicle, removal of license plates, placing all personal property in a sealed dated box or bag and stored in a secure environment. In addition, agents must index and upload the personal property report to the debtor’s file. This entire process takes on average, anywhere between 25-35 minutes per vehicle which includes 15-20 minutes for two employees to clean out a vehicle and 10-15 minutes for one employee to finalize personal property content and secure the items in storage. In extreme situations, and with recreational vehicles or other vehicles used as residences, this process can require an hour or more to complete.

Separate & Secure Space

Most states require that the repossession agent secure and store personal property in a separate and monitored space. In addition to the cost of renting and maintaining the space, there are additional expenses relating to security, maintenance, monitoring, etc. This obviously varies by situation, size, etc. but the expense in not insignificant.

Inventory & Storage of Personal Property

Recovered items are usually required to be stored in a secured and monitored environment. Agents are also required to create and retain a detailed written inventory report. In some states a letter with a copy of the inventory must be sent to the debtor notifying them of their personal property being removed and in storage.

Return of Property

While returning property to the owner may seem pretty straightforward, it can be time consuming and tedious. Several steps are typically involved:

- Scheduling an appointment with the owner.

- Having the owner review, sign, and date a personal property release.

- Possibly assisting the debtor in carrying out personal property.

- Uploading the signed personal property release to the debtor’s file and maintaining the record pretty much indefinitely

This process takes 15- 45 minutes for one employee to complete, when everything goes smoothly. However, things don’t always go as planned (appointments missed, accusations of theft, damage, etc.) These issues involve even more time and costs.

Property Disposal

After the required hold period, the unclaimed personal property must be disposed of in a legally required method. Also, any NPPI (Non-Personal Public Information) has to be identified and placed in a secured area for shredding. The remaining items are either disposed of or given away to charitable organizations. Depending on the situation, this can take 15-60 minutes.

Other Possible Issues

In addition to all of the factors mentioned above, there are several other scenarios that can come into play in any given situation, adding to the time and cost involved:

- Returning vehicle license plates in accordance with state law.

- Proper dumpster removal and bio hazard material handling to an approved facility.

Cost Analysis

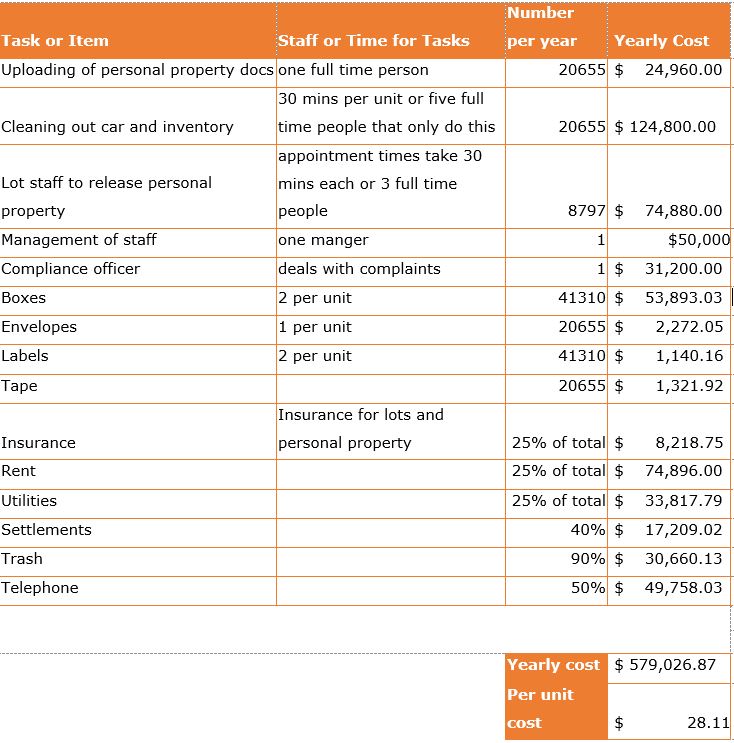

The table below provides a cost analysis, relating to the handling of personal property, provided by the American Recovery Association. It represents an actual case study by a large repossession agency. Per unit costs for smaller firms would likely be meaningfully higher.

In Conclusion

As discussed, and well documented above, there are numerous considerations to this critically necessary process and a clear financial impact to handle them properly. As lenders and forwarders grapple with regulator expectations on the handling of personal property, we all need to be mindful of the costs involved.

About ALS Resolvion

In August 2014, American Lending Solutions and Resolvion combined to form ALS l Resolvion. In doing so, two of the nation’s leading skip tracing and repossession management firms came together to form an industry leader capable of handling virtually any recovery assignment for virtually any type of equipment.

We offer a powerful combination of unique technology, efficient processes and skilled people, all working together to minimize loss and maximize recovery for our lender clients. Whenever and wherever needed, whether it’s across town or across the country, our highly skilled team is available to resolve even the most challenging of cases.

Based on the unique needs of each client, we design industry-leading, fully scalable and customized solutions. Our valued client partnerships cover the spectrum from super prime to title lenders and from small to large volume financial institutions. We uphold the most comprehensive compliance program in the industry, while maintaining the highest standard of professionalism. Our total commitment leads to our client’s total confidence.