Wholesale Prices, Week Ending October 29th

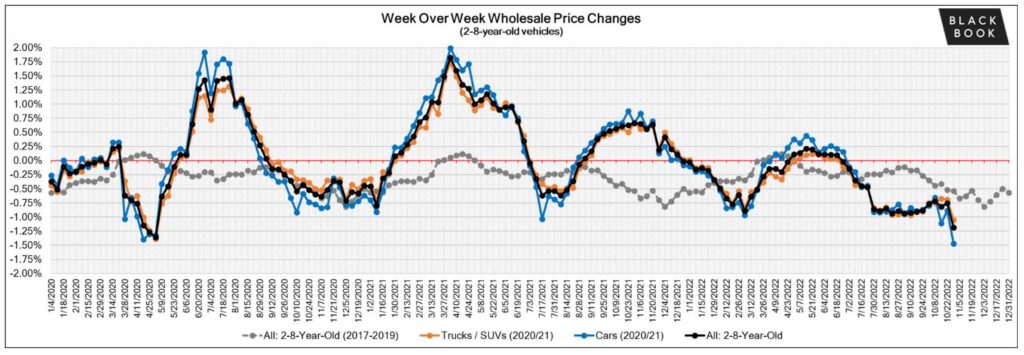

The fourth quarter is when the market traditionally experiences the largest declines of the year and this year is following the same path. The month of October is finishing up with some large declines as retail demand remains soft and many sellers continue to hold firm on their floors, while others accept the changes in the market and allow their vehicles to sell at the current market rate.

This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -1.47% | -0.89% | -0.57% |

| Truck & SUV segments | -1.05% | -0.70% | -0.51% |

| Market | -1.19% | -0.76% | -0.54% |

Weekly Wholesale Index

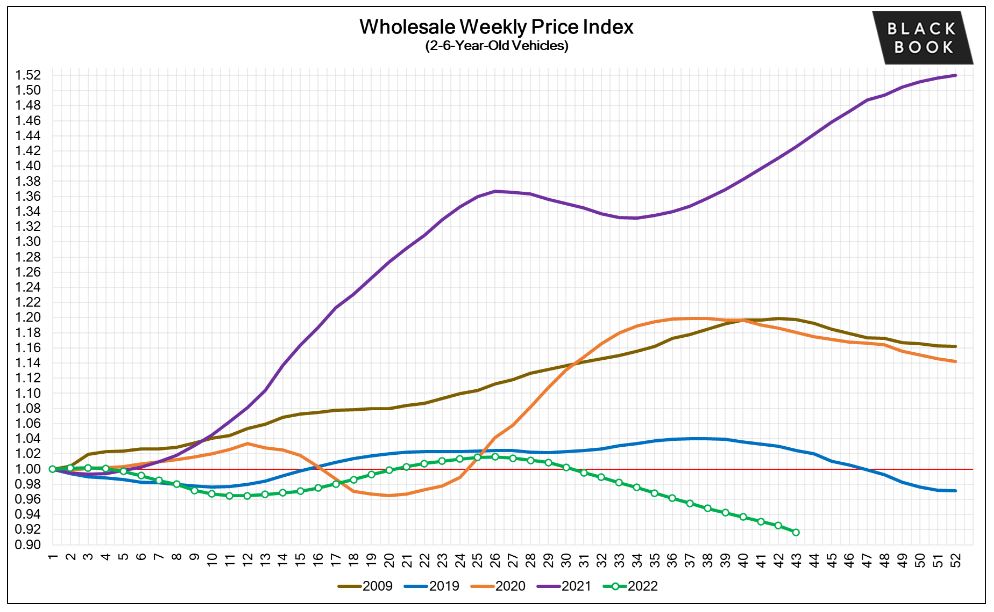

Calendar year 2020 and 2021 ended with used wholesale prices at elevated levels. With economic patterns (including the automotive market) driven by the pandemic, normal seasonal patterns (e.g., 2019 calendar year) in the wholesale market were not observed for most of the last two years.

We saw a similar picture in 2009, at the end of the Great Recession. Calendar year 2021 did not have typical seasonality patterns as the market had rapid increases in wholesale values for the majority of the year.

The Wholesale Weekly Price Index reached the highest point of the year at the end of December 2021, reporting over 1.51 points.

The graph below looks at trends in wholesale prices of 2-6-year-old vehicles, indexed to the first week of the year. The index is computed keeping the average age of the mix constant to identify market movements.

Wholesale

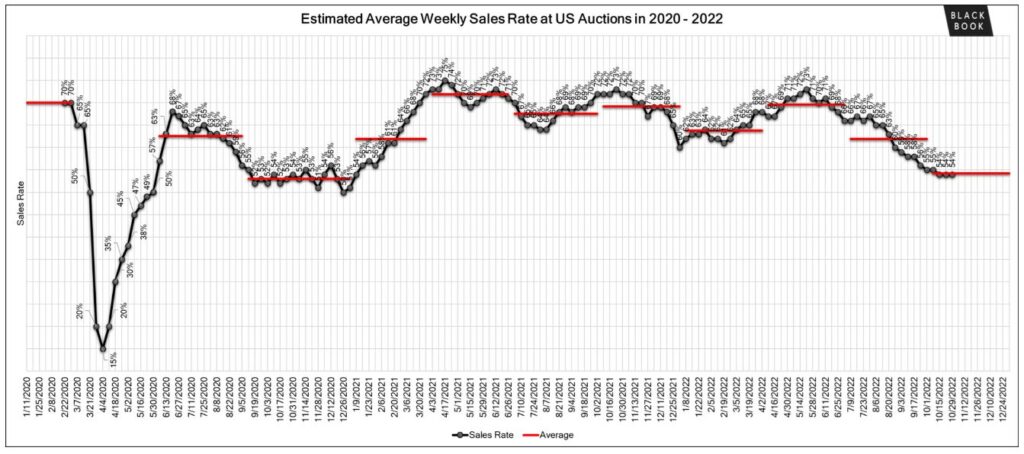

It was another stable week in the lanes last week. Inventory is still available and consistent, but there has been a noticeable increase of IF sales and no sales. This could mean that there is room for negotiation between sellers and buyers and hopefully, they will reach some middle ground soon.

Buyer count remains stable, which could potentially mean that buyers are patiently waiting for sellers to soften their floors. There are still minimal signs of flood vehicles coming through, but announcements of flood vehicles from the recent hurricane are expected.

In addition, with vehicle delinquencies increasing, an uptick in repossessions may make their way to auction lanes soon. Some model year 2023 vehicles are popping up in the lanes, which is no surprise as more model year 2024 launches and vehicle announcements are coming out.

Newer used vehicles (model year 2018 to model year 2020) values seem to be slightly increasing, although overall, wholesale values are continuing to decline.

The Estimated Average Weekly Sales Rate remained at 54% last week.

Source: Black Book