Bank Repossessions Up 4 Percent From Previous Month, and Up 22 Percent From Year Ago; Foreclosure Starts Down 13 Percent From Previous Month, and Down 11 Percent From Year Ago

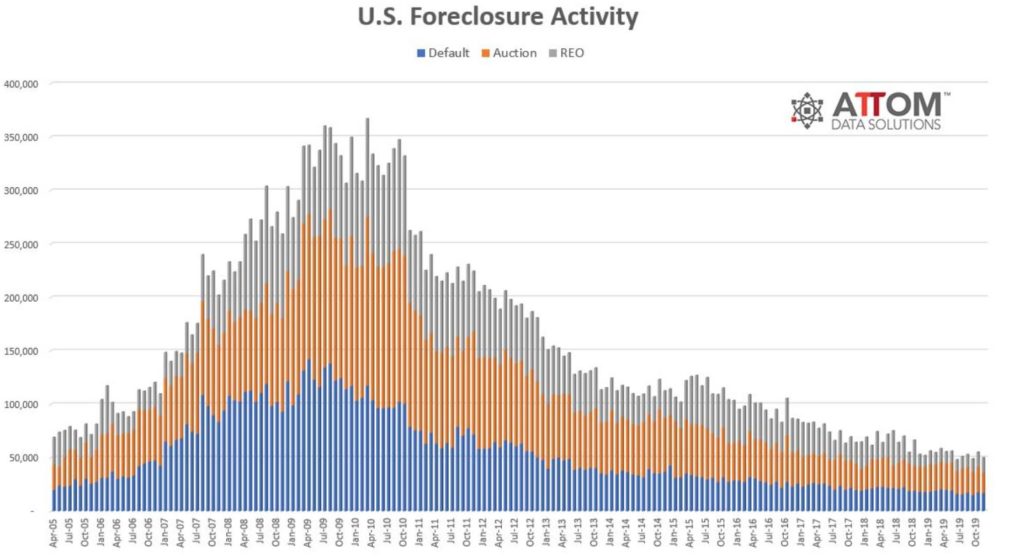

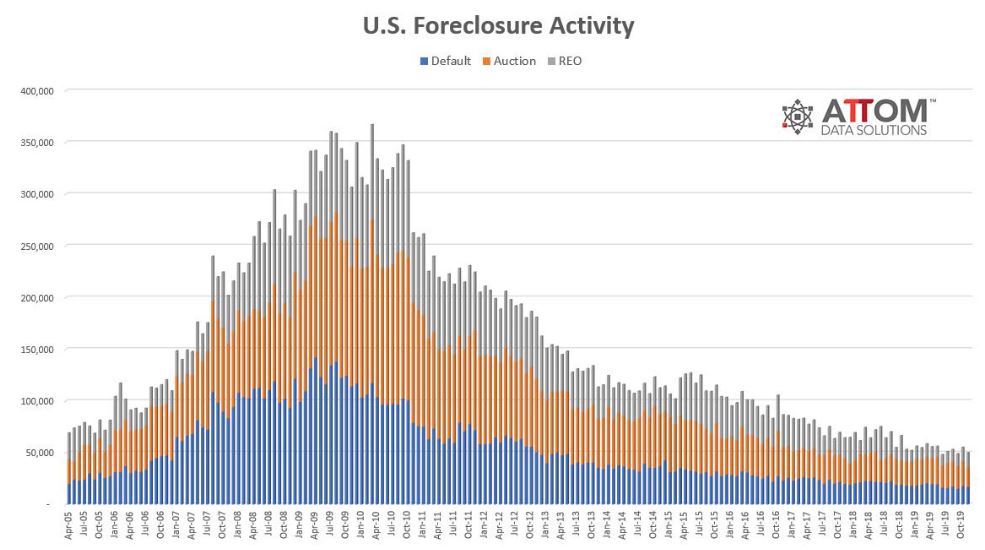

There were 49,898 U.S. properties with foreclosure filings in November 2019, down 10 percent from October 2019 and down 6 percent from a year ago, according to the latest ATTOM Data Solutions U.S. Foreclosure Activity Report. Nationally, one in every 2,713 properties had a foreclosure filing in November 2019, according to the analysis.

Delaware, New Jersey, Maryland top states with highest foreclosure rates

States with the highest foreclosure rates in November 2019 were Delaware (one in every 1,112 housing units); New Jersey (one in every 1,278 housing units); Maryland (one in every 1,476 housing units); Illinois (one in every 1,535 housing units); and Florida (one in every 1,607 housing units).

Buffalo, Atlantic City, Columbia post highest foreclosure rates among major metro areas

Among the 220 metropolitan statistical areas with at least 200,000 people, those with the highest foreclosure rates in November 2019 were Buffalo, NY (one in every 798 housing units); Atlantic City, NJ (one in every 968 housing units); Columbia, SC (one in every 1,082 housing units); and Fayetteville, NC (one in every 1,134 housing units); and Trenton, NJ (on in every 1,146 housing units).

Among the 53 metro areas with at least 1 million people, those with the highest foreclosure rates in November already including Buffalo, NY were Jacksonville, FL (one in every 1,172 housing units); Cleveland, OH (one in every 1,279 housing units); Baltimore, MD (one in every 1,307 housing units); and Philadelphia, PA (one in every 1,343 housing units).

Bank repossessions up nationwide

Lenders repossessed 13,996 U.S. properties in November 2019 (REOs), up 4 percent from the previous month and up 22 percent from a year ago.

Counter to the national trend, 16 states posted year-over-year decreases in REOs in November, including Utah (down 37 percent); Oregon (down 36 percent); Nevada (down 31 percent); Connecticut (down 27 percent); and South Dakota (down 23 percent).

Also counter to the national trend, 75 out of 220 metro areas analyzed in the report, with a population of 200,000 or more, posted a year-over-year decrease in REOs in November 2019. Of the 53 metro areas with at least 1 million people, those areas with the greatest annual decline in REOs were Salt Lake City, UT (down 58 percent); Seattle, WA (down 40 percent); Las Vegas, NV (down 34 percent); Miami, FL (down 32 percent); and Houston, TX (down 30 percent).

Foreclosure starts down nationwide

Lenders started the foreclosure process for the first time on 24,966 property owners in November 2019, down 13 percent from the previous month and down 11 percent from a year ago.

Counter to the national trend, 16 states posted year-over-year increases in foreclosure starts, including Indiana (up 77 percent); Utah (up 44 percent); Nebraska (up 44 percent); Delaware (up 41 percent); and Mississippi (up 38 percent).

Please contact us if you have questions about the underlying data referenced in this article, or would like to have access to that data in the form of custom reports, API, Bulk File or DaaS.

Source: ATTOM Data