Live NorthLegal Webinar Next Week

The Servicemembers Civil Relief Act is about much more than lowering interest rates and (contrary to popular opinion) it does not always only kick in when you are told a borrower has been called to active service. In fact, portions of it apply even after active service has ended and even to loans obtained while the borrower was already on active service.

Courts, regulators and debtors’ attorneys are cracking down on SCRA violations, so it is absolutely necessary that every lender and collector be sure he or she understands this important law.

During this program, attorney Eric North will provide the information you need to make sure your institution understands and is in full compliance with the SCRA. Eric and participants will discuss—

• Whether you should have an SCRA Compliance Policy and, if so, what should be in it

• Which debts the SCRA does and does not cover (Hint: Coverage is not always limited to loans obtained before active service began!)

• What protection the SCRA gives to spouses and other dependents of a covered servicemember

• How the “six percent interest” rule works; when it begins, when it ends and how it applies

• How the SCRA affects security interests

• The HUD rule intended to make certain servicemembers aware of their rights under the SCRA

• What happens when the servicemember leaves active service

• Steps you can take to improve compliance and lessen risk

• Why it isn’t enough to know about the SCRA when dealing with borrowers in the military

• Common mistakes that have put creditors in trouble with regulators, courts and borrowers

For more information, call NorthLegal at 623.537.7150.

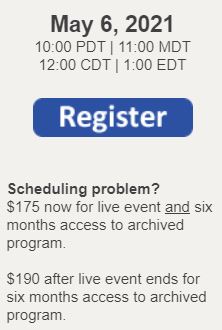

- Registration entitles the participant to a single connection during the live program. However, any number of employees of the participating financial institution may watch the archived version at times convenient for them for six months after the program ends.

| NorthLegal Consumer Collections Conference August 16-18, 2021 Las Vegas, NV | NorthLegal Bankruptcy Fundamentals Seminar September 20, 2021 Nashville, TN | NorthLegal Advanced Bankruptcy Conference September 21-24, 2021 Nashville, TN |

Facebook Comments