Like a double edged sword, social media can be a great way to communicate or if used irresponsibility can make you bleed headaches. Remember, what you post on any social media site it doesn’t go away….ever.

I hope recovery agents and recovery agency owners around the country will read, and maybe re-read this article because it directly affects you and your insurance coverages. You’re probably saying that can’t be possible. Well here is how.

Underwriting guidelines, which sets the rules as to whether you are insurable were primarily based on your past driving record and then expanded into looking at your credit history. Why? Because it speaks of your character and habits. Now, the new phenomenon that insurance carriers are looking at is social media for statements and/or photos that might indicate irresponsibility and/or the potential for violating an individual’s (primarily the debtor’s) privacy rights.

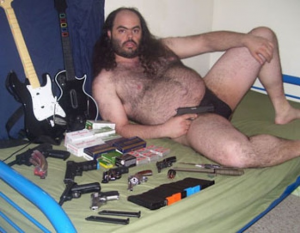

During my discussions with insurance carriers we uncovered a few online posts that caused concern. Below are a few examples carriers cringed at:

- Selfie of recovery agent and girlfriend and repossessed vehicle with the comment, “Got the dead beat p……”

- Selfie with comment about the firearms he carries in his tow truck.

- Selfie with repossession hooked to tow truck with the comment, “another dirt bag bites the dust.”

- Comment, “I’m locked and loaded and looking for another dead beat debtor.”

- Video showing debtor chasing repossessor who had repossessed his vehicle with the comment, “another dead beat debtor bites the dust.”

- Photo showing debtor’s tag number with vehicle hooked to tow truck with comment, “hooked and booked.”

We could include many more of these comments and videos but I think you “get the message.”

When we think of “exhibitionism” we usually picture some clown running around in public “in the buff.” However, the dictionary defines  exhibitionism as “the practice of behaving so as to attract attention”, and that is exactly what these social media “exhibitionists” are doing. And they are doing it in a manner that reflects ignorance and arrogance to the detriment of their career while not appreciating the unfortunate financial situation the debtor has gotten himself into.

exhibitionism as “the practice of behaving so as to attract attention”, and that is exactly what these social media “exhibitionists” are doing. And they are doing it in a manner that reflects ignorance and arrogance to the detriment of their career while not appreciating the unfortunate financial situation the debtor has gotten himself into.

Insurance carriers consider such behavior irresponsible, a potential for litigation and a primary basis for determining potential insurance risks which can lead to non-renewal of coverages and even denial of claims. Recovery industry professionals already recognize the difficulty of securing appropriate insurance coverages for self-help repossession services and if an attorney finds “ammunition” on social media such as the above examples that he can use in court you can be sure he will.

If you are one of those recovery agents or agency owners that subscribe to such posts on social media sites, consider yet another cause for “cleaning up your act”, the Consumer Financial Protection Bureau (CFPB). Suppose one of those debtors whose car you have repossessed files a UDAAP (Unfair Deceptive and Abusive Practice), or Invasion of Privacy complaint over such irresponsible comments and/or photos with the CFPB. GAME OVER!!!

The recovery industry is a profession and those who intend to remain in the profession for the long-term need to conduct themselves as professionals and I think any professional would agree that the examples we have given in this article do not, in any way, denote professional behavior.

Recovery Industry Services Company (RISC) is the owner and administrator of the C.A.R.S. National Certification Program and is recognized within the collateral recovery industry as a leader in the fields of risk management and industry standards that meet both CFPB and lender compliance requirements. Our services include: Certification through the C.A.R.S. National Certification Program, Continuing Education courses, Compliant Agent Network (CAN) membership, compliance vetting and training, office and storage facilities inspections, business consulting, repossession insurance consulting, lock-smith training and supplies, automotive key codes, discount programs, and a $1 million Client Protection Bond for members of the RISC Compliant Agent Network. RISC has the only state licensed school that develops training and certification programs exclusively for the collateral recovery industry. For more information, please e-mail RISC at services@RiscUS.com, call 866-996-7472, or visit our website at www.RiscUS.com.

Recovery Industry Services Company (RISC) is the owner and administrator of the C.A.R.S. National Certification Program and is recognized within the collateral recovery industry as a leader in the fields of risk management and industry standards that meet both CFPB and lender compliance requirements. Our services include: Certification through the C.A.R.S. National Certification Program, Continuing Education courses, Compliant Agent Network (CAN) membership, compliance vetting and training, office and storage facilities inspections, business consulting, repossession insurance consulting, lock-smith training and supplies, automotive key codes, discount programs, and a $1 million Client Protection Bond for members of the RISC Compliant Agent Network. RISC has the only state licensed school that develops training and certification programs exclusively for the collateral recovery industry. For more information, please e-mail RISC at services@RiscUS.com, call 866-996-7472, or visit our website at www.RiscUS.com.

Be safe,

Joe Taylor

Vice President

Director of Education

RISC