The latest entrant to the credit market, point-of-sale loans, may be shaking up how consumers finance large purchases, according to TransUnion’s Q1 2019 Industry Insights Report. Point-of-sale loans provide consumers with an instant offer of credit in the form of an unsecured personal loan at checkout.

“As brick and mortar retailers continue to face challenges, many merchants are implementing point-of-sale financing alternatives as a potential new avenue for growth,” said Paul Siegfried, senior vice president and credit card business leader at TransUnion. “In addition, consumers are increasingly opting to cash in on their preferred credit card reward program rather than apply for a new private label card.”

Personal loans represented the most rapidly growing product in the consumer wallet. Other installment products, such as auto loans, saw steady growth while the number of mortgage loans, in contrast, remained largely unchanged year-over-year. Serious delinquency rates are rising for some products, though most remain well below recessionary levels.

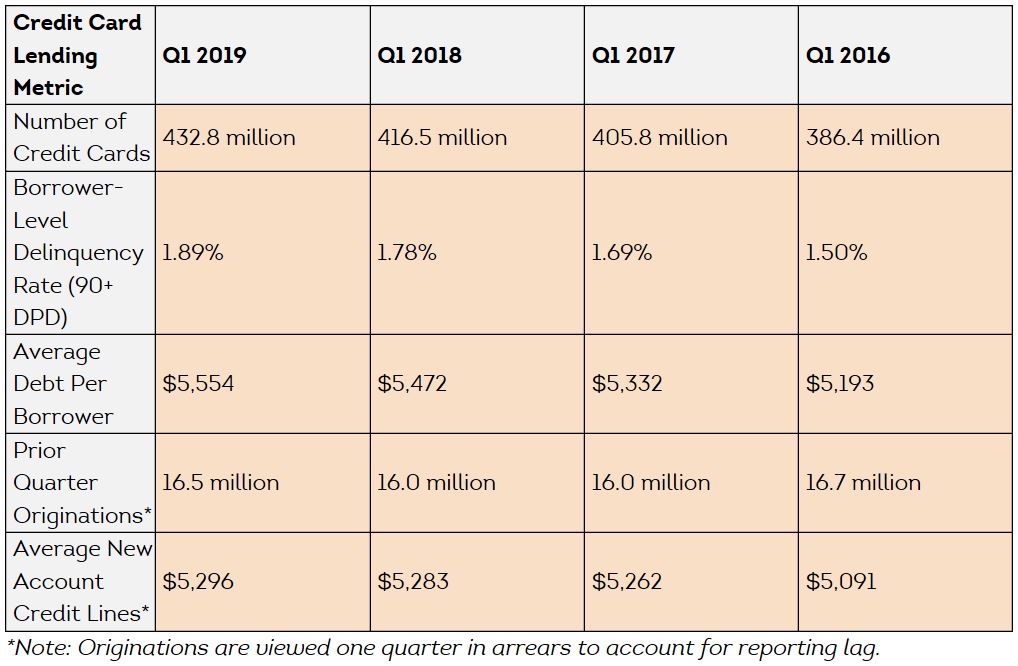

Consumer Credit Trends in the Credit Card Sector: Q1 2019

In Q4 2018, credit card originations grew 2.9% year-over-year with the subprime risk tier showing the highest growth at 8.8% year-over-year. Key takeaways include:

- The average credit line in Q1 2019 was $8,541, up from $8,042 in Q1 2010. For subprime, however, this number fell to $2,421 from $3,083 over the same period as lenders mitigated their exposure.

- Subprime originations grew to 2.97 million in Q4 2018, yet super prime still outpaced the subprime category with 3.65 million originations.

- The percentage of seriously delinquent borrowers (90+ DPD) grew 11 basis points (bps) over the past year to 1.89%. While delinquencies have been trending up since 2015, reaching a level not seen since 2011, they remain below recession-era levels.

Consumer Credit Trends in the Personal Loan Sector: Q1 2019

Personal loan balances continued to climb in Q1 2019, growing 19.2% year-over-year to a new high of $143 billion. Here are three key findings from the Q1 2019 Industry Insights Report:

- Over the past four years total balances have nearly doubled, growing from $72 billion in Q1 2015

- Growth occurred across all risk tiers as originations increased 9.7% year-over-year to 5 million in Q4 2018

- Amid unprecedented growth in this category, the percentage of borrowers seriously delinquent (60+ DPD) is 3.47%, a record low for the first quarter

What’s driving these changes in the personal loan market?

Personal loans remain one of the highest growth areas of consumer credit, with originations increasing 10% in the fourth quarter and balances by 19% in the first quarter. They are continuing to grow in popularity as consumers continue to use personal loans for debt consolidation and financing home improvement. Super prime and prime plus consumers are the fastest growing risk tiers in originations and balances, a key driver of the record highs in balances outstanding.

Consumer Credit Trends in the Auto Sector: Q1 2019

Auto originations grew 1.7% year-over-year and have grown year-over-year the past four quarters, reversing the negative trend caused by pullback in the market the second half of 2016 and full-year 2017. Other takeaways from the report:

- Super prime and subprime borrowers led this growth with year-over-year increases in originations of 5.2% and 4.4%, respectively

- Meanwhile serious borrower delinquency rates (60+ DPD) continued to remain stable at 1.31%, the seventh consecutive quarter with a year-over-year delinquency variation of less than 10 basis points

What’s driving these changes in the auto market?

Despite industry forecasts indicating that new vehicle sales will fall, auto originations outperformed expectations this past quarter. Growth straddled both ends of the credit spectrum, primarily coming from the above prime and subprime risk tiers while the middle segments noticed a slight decline. This growth, combined with steady delinquencies, continues to highlight the underlying health of the auto finance market.

Consumer Credit Trends in the Mortgage Sector: Q1 2019

Originations decreased 13.7% year-over-year across all risk tiers to 1.5 million in Q4 2018. Here are other key findings about mortgages from the Q1 2019 Industry Insights Report:

- As a result of slowing originations, the number of consumers with a mortgage remained virtually flat in Q1 2019

- Above prime borrowers drove balance and account growth, constituting more than 80% of all originations in Q4 2018, the only risk tiers to see consumer growth

- Serious consumer-level delinquency rates (60+ DPD) have reached historic lows, dropping from 1.74% in Q1 2018 to 1.44% in Q1 2019

What’s driving these changes in the mortgage market?

Housing affordability continued to be a significant driver of origination decline, as home prices and interest rates continued to rise in Q4 2018. Subprime originations slowed less than other risk tiers, a pattern we’ve been observing since Q1 2017. Paradoxically, we observed a decline in average new account balances even as home prices have increased. Likely, this is partially driven by a mix shift in the 20 largest MSAs, where originations shrank in the most expensive MSAs and grew in the least expensive MSAs, driving down the overall average.

We continue to monitor the credit market for any changes, and we will likely have a better understanding of the full impact of the federal government shutdown next quarter. Financial institutions can use these consumer credit trends in originations, balances and delinquencies to guide their strategies. To hear more about these trends, view our TransUnion Q1 2019 Industry Insights webinar.

Source: TransUnion

Facebook Comments