Live Webinar, Thursday

May 16, 2019

10:00 PDT | 11:00 MDT

12:00 CDT | 1:00 EDT

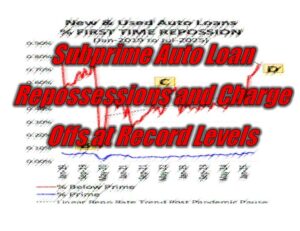

What happens after you repossess a motor vehicle?

- What information must be in a notice of sale? Is any special language required? What statement, if made, can get you in trouble?

- Should a notice of sale be sent if the debtor is bankrupt? Should the language be changed?

- How quickly after repossession must a notice of sale be sent?

- What does the debtor have to do in order to “redeem” the vehicle? What can go wrong if you require payment of attorney’s fees and collection costs?

- Does the debtor have the right to get the vehicle back just by bringing the loan current? May you require the debtor to pay in advance?

- May you require the debtor to provide proof of insurance before you release the vehicle? A current registration? A current driver’s license?

- May you require the debtor to allow you to install a GPS device? A shut off device?

- What do you need to know about selling the vehicle? May you sell online? Do you have to take bids at all? May you sell to an employee?

- What is a “public” sale? What is a “private” sale? Why do you absolutely have to know which yours is?

- What is a “commercially reasonable” sale, and how is that different from a public or private sale?

- May you repair or recondition the vehicle before selling it? Must you make repairs? What could go wrong if you make repairs?

- What happens if you can’t sell the vehicle? May you change the method of sale? If so, is there anything you have to do?

- What notice sometimes (but not always) must be sent after the vehicle has been sold? When must be in that notice? How does bankruptcy affect it?

Attorney Eric North has represented financial institutions concerning consumer repossession procedures for more than 30 years and has taught and written extensively about the subject for almost as long. During last month’s webinar Repossessing Motor Vehicles, Part I, Eric discussed legal issues creditors need to understand that arise before a motor vehicle is repossessed. This Thursday, Eric will help participants understand important rules that apply after the repossession has occurred.

For more information, call NorthLegal at 623.537.7150.

NOTE ABOUT CALIFORNIA AND OTHER SPECIAL STATE RULES: This webinar will address rules applicable to all states. Some states, such as California, have additional rules that will not be addressed here and that may be the focus of other programs in the future. However, financial institutions repossessing vehicles in those states must also know the information presented in this program.

| UPCOMING NORTHLEGAL CONFERENCES |

| NorthLegal Bankruptcy Fundamentals Seminar June 10, 2019 New Orleans, Louisiana | NorthLegal Advanced Bankruptcy Conference June 11-14, 2019 New Orleans, Louisiana | NorthLegal Consumer Collections Conference August 12-15, 2019 San Diego, California |

NorthLegal Training and Publications | 5115 N. Dysart Rd, No. 202-500, Litchfield Park, AZ 85340

Facebook Comments