….A long, long time ago

Guest Editorial

In looking at our industry as it is today I began to compare it to what it was like some 50 years ago. The changes are huge and so I thought maybe it might be interesting to reminisce by putting those changes in an article. Some of the “old timers” (I mean really, really old timers) will relate to those times and those who were not there back then may enjoy reading about them. This article is all factual and is based completely from my personal experiences when I came into the industry in the 1960’s.

After my Honorable discharge from the military in 1959, I became a police officer. Disenchanted with the “old boy” politics of a small-town police department I began my career in the repossession industry as an employee of Associates Finance Company in 1961. However, I kept my law enforcement certification by working a night shift for the Sheriff’s office. Color of law? Never heard that term back then.

No FDCPA (not until 1977), no GLBA, no Dodd, Frank Act, no CFPB, no ADA, no TRPPA and about the only consumer protection lawyers were those suing on behalf of individuals involved in automobile accidents. No cell phones, no computers, no fax machines and what in the world was an “internet”?

Associates had an iron clad policy that their employees who handled repossessions were not allowed to repossess a customer’s car until you actually sat down with the debtor, look at his income and determine whether he could actually pay for the car. Only after determining that the debtor could not afford the payments were you allowed to take the car. Could you imagine that process in today’s society? This training taught me the very important communications skills that served me well in the coming years when I had my own repossession agency. The lack of communication skills in today’s repossession industry is a huge detriment for the recovery agent and a potential for violence and Wrongful Repossession lawsuits.

Tow trucks? Didn’t need one. We either drove the car in or towed it with a chain hooked to our company car. Only if the tires were missing did we call for a roll-back. And, with a mostly non-transient society we didn’t hear much about skip-tracers. During the 60’s, our office had 2 actual skips and I still, to this day remember the names of those skips and the collateral. One was a gentleman named George V. Lampkin and the collateral was a black Buick. Mr. Lampkin left Ocala to go to Pavo, Georgia to pick cotton and was never heard from again. The other was James Robinson, the collateral being a White Chevrolet Panel Van. Mr. Lampkin was a preacher and Mr. Robinson was a snake handler for the Ross Allen Reptile Institute. Maybe one of his snakes ate him. I have no idea why these memories are so vivid to me. Maybe they were challenges where I was unsuccessful in meeting.

It seemed that debtor’s “back then” realized that if they couldn’t, or wouldn’t pay for their car, they understood that repossession was the alternative and the potential for violence during a repossession was virtually non-existent. Two instances I remember well. One, we had a delinquent debtor in Daytona Beach, some 75 miles from our office. I got to Daytona on Greyhound bus and caught a taxi to the debtor’s address. The debtor did not know I was coming and when I arrived and told him what I was there for he gave me the keys to the pick-up truck. In the other instance, the debtor lived in West Palm Beach, some 200 miles from my office. This time I contacted the debtor and advised my purpose for calling. The debtor advised that the car would be at his residence address. Again, I rode a Greyhound bus to West Palm Beach, caught a taxi to the residence where I found the car with the keys inside and I drove it back to my office. As I said, the industry was so very different “back then.”

I hope those who took the time to read this article enjoyed it and if you would like to read about the industry as it was in the 70’s, just post a comment and I will “reminisce” again.

Be safe,

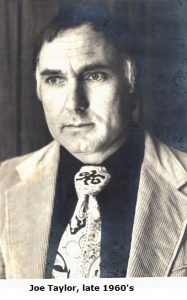

Joe Taylor