Almost unnoticed last month, the Consumer Financial Protection Bureau released a Data Point report on Subprime Auto Loan Outcomes by Lender Type. In this forty-six-page report, they examine the effects of interest rates and default risks variances based upon different types of subprime lenders and how variations in interest rates can be explain the differences in default rates. In general, they concluded that the rates vary depending upon the lender type and that the default rates coincided in relation to those higher rates.

The CFPB discussed some of the difficulty they had in acquiring complete data pools, as some lenders report 30 days out and some 90 while some, do not report at all. Examining the 2014 to 2016 loan origination pool with FICO scores at or below 620, they used Experian’s AutoCount for loan origination data, and Experian for default and other data. Missing to a very large degree is the buy-here-pay-here (BHPH) industry who typically do not report to any of the Nationwide Credit Reporting Agencies (NCRA’s.)

The report puts identified lenders into five categories: banks, finance companies, captives, credit unions, and BHPH dealerships. Among their findings, the Bureau’s found:

- Interest rates often vary across lender types for reasons that have nothing to do with delinquency risk. As depository institutions, Banks and Credit Unions have may have access to cheaper funding than Finance or BHPH lenders, and so may be able to provide all customers lower interest rates. If there are returns to scale in auto lending, then larger institutions may be able to provide loans more efficiently and thus at lower interest rates than smaller institutions.

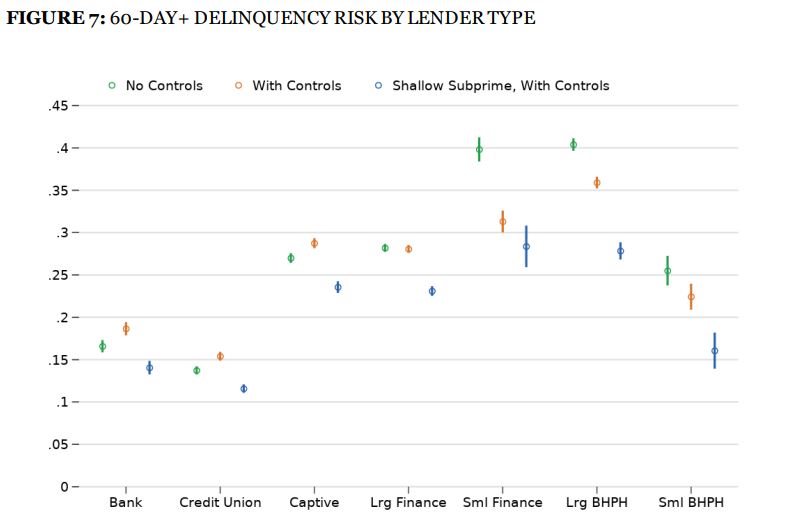

- Auto loan default rates were higher with lender types that charge higher interest rates. Bank originated subprime loans showed a 15% history of a 60-day delinquency over three years, while amongst the finance companies and BHPH dealers, the rate was 25% to 40%.

- Interest rates varied dramatically based upon lender types. They found that, on average, the interest rates banks charged were about 10% while finance companies and BHPH dealers charged between 15% to 20% on average.

Overall, it is a worthy read and study. If I had the war chest to do a deeper dive into the data, I would capture all loans with a repossession reporting code, month by month and extrapolate some aggregate volume data by regions, cities and lenders. Perhaps then we could then drill down on the affected loans and identify common and perhaps avoidable default denominators to protect both the consumer as well as the lending world from defaults. I looked into this, but Experian wanted to charge roughly $30K per report and would neither allow it to be sold for a profit nor would they identify the lenders.