Well, this isn’t likely to help in my job hunt in lending and collections, but I’ve got to get it off my chest.

A friend of mine who works in a repossession related business, recently had a meeting with a leader of a large financial organization who assigns their work through a large forwarding company. Their conversation turned to fees and my friend brought up the fact that many repossession agencies are closing due to decades long stagnant fees created by the forwarding model. The leader of this organizations indifferently said, “that’s their problem.”

I found that statement more than just a little bit short sighted, to say the least. It is almost amazing how someone of their position would be incapable of seeing the big picture.

Imagine a year in the auto lending world without professional repossessors, either in your area or any area for that matter. Delinquent borrower heaven, right?

Well, in most areas, tow companies could carry some of the slack, but honestly, would they be willing to run five bad addresses on an assignment at all hours, store cars for free and close accounts for no fee? Not likely. Needless to say, in those areas, recovery rates would go down.

Just imagine the scenario in licensed states like California, Florida and Illinois. They just wouldn’t exist. And those are some high volume loan areas.

Without repossessions and the recoveries that the lenders receive from them, loan losses would skyrocket. Underwriting guidelines would tighten to strangling levels and loan volume would wither.

The end result for the lender would be high losses + low loan volume = high delinquency and loss ratios, which follows with lower earnings. Do you see where I am going with this?

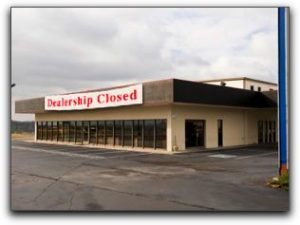

Now, let’s take it one step below that. Without easy access to loans, dealer sales would drop dramatically. Salesmen and finance staff would lose their jobs and dealerships would fail and close.

Now, let’s take it one step below that. Without easy access to loans, dealer sales would drop dramatically. Salesmen and finance staff would lose their jobs and dealerships would fail and close.

Furthermore, local and state taxes received on these sales would create budget deficits at the state and city levels, causing cut back in services to all of their citizens.

And one step below that, production. If no one can easily sell cars, production would also drop dramatically. This would affect the manufacturers and transporters, again causing layoffs and more unemployment.

The net effect would be an ice age in the auto industry and a probable recession. Another market interruption of this scale would likely cause another housing meltdown. Another housing meltdown that would shutter more lenders, realtors and further reduce employment, taxes and create further unemployment. Can we say “Depression?”

The net effect would be an ice age in the auto industry and a probable recession. Another market interruption of this scale would likely cause another housing meltdown. Another housing meltdown that would shutter more lenders, realtors and further reduce employment, taxes and create further unemployment. Can we say “Depression?”

A perfect case in this was experienced in Brazil and illustrated by a similar situation in the court required approvals for liquidation, which took an average of two years and was well documented in a study called “Repossession and the Democratization of Credit” by Juliano J. Assunção in 2014.

After the change to allow lenders easier liquidation processes, auto sales soared.

What I’m hoping here, is that lenders and repossession forwarding companies will take off the horse blinders and see the big picture.

The repossession industry is dying. Plain and simple. It can not exist with the same fees as they received over 25 years ago!

The situation has reached critical levels. More professional repossession agencies close every year and there are very few entering the market.

Just because you are paying a repossession forwarding company $450 does not mean the agency is seeing all of that. For the record, $450 is not even consistent with the rate of inflation over the same period.

Repossession agencies are partly to blame for not having pushed for higher fees all along the way and it is time they do so now, or they will not last long. For anyone who thinks the can hold out and be the last man standing and capitalize on that, good luck!

But the lenders and forwarding companies must pay attention too. Their livelihood is at stake here as well. If there is no one to repossess, then who will your forward accounts to?

If there is no one to repossess, then how can you lend?

It is in everyone’s best interest to charge and pay professional repossessors what a repossession is worth.

It’s a pretty simple “Financial Ecosystem” if you objectively think about it. One in which, if one piece falls out of the equation, the whole system dies.

Don’t believe me? Do you want to risk being wrong? Go ahead, time will tell.

Kevin Armstrong

Editor,

CUCollector.com