Over the last twenty years, the proliferation of credit fraud and identity theft has mushroomed into a pernicious $6B a year problem for the lending industry. While card skimming, jackpot ATM Hacking and account takeovers tend to steal the forefront conversation, one persistent fraud method that has exploded in contributing to this is “Synthetic Identity Fraud.”

The term “Synthetic Identity”, for most, conjures up images of the nebulous “Dark Web” and black hat foreign hackers exploiting financial institutions all over the world from dark rooms in some far away country. But in reality, a Synthetic Identity is just what it sounds like. Phony and man made. It’s users tend to be far less sinister and possibly people you know.

In short, the social security number used is either fictitious or does not belong to the claimed person using it. These numbers are acquired through either stealing the identifying numbers from another person or, created out of thin air. Their access and availability, while seemingly nefarious to obtain, may not be as difficult to find as one might think.

Obviously, fake social security numbers created out of thin air don’t fare as well passing through the fraud filters of a loan originating system (LOS) and their ancillary fraud protection databases, provided by the credit bureaus, that easily recognize unissued social security numbers or those belonging to deceased persons, but the fraud industry is generally smarter than that and such methods rarely succeed except in weak lending environments absent the aforementioned protections.

The Impact of False Victim Information

- 33% of victims report that identity thieves committed checking account fraud.

- 66% of victims’ personal information is used to open a new credit account in their name.

- 28% of victims’ personal information is used to purchase cell phone service.

- 12% of victims end up having warrants issued against them for financial crimes committed by the identity thief.

Costs of Identity Theft

- 47% of victims have trouble getting credit or a loan.

- 19% of victims have higher credit rates.

- 16% of victims have higher insurance rates.

- 11% of victims say identity theft has a negative impact on their ability to secure jobs.

What are the Motives?

Before we dig into where these numbers come from, let’s consider the motives behind persons using them. They usually aren’t as dark and as you might think.

- Reestablishing credit

- No valid social security number

- Fraud

Either of the first two will have either a completely blank credit profile or one that is littered with years of delinquency and charge off losses that make any reasonable credit availability out of reach. The third is the most dangerous one. A fraudster willing to patiently invest money and time into developing a “synthetic person” from which to defraud lenders in the very near future.

Where Do These Numbers Come From?

Type in the letters “CPN” into your search bowser and you will see that the internet is loaded with credit repair companies who are advising the public that they can start their credit history from fresh using a Credit Protection Number (CPN) and propose that it is completely legal according to Title 5, Section 7 of Publication Law 93-579 of Government Organization and Employees Act. While this is true, what is illegal, is what they do with it.

The credit repair companies are motivated by selling you the SSN or CPN numbers as well as upselling all of the necessary tools needed to reestablish or establish the new identity. They claim no obligation or responsibility to advise persons of the consequences of illegal activity and sheepishly claim to be completely on the level.

Most often, these “CPN’s” are stolen social security numbers and not in use, often beloning to persons under three groups and one other group that has yet to, but could emerge as a growing segment.

Yes, you can buy these too. Click Here for an example!

Children

Children

Parents usually file for their childrens SSNs shortly after birth and then forget all about them except when tax time comes around. Most parents do not even consider the potential of that number being used before the child comes of age. Unfortunately, CPN scammers prey on this segment and have created bad credit for millions of children without the knowledge of their parents or themselves until they come of age.

Fortunately, credit reports, with the proper filters turned on, can identify the year and state of issue of these types and lenders can generally spot these issues quickly by the disparity in year of birth and year of issue. However, in states like California and other immigration hot spots, it is not at all unusual to see a 25 year old man with a social security number issued two months earlier.

Depending upon the lenders appetite for destruction (or risk tolerance if you prefer) this fraud alert may be turned off to improve the loan approval ratios or take advantage of thin credit files for higher interest yield. Pick your poison. In this ultra competitive lending era of fintech and the evolution of lending into being an instant gratification process, this risk may often be necessary to compete in some regions of the nation.

Incarcerated Individuals

Incarcerated Individuals

The American criminal justice system holds almost 2.3 million people in it’s prisons and jails every year. Men and women locked away for months or years with little or no internet access. Persons serving time tend to completely disregard their credit and are very unlikely to monitor their already bad or deteriorating credit reports. What many do not consider, is that their credit history has a shelf life. In approximately seven years from it’s occurrence, the activity falls off disappearing like a fart in a hurricane.

Now, many of those, unbeknownst to them, have been the beneficiaries of the credit histories statute of limitations and have clean or now, blank credit reports. While initially they would know nothing of the goings on with their social security number, or possibly their entire identity, when they are released from prison, they may very well find this misuse of their ID is just another roadblock to finding employment, housing or access to credit.

Elderly

Elderly

Older persons may have better and longer credit histories that have been clean for many years. As such, it is safe to surmise and studies suggest, that people over the age of 60 are less likely to have frequent activity and transactions on their bank accounts and therefore don’t monitor them as often as younger account holders making them ripe fruit for for credit repair companies and fraudsters looking for clean SSNs.

Persons Out of the Country

Since 2000, approximately 1,000,000 people per year have been entering the United States legally. Legal immigrants in the United States are now at their highest level ever, at just over 40,000,000 legal immigrants. What is not accounted for, are the people who are issued social security numbers and leave the United States. These ae still valid social security numbers and very prone to reuse by either family or friends as well as fraudsters and CPN vendors.

The financial impact to the affected persons whose identification numbers have been stolen can be catastrophic to both the victim and the lender.

How are Fake Trade Lines Created?

How are Fake Trade Lines Created?

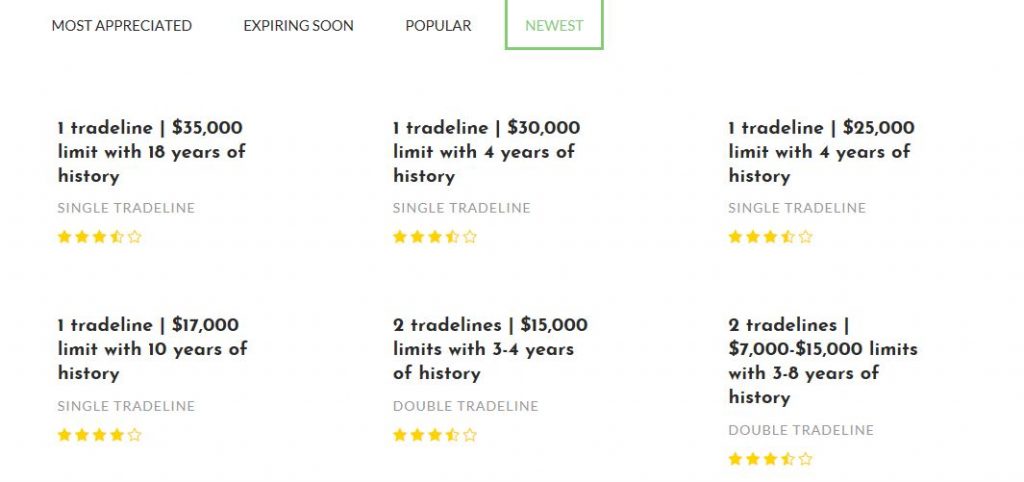

Yes, you can buy a trade line. There are vendors maintaining marketplaces where a buyer can rent a trade line from a willing card holder who will then add the buyer as an “Authorized User.” There is little risk to the seller, who is paid for this and the authorized user card is sent to them and destroyed with it to be later cancelled under the terms with the buyer. Under the terms of agreement, the fee for usage is generally dictated by the size of the credit limit and for how long the buyer wishes it to be maintained as active on their report.

Selling credit tradelines is not illegal. However, it is against most credit card terms of service, which is why they are coached to not telling their bank or card company about what they are doing.

Sound crazy? Come take a peek – CLICK HERE! or CLICK HERE!

There are other companies just like this and I provided access simply for demonstration.

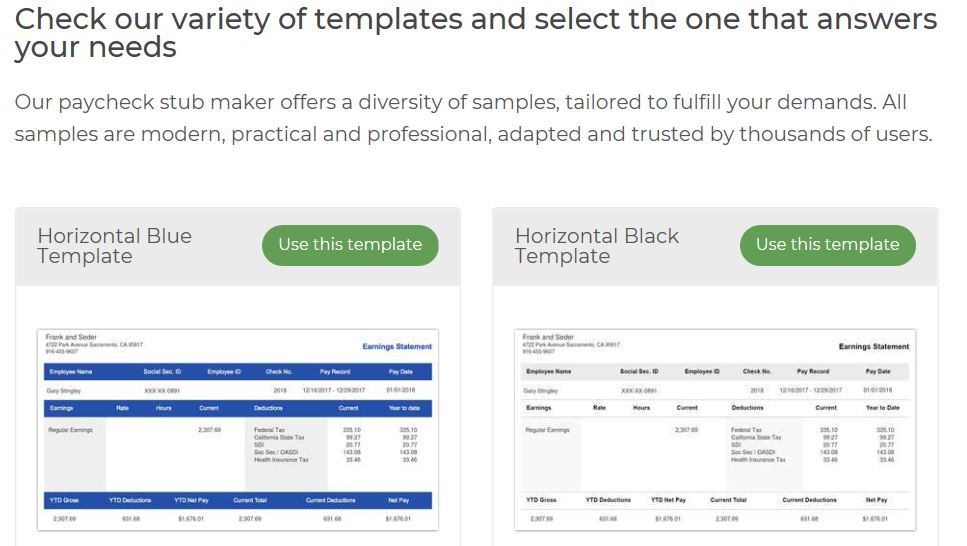

Income Verification

So, your lending division decides to tighten up their underwriting to require proof of income (POI) on applications with thin files, authorized user cards and fishy social security numbers. Bad news. Fake pay stubs are as old as the hills and templates for creating them are cheaper and even more available than trade lines.

Here’s an example (PayStubCreator.net).

As if that wasn’t bad enough, there are now companies that not only create the pay stubs, but websites to fictitious companies matching the pay stub and live persons answering phones for verbal verification.

Good luck spotting these.

I wrote an article exclusively about these companies in July 2018; “Fake Employment Scams – A New Cottage Industry for Fraud”

“Here’s an example; Click Here!

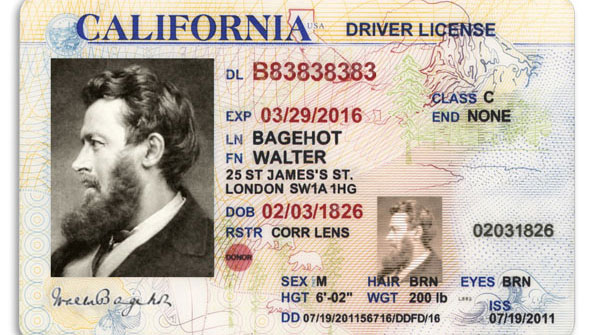

Fake Identification Cards

Really? This market is stacked as well. What’s worse, is hard core fraudsters or novices with access to the information can actually recreate new ones using valid ID and drivers license numbers. Technology has made the creation of fake ID’s simple enough to pass the sniff test of a scanned or photographed ID stipulation. Seriously, how often does your loan funding department run drivers license or ID numbers as part of their funding process? The AWESOME state of California makes it even easier by providing real ID’s and licenses to illegal immigrants with no corroborating proof of identity.

Dealing with It

As you can see, with internet access, a few hundred dollars, a mailbox and a little patience, fraudsters, or even persons simply trying to rebuild their credit can compromise a loan portfolio’s risk factors without the lender knowing until it is too late.

Unfortunately, as previously mentioned, the lending world has become very competitive. The drive for automation and instant decisions has created the perfect environment for this type of fraud and stopping it may be hopeless. In fact, many lenders may actually see an upside to it in that some segments of this pool can be very profitable.

- New immigrants using Social Security Numbers not issued to them to establish credit.

- New immigrants using falsified TIN’s not issued to them to establish credit.

- Legitimate borrowers that want to re-establish credit with a good payment history but provide a fake social security number.

Believe it or not, this segment can perform very well depending upon their motives and circumstances. These are not per se, fraudsters so much, as persons trying to et their lives together. It’s harder to judge harshly people who cross the black line of illegality for genuine and honest motives than it is those of malintent.

This problem is not going away anytime soon. It is growing right under our noses and you can expect it to continue to grow until someone comes up with a technical solution.

Simple Ways to Kill or Reduce the Problem

A willingness to tackle this problem is imperative to its solution, but under the contemporary and competitive high speed lending environment, it requires some hard choices that can kill all of those “fintech” efficiencies and experiences the public demands and the lenders are striving for.

- Don’t tolerate it – If the SSN has a flag or warning on it, turn it down. Period.

- Verify everything – Definitely a production and efficiency killer.

- Attempt to verify questionable social security numbers directly through the Social Security Administration – The process is manual but available here.

- Lobby for legislation to criminalize or regulate the activities used in the creation of synthetic ID’s.

- Post Mortem – If your collections and lending teams don’t meet up to discuss your fraud losses, you have no chance. Don’t be afraid to discuss the roots of your fraud losses. Don’t be defensive.

Good Luck

Good Luck

Don’t expect any quick fixes to this problem. It’s not going away anytime soon. In my twenty plus years in collections and lending, I have experienced and dealt with many forms of fraud and watched as they evolve and become more and more difficult to catch on the front end. Once you close down one form of fraud, another pops up. Fraudsters are ingenuitive and always find a way around every obstacle eventually. Always be on your guard and educate yourself on the latest trends. Network and share your experiences with others in your industry. Learn from each others mistakes and fight the good fight.

This article is not intended to be a “How To” article to assist anyone in perpetrating fraud. While a person perpetrating this may get away with it for years, it could catch up to you later. Anyone wishing to do so, you’re on your own. Don’t say I didn’t warn you.

Kevin Armstrong

Editor

CUCollector

The Editor and CUCollector are not and have not used practicing attorneys in the development of this article and are not offering and do not profess to be dispensing legal advice. Please consult with your legal counsel should you desire to obtain proper legal opinion.