In March of 2017, my 16 years of employment with the credit union I had been working for, came to an end. The writing had been on the wall for a while, so it was disappointing, but not a complete surprise. The only question was, what next?

Plan B – My 19 year career in collections and banking started from my experience and contacts I had made way back with National Auto Recovery Bureau in San Jose as a Manager, where I had spent 4 of my 7 years in the industry. Having closely followed the repossession industry for all of these years, I saw opportunity in the “Boom Town” of Silicon Valley where I reside.

So, before jumping into the fray, I started doing the numbers.

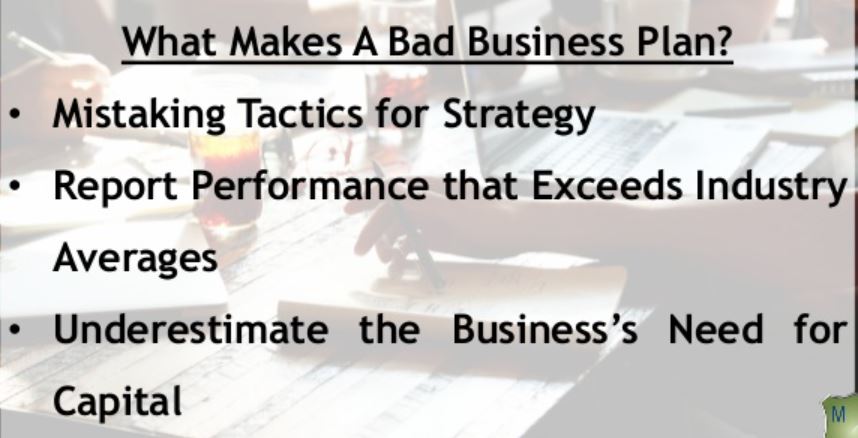

- Rent – Traffic in the bay area is as bad as Los Angeles, so, operating inside the bay area was the only practical solution I could see. Unfortunately, this in itself, is a big problem. Lease space runs from about $12-$15 per square foot per year, equating to approximately $10K to $12K per month in expenses. That equates to about 24-29 units repossessed per month at $425 each. That’s assuming I can get that much!

- Insurance Costs: Over the past 2 short years insurance costs for the industry have increased, in some instances, 100%-200%, and that is if you can still get it. In the late 1990’s, when proper coverages became available there were at least 20 insurers happy to write your coverage and they were very competitive in their pricing. A 3 truck/man recovery operation could purchase full coverage for $7,500 to $8,000. Today, we see those costs reach over $45,000, and again, if you can still find a carrier that will write those coverages. Premiums will continue to increase due to the commercial auto claims. This factor alone is causing many good recovery agencies to close their doors.

- Tow Trucks/Equipment: A new, properly equipped single tow truck will cost you in excess of $70,000 and prices increase at an average of 4% each year. As a result, in many cases worn out tow trucks and equipment are being used which leads to downtime (longer to complete the repossession), breakdowns, and wrecks. Breakdowns further exacerbate the issue as a downed truck means no incoming revenue.

- Labor Hard to Find (Field Agents): Recovery Agents today must be knowledgeable of all the federal and state laws that have been created over the past few years. They must know how to handle confrontation with debtors in a way that does not get them, the recovery agency owner, the insurance carrier AND THE CREDITOR sued or someone hurt. They must be self-sufficient, typically work alone and at night, must understand how to manage technology; MBSI/RDN, DRN cameras, mapping software, video cameras, laptop or PDA. And, they must have a clean background, and a clean valid driver’s license. It is very, very difficult to find individuals of this caliber as compensation simply isn’t commensurate to the skills and expertise required to do the job. The extremely high cost of living in the SF Bay Area further exacerbates this factor.

- Compliance: Vetting costs per recovery agency and agent has increased annually since 2015.

Needless to say, that’s a lot of overhead and a lot of challenges. Not that I’m afraid of a challenge, but cutting corners to make things work is a dicey proposition, but it can be done. Unfortunately, these issues accompanied by ridiculously low repossession fees that have remained unchanged for over 20 years, have created a very unfriendly business environment to open a new agency or even operate an existing agency in. This is having a negative effect in many ways that I witnessed firsthand as a lender.

dicey proposition, but it can be done. Unfortunately, these issues accompanied by ridiculously low repossession fees that have remained unchanged for over 20 years, have created a very unfriendly business environment to open a new agency or even operate an existing agency in. This is having a negative effect in many ways that I witnessed firsthand as a lender.

- It has become much more difficult for lenders to find properly trained, vetted and insured recovery agents to cover the lenders’ service areas.

- Older equipment is staying in operation longer. Trucks in need of repair on the road inevitably lead to potential for tow truck accidents, damage to lender collateral, physical property damage, injuries, and lawsuits.

- Smaller lots and fewer storage facilities are requiring more time to be spent in transporting recoveries, which means recovery agents are traveling less to service accounts, thus reducing income.

- Fewer recovery agencies for the lender to choose from. Many good agencies simply cannot afford the drastic increases in overhead so they are opting for other careers.

- Due to cost of doing business vs return on investment, fewer new agencies are entering the industry and many of those new agencies enter the business with poor equipment, little or no training and certification creating the potential for lawsuits. And remember, new agencies will struggle to find insurance as new ventures don’t often get written by an insurance carrier.

- Poorly trained staff due to associated costs.

- Lack of technology improvements to mitigate risks for lender and recovery agent. An example, video cameras for tow trucks to minimize damage complaints and lawsuits from debtor contact should be standard practice.

- Ancillary fees being reduced; keys, inventorying and protecting personal property, safe storage of collateral, administration fees to debtor.

So, how can I, or anyone make this business model work?

In order for the lending industry to ensure the recovery agents they use are professionally certified compliant recovery agents, recovery agents need at least $50.00 to $100.00 more per assignment. This is simply to stay even with escalating costs and does not take into account inflation, which has risen by an average of 2.08% per year since 2000! Needless to say, the “Frozen in Time Fee Environment” of the repossession industry has been unable to make any adjustments for that simple factor despite its application to everything else under the sun.

Across the board price increases MUST HAPPEN! This needs to be unilateral to all clients serviced by a recovery agent. A recovery agent cannot expect to increase his fees to only a handful of his clients and still maintain or advance the success of their business. Fees have to go up across the entire client base and ALL RECOVERY AGENCIES NEED TO DO THE SAME TO SURVIVE! Low ball prices may provide a competitive edge in the short run, but they hurt ALL in the long run.

As far as my foray back into the repossession industry goes, unless the repossession industry can coalesce amongst each other to create reasonable and realistic fees, I can’t make the numbers work without requiring unsustainable recovery figures in a high income area, 14 hour days of picking up cars and transporting them because my lot would be too small to accommodate the inventory, dealing with borrowers and lenders on the phone and after all of that, I would still find myself unable to build capital for growth while being able to market and grow my company.

So, at least for now, I can think of better ways to blow my time, effort and money. Good luck folks! On to plan C!

Kevin Armstrong

Editor, CUCollector.com