EDITORIAL

With the never ending increases costs of repossession agency insurance, a solution rising in popularity is the use of Progressive Paloverde insurance. I’m not speaking of the cleverly marketed national carrier “Progressive”, but “Progressive Paloverde” insurance which provides policies that cover only the portion of business that a business conducts that are repossessions. These policies are intended for companies who do not solely function as repossession agencies and conduct basic tow functions or any other allowed services under the policy terms.

While these may seem adequate to protect the agency or lender in the event of legal action arising from catastrophic injury, collateral damage, truck damage or simple slip and fall incidents on an agencies lot, they can be riddled with inaccuracies reported to the insurance carrier that could leave both the agency and the lender denied in the event of claims.

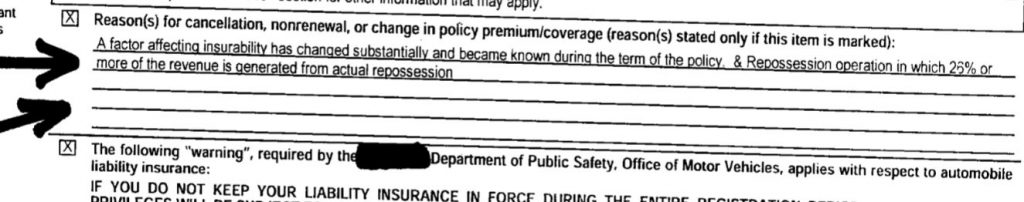

This exposure is created in the information provided to the actual policy carrier by the broker, who in some cases reported to myself, was very inaccurate if not out right purposefully fraudulent.

It has been brought to my attention by several agency owners, that at least one broker reporting to the carriers providing these policies, was grossly underreporting the estimated or actual numbers of repossessions conducted by the agency as well as the locations of the agencies trucks which were actually being run out of satellite offices and not the reported home office.

It’s easy to understand why an agency might opt for this type of policy. For some, they actually do operate primarily as a tow company or otherwise. For some, it’s just an easy way to save money with a name change. Either way, insurance carriers are always looking for a reason to decline a claim.

Risk, exposure and scale are some of the primary drivers of policy premiums and the premium costs are based upon the provided information. If this information is understated and found to be grossly and inaccurately reported, they have all the reason they need. I am not an attorney, but in my opinion, this could even be grounds for criminal charges of insurance fraud.

From a lender standpoint, please know what you’re looking at when you accept an insurance policy from your agents. A denied claim due to these reasons could cost your company tens of thousands of dollars or more. If you’re not sure, get some training. I’ll be glad to point you I the right direction.

From an agency point of view, please remember, there is nothing free in this world. Cutting corners on your insurance could cost you a small fortune, your clients, your company and perhaps your freedom.

“Penny Wise, Pound Foolish” –

Origin: “Least he (as it is wont to be sayd) be penny wise and pound foolish, least he I say, gather ashes, and cast away flower.”

Francis Meres’ Luis de Granada’s “Sinners Guyde” – 1598

Kevin Armstrong

Editor