RSIG requires members and most national client contracts require repossessors to have $1,000,000 in commercial auto coverage for scheduled vehicles or “owned-autos” a/k/a your tow trucks, spotter vehicles and camera cars. Repossessors have often tried to minimize insurance costs by just having a towing policy, which they believe covers repossession activities. And for years towers have used their towing policy to try to get into doing repossessions, without having the same coverages and costs associated with their policies.

But 2017 is showing that the towing insurance market is experiencing the same type of rating experience that the repossession insurance market has had and that RSIG has warned about for years. Insurance agents have sold insurance carriers on the idea that towing and repossession is a money making business for insurance. So lots of carriers bought in and in doing so, the price of insurance went down… drastically. Repossessors thought they had found the pot of gold at the end of the rainbow when they saw unbelievably low insurance rates. But there are different types of gold….. one that we’re all familiar with is Fool’s Gold. An essentially worthless rock that looks pretty like it could be gold, but once you get inside, you find it is just rock – not worth nearly what you thought it was.

Several articles recently posted, on different sites, by different authors, tell the tale of why the towing insurance market, similar to the repossession insurance market, is struggling:

From: Autorisk.org – Dec 20, 2016 http://www.autorisk.org/2017-tow-truck-insurance-market/

There are three reasons why there are fewer choices available to insure risks in the towing and recovery industry.

- Insurance carriers were interested in handling these risks because they saw high premiums. However they did not understand the true costs of insuring these risks and the high claims payouts associated with them.

- Tow truck operators have a hard time hiring, training and keeping good employees at wages the operators feel are reasonable.

- Specialized agents and brokers who help operators choose where to spend the time and money to develop effective safety and compliance programs which carriers require to offer insurance are becoming a rare breed

From: TowIndustryWeek.com – Feb 1, 2017 http://www.towindustryweek.com/rates-trade/3287-insurance-industry-its-own-worst-enemy

Summarizing why insurers are leaving the towing market:

- The Obvious: they aren’t making enough money.

- No Risk Management in place.

- Inability to Retain Quality Operators

These comments mirror what RSIG has been saying about and to this industry for years. For years, RSIG has not increased our rates to our members, why you ask? Because we have properly rated our program so the carrier doesn’t fail to see a profit. We may not produce as big of a profit for the carrier as we once did (as a per repossession policy, we only get paid for the repossessions members complete and report – so repossessors working contingency or those that try to cheat the system has its impact on us as well); and RSIG has not experienced a profit reporting year for several years now because of what we pay in insurance premiums for repossession coverage, the Commercial Crime Insurance Policy (a/k/a Employee Dishonesty Bond/Coverage), Accidental Death and Dismemberment Coverage for all members and their reported full time employees in addition to what we pay out in order to continue our education, training and risk management efforts. But we also have maintained our insurance program, where others have not.

From: Autorisk.org – Dec 20, 2016 http://www.autorisk.org/2017-tow-truck-insurance-market/

These factors make it difficult for an insurer to make a profit on insuring these risks. We have seen three large insurers exiting the Towing and Recovery Market in 2016.

- Progressive Insurance has ceased writing new business until January 1, 2017.*

- Atlantic Specialty ceased offering insurance to this market in April 2016.

- Markel will do away with their tow programs effective December 31, 2016.

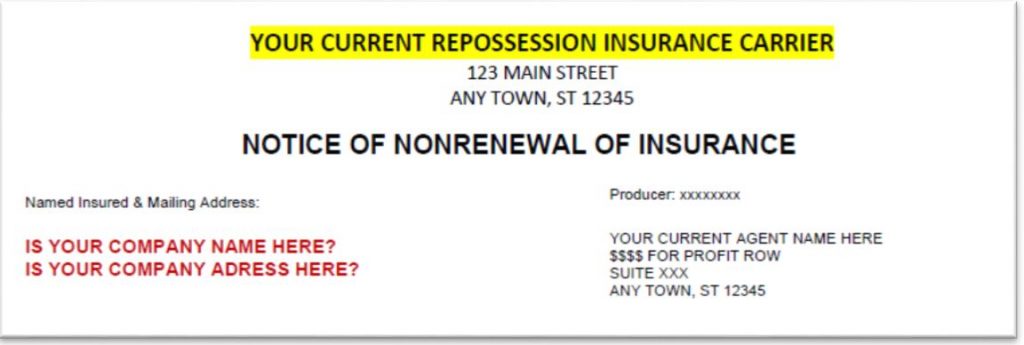

We have seen the results of these carriers exiting the market and we know you have to because we have seen the non-renewal notices not only from these carriers, but others as well. (*One point of interest in the Progressive re-entering the market in 2017, is that they still do not write businesses where more than 25% of your income is from repossession activities. Don’t believe us, Fact Check on their website: https://www.progressivecommercial.com/commercial-auto-insurance/what-we-do-not-insure/)

Of course other carriers will enter the market eventually. Insurance markets are fluid like water – there are ebbs and flows. Sometimes the waters are calm for smooth sailing and at other times you struggle to find the Beacon of Light in the rough seas. But you can be assured when new carriers enter the market, they will do so at higher prices than previously seen, stricter underwriting requirements and less tolerance for losses, questionable drivers, late payers and those with no risk management in place.

So what can you do to help yourself in this ever evolving market?

Obviously first and foremost – risk management is the key. That is one of the main things that has always set RSIG apart. Repossession insurance and repossession related risk is the only thing we do. Other programs may have specific agents that sell to these markets, but do they truly understand the market? Can you call them and ask if something you’ve been asked to do is something that will get you sued? Are they providing you with the policies and documents you need to meet your lender requirements? Do they offer specialized on-going training? Are they constantly looking at your losses and offering ways to do things differently in order to avoid future losses?

Next: Pay your premiums and other bills…on time! – Insurance carriers whether paying direct or through a premium finance company look at a company’s payment history as a sign of stability and more importantly responsibility. If you are constantly being cancelled due to non-payment there are administrative costs to the carrier associated with notifying you, certificate holders, the state if required and in dealing with filings if required. If the carrier already believes you have a low premium like what has been seen in the industry the past several years and you’re costing them more in administrative costs, they are not likely to continue on that path. Furthermore, they are less likely to rewrite or offer renewal terms for risks they view as irresponsible and costly. Carriers cannot judge their decision to write business solely on a company’s financial picture, but it can most certainly factor in to how they view your ability to run your business and how risky your behavior is.

Finally: Drivers, Drivers, Drivers! Those people behind the wheel of your tow truck are your bread and butter. So invest in them to make sure they are really working for you and not against you. Give them the training they need to protect your business and your assets. Their  driving record is their resume… it tells you a lot about them. Listen to what it says! Look beyond the obvious accidents, speeding tickets and DUI – which in and of themselves says a ton. But if they have been caught driving on suspended license, failure to wear a seatbelt, texting and driving, etc. they are exhibiting risky behavior that increases their risk to your business. If they have failure to appear on their record, they could be showing a disregard for authority – tendency to buck the system – not being responsible to pay their fines or show up to dispute the charge.

driving record is their resume… it tells you a lot about them. Listen to what it says! Look beyond the obvious accidents, speeding tickets and DUI – which in and of themselves says a ton. But if they have been caught driving on suspended license, failure to wear a seatbelt, texting and driving, etc. they are exhibiting risky behavior that increases their risk to your business. If they have failure to appear on their record, they could be showing a disregard for authority – tendency to buck the system – not being responsible to pay their fines or show up to dispute the charge.

And when you hire someone – before they get into your tow truck and you let them out on the road  with a $1,000,000 check payable to “Injured Claimant” report them to your carrier, but only after you have reviewed their MVR and you are certain you trust them with this blank check!

with a $1,000,000 check payable to “Injured Claimant” report them to your carrier, but only after you have reviewed their MVR and you are certain you trust them with this blank check!

Unreported drivers are becoming costly drivers and costly drivers are a quick road to uninsurability. Unreported drivers also reflect on you and how you manage your business. It usually does not cost you anything to add a new driver to your policy; but having unreported drivers (especially those involved in claims) can cost you your policy at renewal. You shouldn’t be letting an unlicensed driver behind the wheel of your truck, so why let an uninsured one be there?

Just like your business, insurance carriers want and need to make a profit. Insurance is a highly regulated industry, carriers must prove their ability to pay claims and still be able to satisfy investors and stock holders. Recovery Specialist Insurance Group is a not-for-profit insurance purchasing group working for the benefit of the professional repossessors exclusively for more than 30 years; and in those 30 years, we can tell you now more than ever that it is essential that you do everything in your power to protect your insurance policy. If you lose it, it is going to be very difficult to find replacement coverage.

So, just a few tips from us to you…

- Practice Smart and Strong Risk Management.

- Have Clear Written Policies on Expectations of Drivers and Stick To Them!Offer training and continue to educate your staff on a regular and on-going basis.

- If your drivers are having accidents, put them in defensive driving or driver improvement classes and hold them accountable for their actions.

- Review Often and Pay Attention to Driving Records.

- Don’t Let Your Policy Cancel for any reason that is within Your Control… Pay Your Bill On Time!

- Listen to your insurance provider, if they are concerned about a driver… you should be too. Don’t ask for too many exceptions to the rules. Underwriting guidelines are there for a reason!

Eliminate problems – if you can’t rehabilitate a driver and you can’t more fitting job function, it may be time to cut your losses and let them go.

From the desk of: Dana Loan, Recovery Specialist Insurance Group, Manassas, VA (Feb 2017)