NY Fed’s Q3 Data shows an economy under strain

Record high inflation and fuel prices are taking their toll. Relying on plastic credit to keep up, the American public’s credit card balances grew by $38 billion since the second quarter of 2022. That’s a 15% year-over-year increase and marked the largest in more than 20 years. With rising interest rates and layoffs kicking in, delinquency is returning to pre-pandemic levels and this is just the beginning.

The Pajama Party is Over

For two years, loan delinquency data had been painted over by stimulus programs and loan modifications that distorted any honest semblance of the true state of the economy. But the pajama party climate of covid lock downs and tolerances is finally showing to have come to an end.

According to credit reporting agency TransUnion, 1.65% of auto loans were at least 60 days behind their monthly installment in Q3. This marks the highest rate of delinquencies in over a decade. TransUnion also reported that approximately 200,000 car loans that had previously taken advantage of pandemic-era loan modification accommodations are now listed as 60 days delinquent.

According to Satyan Merchant, TransUnion’s senior vice president; “There has been this effect where the delinquency that may have occurred over the last few years is really just pushed out or delayed because that consumer didn’t have to make payments or their status was on an accommodation. So now some of those are hitting,”

Debt and Delinquency

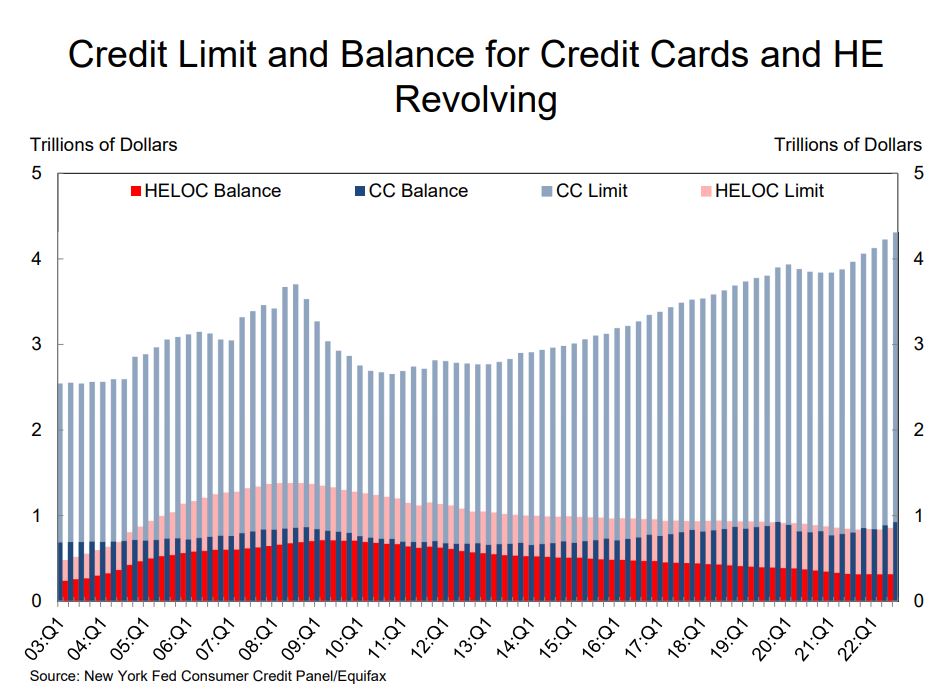

According to the New York Fed’s recently released Quarterly Report on Household Debt and Credit; Credit card balances saw a $38 billion increase since the second quarter, a 15% year-over-year increase marked the largest in more than 20 years. Credit card balances are nearing their pre-pandemic levels, after sharp declines in the first year of the pandemic. Auto loan balances increased by $22 billion in the third quarter, continuing the upward trajectory that has been in place since 2011.

Aggregate household debt balances increased by $351 billion in the third quarter of 2022, a 2.2% rise from 2022Q2. Balances now stand at $16.51 trillion and have increased by $2.36 trillion since the end of 2019, just before the pandemic recession.

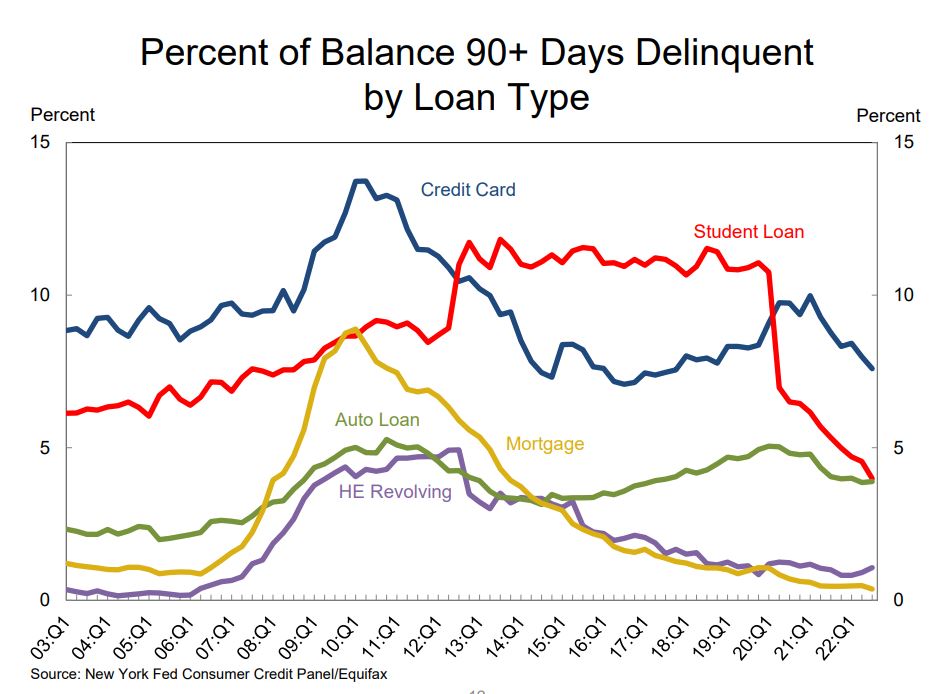

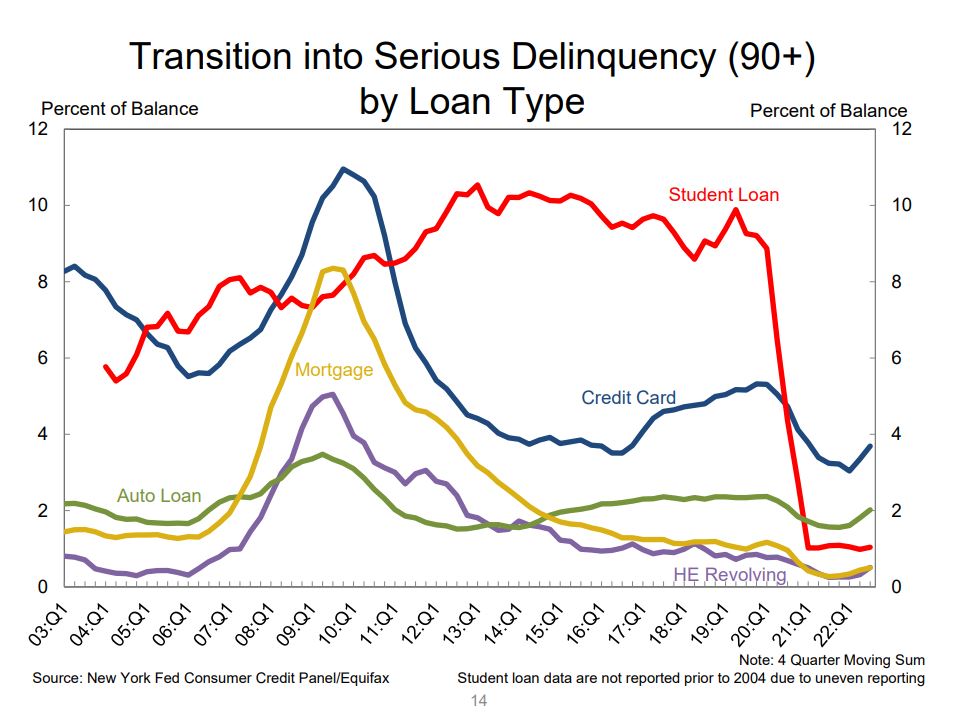

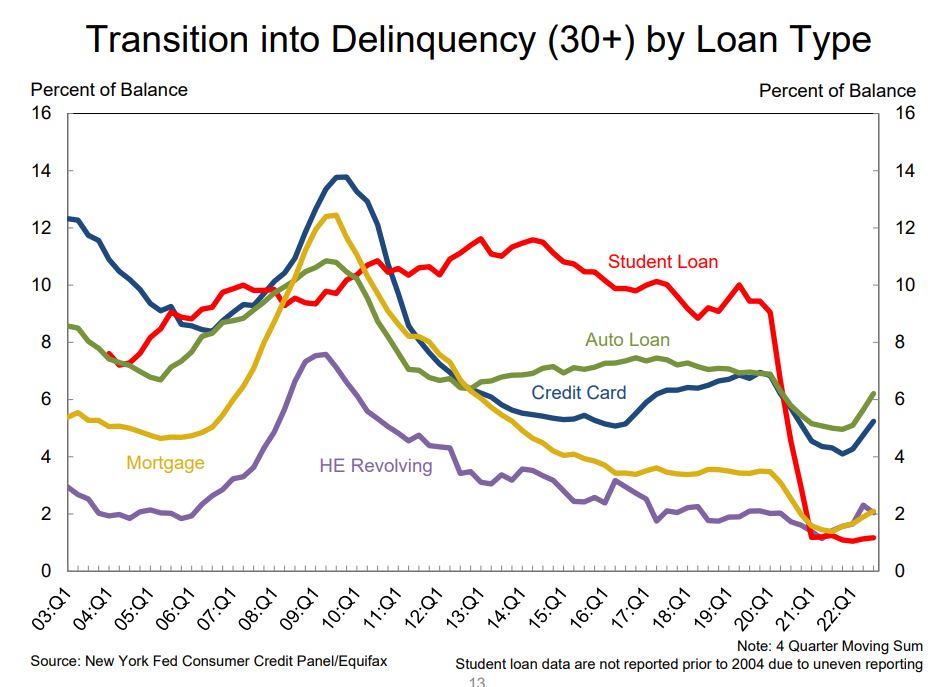

Their narrative is a little flat, and if you look at the data via their charts, you can see exactly where things stand. As a percentage of portfolio balances, 90+ days delinquent auto loans and home equity loans are beginning to trend upward mirroring TransUnion’s earlier statement of it being the highest level in over a decade.

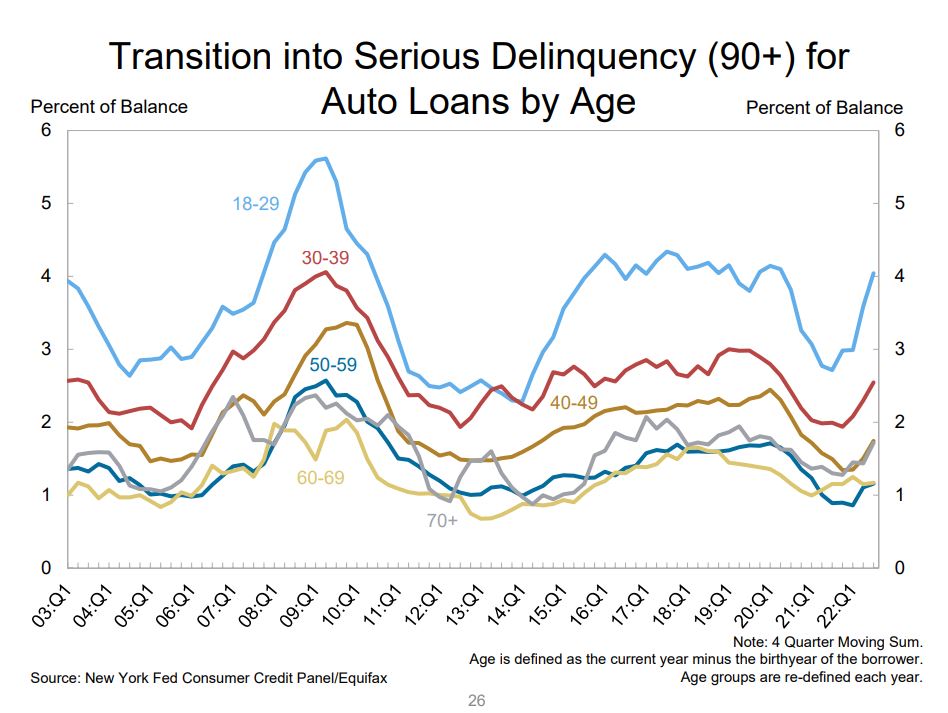

Breaking the 90+ day delinquent auto loans down by age, the 18-29 group has already climbed back to pre-pandemic levels in a matter of nine months. If this trend continues, as it usually does in the fourth quarter, they will likely represent their highest levels since the months leading into and out of the Great Recession.

More dramatic is the percentage of auto loan balances transitioning into 30+ days delinquent. While still below pre-pandemic levels, they illustrate an abrupt climb over the year that can only be compared to 2005 in the months leading into the Great Recession.

Credit Quality

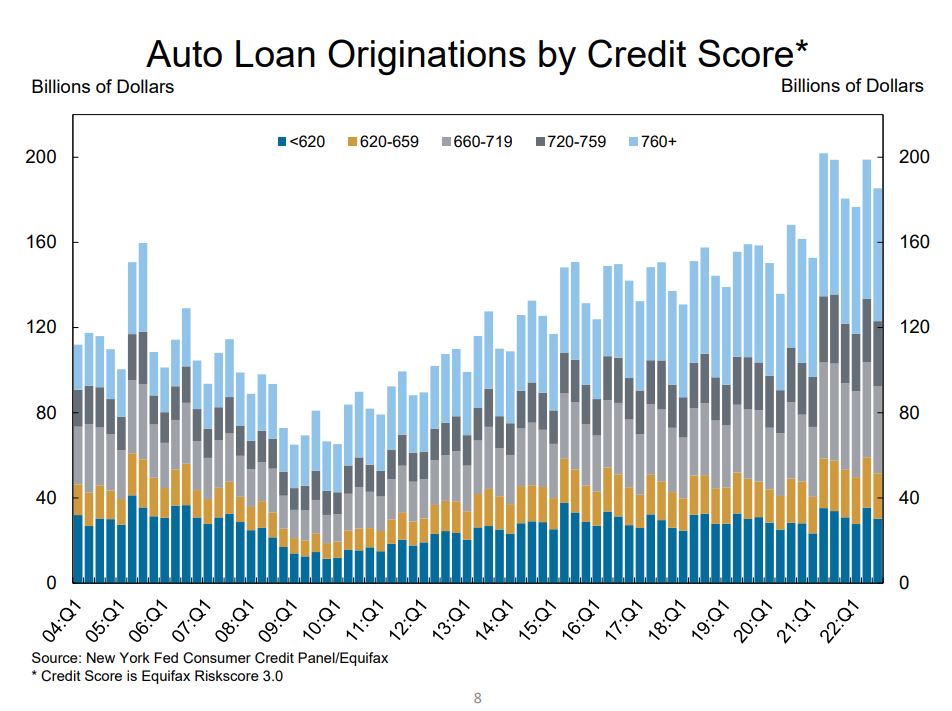

According to Experian, subprime auto loan balances sit at about $250 billion. This total is relatively flat over the years and fairly miniscule when compared to the rise in auto loan balances in the higher credit score tranches of 720+ which account for about half of all new auto loans originated in Q3 2022.

According to the Fitch Auto Loan 60+ Days Delinquency Index that tracks subprime loans packaged into Asset Backed Securities (ABS) and sold to investors; subprime auto-loan delinquencies dipped to 5.1% of subprime auto-loan balances in October.

October’s 5.1% delinquency rate was still down from the October 2019 rate of 5.4%. This index has held fairly steady at this rate since 2016, as more aggressive subprime lending and securitizations gained in investor popularity a few years earlier.

Bankruptcy and Collections

While the repossession industry is enjoying some steady increases in assignment volume, the heaviest of the volume has probably not kicked in yet.

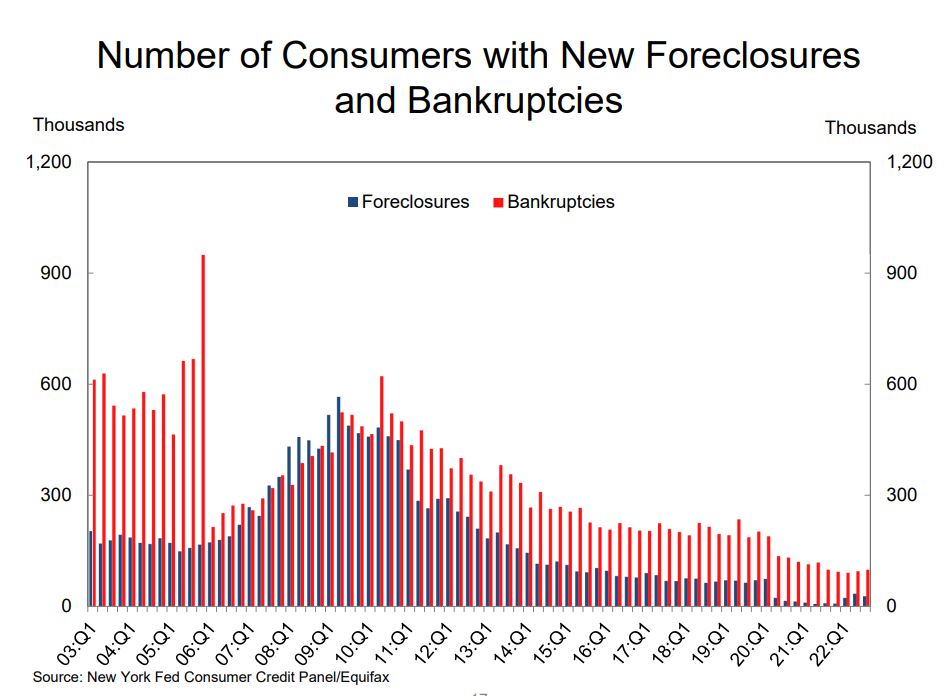

About 99,000 consumers had a bankruptcy notation added to their credit reports in 2022Q3. New bankruptcy notations dipped below 100,000 for the first time one year ago have remained at historical lows since.

The share of consumers with a 3rd party collection declined slightly from 2022Q2 and is at a historic low; approximately 6% of consumers have a 3rd party collection account on their credit report, with an average balance of $1,266.

With rapidly climbing credit card balances, high fuel prices, inflation still unchecked and layoffs starting, the potential for a rash of new bankruptcy and foreclosure filings increases by the month.

Recession

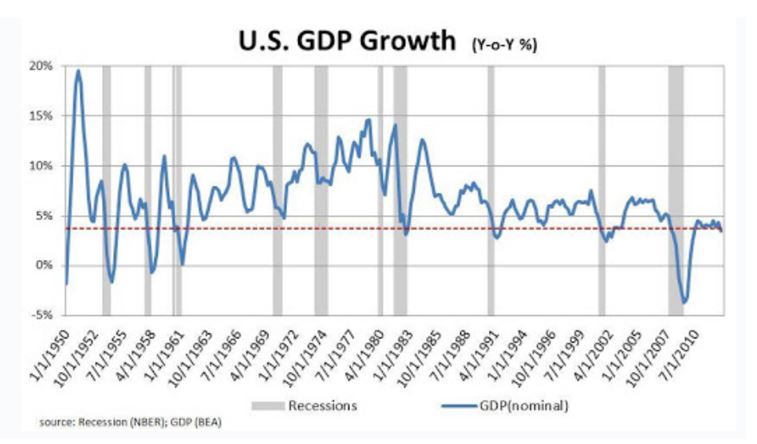

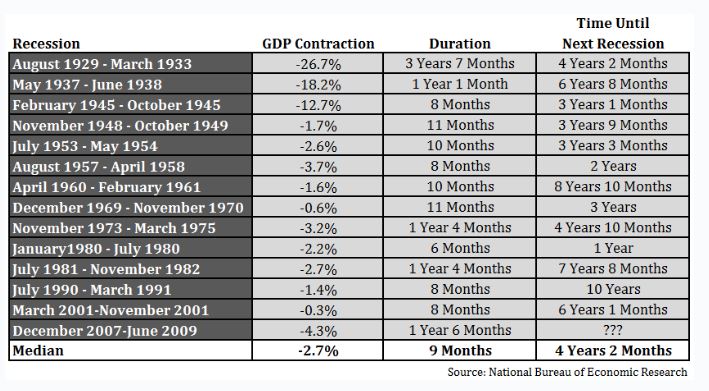

The Fed’s ever increasing prime rate appears to be the only remedy for fighting this inflation. Unfortunately, or fortunately depending upon what line of work you’re in, their tactics are showing a 50% or greater probability of kicking us into a recession in 2023, depending upon who you listen to.

It’s been over 14 years since we’ve had a real recession. Not a pandemic induced one with tons of loan mod’s. That’s the longest gap between recessions on record.

Although spin doctors in Washington may try to redefine what a recession is measured by, the traditional definition is, according to The US National Bureau of Economic Research; a significant downturn in economic activity spread across the economy, lasting more than two quarters, i.e. 6 months.

They also states that a recession usually implies negative economic growth, lower employment rates caused by a stop in hiring, lower personal demand, personal spending, company earnings, industrial production and retail sales.

It’s not hard to see it coming under the current economic conditions.

This is unfortunate for our nation who are still fighting our ways from the hardships created under the pandemic. This is also going to pose a big problem for the collections and repossession industries. It’s been so long since we’ve had a recession that the pool of experienced collectors and recovery agents is thin. Where are these people going to come from?

Kevin

Kevin The Pajama Party is Over – Delinquency on the Rise – Collections – Repossession