EDITORIAL

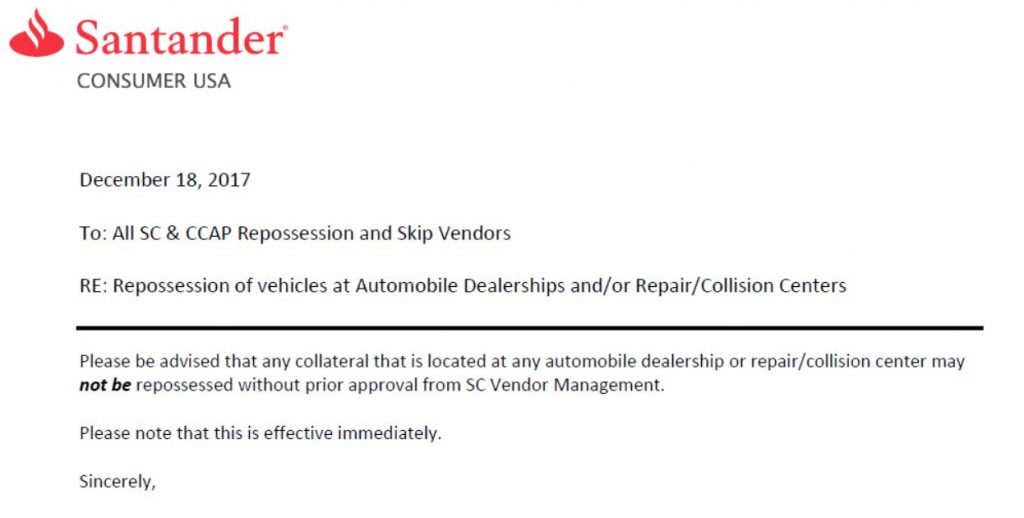

In a memo issued to all repossession agencies working for Santander and Chrysler on December 18th, 2017, Santander has declared that their agents are forbidden to perform repossessions at dealerships and auto repair or collision centers without expressed consent from Santander’s Vendor Management group.

On the surface, this appears rather banal and clearly an attempt to avoid damaging their relationships with dealers, but this also leaves some scenarios unanswered.

- What about the common parking areas, parking lots shared by dealerships in “auto mall” areas?

- What about dealership employees? No big surprise here, the world of auto sales can be “feast and famine” just like the repossession business and I can’t tell you how many times I’ve seen their salesmen, mechanics and even Finance Managers go out for repossession.

- What about when the Dealer is hiding the car for the borrower or repossessed it themselves, unlawfully, over a down payment check reversal? Yes, this does happen. I’ve seen it.

I have heard from several agents of situations where they enter a dealership and their LPR cameras go off with some frequency. I’ve even heard of several Santander cars in the LA County area where the agent has advised Santander multiple times over several months of these cars locations, but yet they remain unrecovered and unassigned to the locating agent.

In my screenwriting classes my teacher once told me an old writing saying that goes, “Less is More.” Unfortunately, sometimes less is just not enough and this seems to be one of those moments where “because I said so” only creates confusion on how to practice the demand and frustration for the lack of clarity on “Why?”

With Christmas repossession moratoriums coming down the pipes, this is yet one more lender mandated obstacle in doing what is already a difficult enough job that leaves many asking “What next?”

Kevin Armstrong

Editor

CUCollector