Hardly a day goes by without getting a credit card offer in the mail. Preapprovals, pre-approvals to apply and sometimes worthless credit card appearing “this could be you” props included in these annoying pieces of junk mail that we intuitively know must be shredded. Odd enough, this problem is far older than anyone would imagine as one unfortunate Kansas livestock trader found out the hard way in 1899.

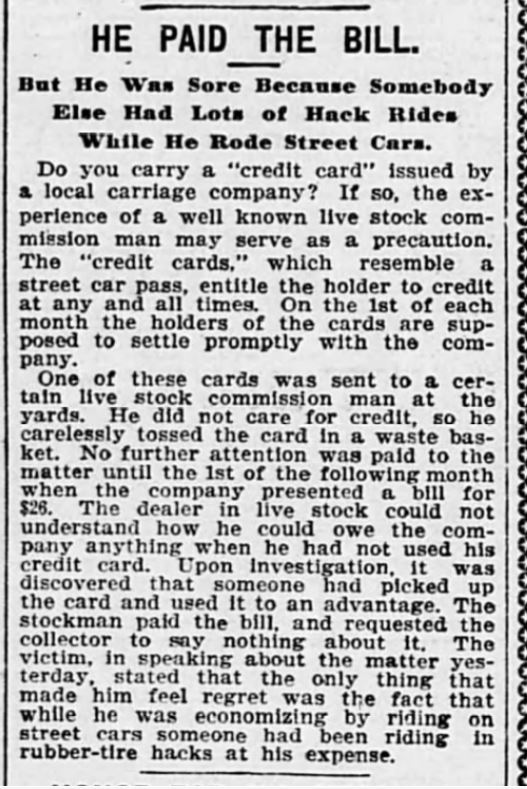

Buried deep in page 12 of the January 9, 1899, edition of the Kansas City Journal is the story of a Kansas City cattleman who received a carriage credit card in the mail. The card, resembling a street car pass, enabled the user to ride on the cities, luxurious for their time, rubber-tired steam carriage “hacks”, or taxis or limos as we would call them now. As with charge cards now, the user would then be billed at the end of the month and expected to pay on demand.

Thrifty and suspicious of credit, as many of this era were, the man promptly threw it away. He probably would have done better if he’d had a paper shredder. Unknown to him, the card was retrieved from the trash and put to good use. Good use, which racked up an astronomical total of $27 in charges, About $700 in modern equivalency.

As customary, the card company sent the bill at the end of the month. And as expected, when the bill reached him, the cattle man blew his top.

Contacting the carriage company’s collections department, he discovered that his thrown away card had been used by an unknown fraudster all over town for the month before. Embarrassed, he requested the collector tell no one and he promptly paid the bill.

Somehow, the reporters of the local paper did find out and interviewed him about the incident. The man would only say that his only regret was that while he was economizing by riding the steel wheeled street cars about town, the fraudster had been riding around town on rubber tired “hacks” at his expense.

The First Case of Credit Card Fraud – 1899 – Fraud – Repossession History