On October 19th, Ally Financial held its third quarter 2022 earnings conference call for investors. With their eluding to a new “just giving our customers a little bit more time to pay” strategy to explain a rise in delinquency in their 60-day (3 payments past due) tranche in the Q2 report in July, it became a point of interest in its effect.

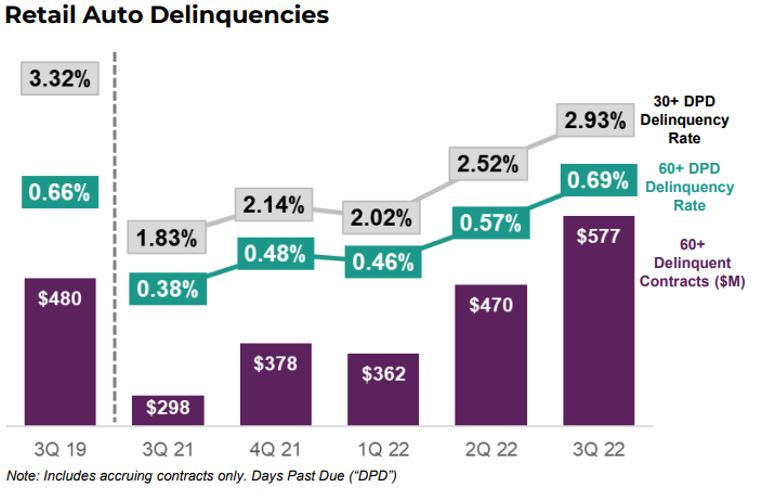

Ally Financials quarterly call report meeting for investors for the third quarter was actually even more mundane than the second quarters. Most notable was the rise in delinquency in their 60 days plus delinquency category. This delinquency tranche, where most repossession activity occurs, rose to 0.69%, just above the Q3 2019 pre-pandemic levels of .66%.

Read the Meeting Transcript here

The New Strategy?

As you may recall, we had reported in CURepossession that the question of rising delinquency in the 60-day delinquency category came into question by Betsy Graseck, an analyst with Morgan Stanley, requested some follow up to a statement that; “mentioned that you have taken some actions or recognized some parts of the portfolio differently maybe than you had in prior quarters”

In response, Jenn LaClair, Ally’s Chief Financial Officer, replied;

“So first on the delinquencies and settlement to the guide. So on delinquencies look, you’re seeing some normalization flow through both the 30-day and the 60-day, it’s all within our expectations. I did mention in the 60-day, look, we are always investing in new strategies and new approaches to help our customers, keep our customers in their cars longer.”

“So I made note of one of those around repossession timing, which is essentially just giving our customers a little bit more time to pay. We have had tremendous success with that approach, and that just keeps that 60-day number up temporarily as we are rolling through this new policy. But it’s normalization of the portfolio as expected. There is some seasonality in there from a delinquency perspective and then some policy changes that are driving that growth.”

No further inquiry or mention of this “new strategy” was made in the call transcript leading us to believe it is either been abandoned or its effects unmeasurable in the face of delinquencies rise regardless. Like a lot of things, their results could have been worse without it, but you can never really know.

Read the Ally Financial 3Q 2022 Earnings Review

Projections

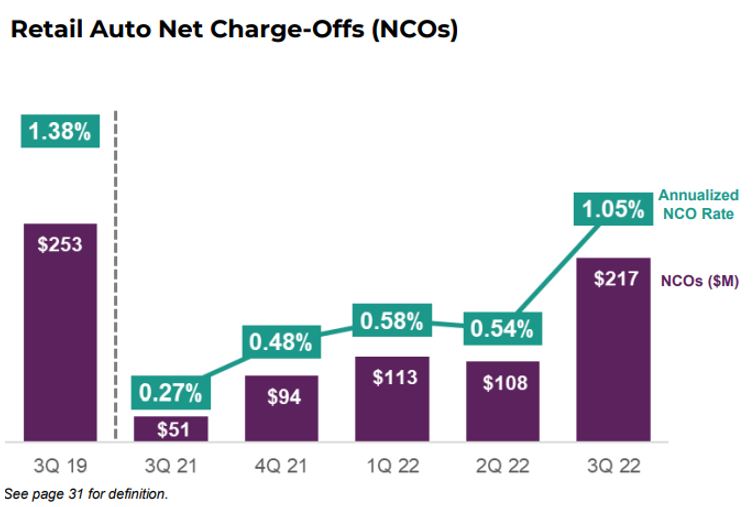

While their 30 day plus category rose just over forty basis points to 2.93% from Q2’s 2.52%, it is still far below pre-pandemic levels of the same quarter in 2019 when it was 3.32%, their annualized net charge offs (NCO) rose to 1.05% from .54% in the previous quarter. This is still below the same time in 2019 when it was 1.38%, but it does appear as though delinquency is creeping into their portfolio.

Regardless, their 2023-2024 projections for delinquency only expect a rise to 3.4% to 3.8% with net charge off peaking out at 1.6%.

These projections are rather optimistic and no one brings up the issue of fourth quarter seasonal delinquency creeping in that could completely blow the lid off their 2023 projections before the year is even over. Time will tell, but worry not for Ally Financial, they’re doing just fine. While their Core pre-tax income dropped to $488M from $825M the same time last year, this is very much the result of increase reserves to guard from future losses.

Over all, the major auto lenders and banks are faring well so far with the majority of their reduced incomes coming from strategic reserves for what rises in delinquency are coming. And it’s clear that they are coming. The trillion-dollar question remains; just how bad will auto losses be in 2023.

Time will tell. A fly on the wall – Ally Financial 60-day delinquencies rise above 2019 levels – Credit Union Collections – Credit Union Collectors – Ally