EDITORIAL

If you asked most people what the biggest danger in the repossession industry is, they would respond “violent borrowers.” Once upon a time that was true, but in reality, it has become “Intruders”, unfortunately, too many of you just let them in.

In the past several years, the intrusions to the day to day operations by forwarding companies on their enrolled repossession agencies has grown to ridiculous levels. From periodic lot inspections to background checks, little by little, agencies have made exceptions to maintain these often less than profitable relationships. But the level of intrusion is getting down to the point where it makes you wonder who is really running your company?

Direct Contact with Employees

Recently, an agency forwarded to me an email sent directly to an agency owner’s employees from MBSi instructing them directly to take an assigned compliance training program.

See Below;

You have received this email notification on behalf of PAR North America. You have been assigned to complete the Training Comply Program listed below.

User Name:

User Login ID:

Requesting Company: PAR North America

Notification Name: Wrongful Prevention

Program Material Name: PAR- Schedule A 2018 (003).pdf

Expected Completion Date: 8/1/2018 12:00:00 AM

To complete the program, please log into RecoveryConnect Office. Upon successful login, the “Pending Training” interface will display. Click “Continue to Program” on the grid to access the exam. You can also select “Complete Notifications/Exams” from the “Training Comply” menu item found on the left side menu of RCO to find the program in question.

If additional supporting materials have been supplied by PAR North America, you will be able to access that material within the “Pending Training” Interface as well. Before completing a notification/exam, please prepare by reviewing the Training Materials using the “eye icon” found below, under the Training Material column.

If the Training Comply menu is not available when you log into RCO, please request your company Admin to activate Training Comply for your user ID.

If you have any questions or concerns regarding this notification please contact your national representative from PAR North America

Best Regards,

The MBSi Team

Topically, this seems a little harmless, but it certainly seems odd that they would be contacting agency employees directly. After all, who do they work for, the agency or the forwarder? Allowing a forwarder to contact your employees directly and make demands is certainly an intrusion. An intrusion that weakens not only your control of staff and day to day operations but your credibility as an owner and a leader.

Mobile App Contact Requirements

While I hadn’t intended this editorial to focus on one company or forwarder in particular, the names Santander and MBSi seem to come up pretty frequently.

Last week, ALS Resolvion passed along to their agencies an announced full compliance requirement that all agents must check MBSi’s RC Mobile App on all Santander accounts 10 minutes before they attempt recovery of a vehicle. The consequences of non-compliance are being blocked and having your fees unpaid. 10 minutes! That makes Consolidated Asset Recovery’s penalty term look tame.

The rational seems reasonable on the surface, the desire to avoid wrongful repossessions, a true bane on the lenders and agencies alike, but there are issues with this that are obvious.

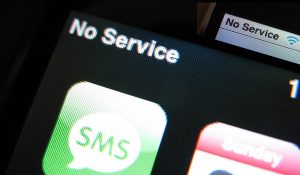

- Network Coverage Areas – In remote areas, internet access is sketchy to say the least, in New York State alone, there are 4,300 wireless dead zones. No one in this area has received any clarification on how they are supposed to comply and I doubt anyone else operating in similar dead zone conditions has. So what is an agent to do? Decline every assignment that could be in one of these areas? Risk not being paid and being cut off for accepting one and then having the unfortunate situation that they can not connect for desired verification?

- RC Mobile Support? – No, they can’t simply call in for verification. MBSi has limited customer support hours that don’t even open until 10am according to one agency owner.

Aside from agent complaints that the RV Mobile app is “buggy” and the aforementioned issues, it appears as though the whole mandate reasoning is disingenuous to say the least. If they cared enough to avoid wrongful repossessions, they would have a back up system in this process that included a back up support staff. Instead, they want to threaten to cut the agencies off and not pay them, while having a flawed and punitive one size fits all solution in a world of many variables.

Lot Inspections

In recent years, as a part of agency compliance verifications, many forwarders and large national lenders have been employing a variety of outsource partners to conduct lot inspections. While altogether not a bad idea, the devil is in the details.

I hate clowns! But that’s exactly what one forwarding company sent to an agency to do a lot inspection. A rodeo clown, which is a little better, but a clown all the same. The sad thing is, the people the forwarders usually employ, housewives, retirees and anyone they can lure with easy money on Craig’s List, are all untrained and have no idea what they are inspecting.

Furthermore, who vets them? How does an agency know that they won’t try to access borrower data or capture it with mobile phone cameras, that’s a GLB violation? Are they insured by the lender or forwarder for injury that could occur in the event of a slip and fall? Of course they don’t vet them and of course they aren’t insured.

As I’d said, this process is lipstick on a pig to make the forwarders appear compliant while intruding on the agencies time, which is money and placing the agencies at risk for lawsuits.

Consent of Use of Data

As I’d said, I did not intend to pick on anyone in particular, but in MBSi’s contract, they have a “Consent of Use of Data” clause.

- Consent to Use of Data. You agree that Application Provider may collect and use data and related information from the Licensed Application, including but not limited to information about Your location, device, system and application software, and peripherals, that is gathered periodically to facilitate the provision of software updates, product support and other services to You (if any) related to the Licensed Application. Application Provider may also use this information, for reporting and analytical purposes and to improve its products or to provide services or technologies. Application Provider may also disseminate user data and certain transactional data to third parties for the provision of services and related uses.

I underlined the last section for what I hope is obvious reasons. The data you are providing them is their and theirs alone under this contract. They are wide open to provide your data to whomever they feel fit. Data on your employees and your activities could be provided to your competition and who knows who else?

A Rumor of More to Come

Based upon a yet to be proven rumor by Repo Buzz’s Facebook page, and I prefer not to dive into the rumor mill too easily, a source at a large national forwarder communicated that; “’New from Capital One today, sent out to all forwarders: Note: No customer should be charged redemption storage after July 1st. Capital One will pay an additional $10 per repo to the forwarder instead. Its up the forwarder if they want to pass that along to the repo agent.“

Based upon all of the intrusions I’ve listed above, and some I left out, this rumor would not surprise me if it is true. The wheeling and dealing going on between the Forwarding industry and the large national lenders is all being done on the backs of the repossession industry. And they aren’t done.

You Let Them Do This!

So long as the majority of the industry succumbs to the whims of the forwarders who earn on average 60% or more of the total repossession fees charged to the lender or borrower ($675-$1,000), this will continue to get worse, just as it has steadily over the past several years.

Isn’t it bad enough your standard repossession fees have been flat for 30 years and they taken away storage, personal property and keys fees? Are that many of you all so really hooked on the “forwarding crackpipe of volume” that you can’t put your foot down somewhere?

Please go sit down somewhere and do some analytics on profitability. You can’t outrun unprofitable and intrusive business by volume. Seriously, do it. Check Jeremy Cross’s model through the ARA or the new spreadsheet offered by RSIG. If you don’t know your profit margin and what is and is not profitable, you can’t make good business decisions.

Under these circumstances, it is no surprise that agencies keep closing their doors. Good agencies, multi-generational agencies as well.

The forwarders exist because of you, not the other way around. Unite, say “NO!” Join an association, meet with your local competitors and pick a common foe to say “NO!” to.

For those of you that say you’re doing just fine, good luck with that. It might be fine now, but make no mistake, they will take from you until there is no more and move on to the next agency after you have to close your doors.

Unite! Say “NO!”

Kevin Armstrong

Editor