Federal Reserve: Auto Loan Originations Down, Early-Stage Delinquency Steady and Delinquent Student Loans Now Reporting

–

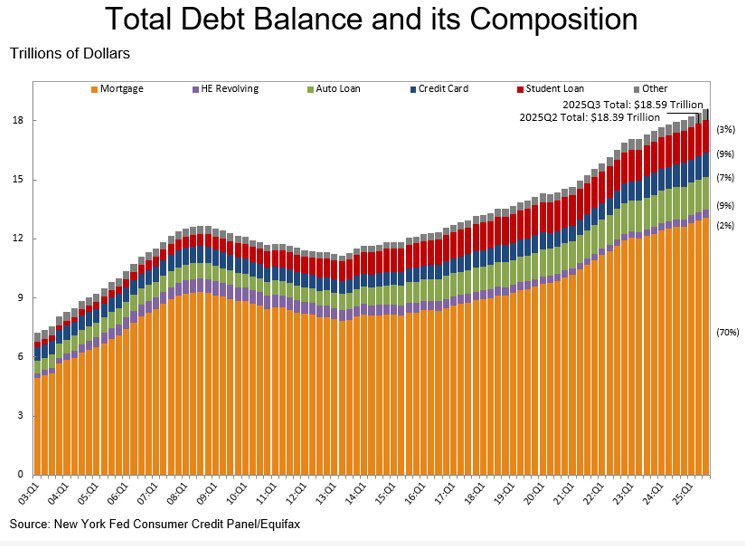

On November 3rd, the Federal Reserve Bank of New York released their quarterly report on household debt. Drawing their data from Equifax credit data, they revealed an economy mired in escalating debt while beginning to experience the ramifications of a four year pause in credit reporting on student loans. Most startling is the new record high in total household debt.

–

FRBNY – Household Debt and Credit Developments in 2025Q3

Aggregate nominal household debt balances increased by $197 billion in the third quarter of 2025, a 1% rise from 2025Q2. Balances now stand at $18.59 trillion and have increased by $4.44 trillion since the end of 2019, just before the pandemic recession.

–

Balances

Mortgage balances shown on consumer credit reports grew by $137 billion during the third quarter of 2025 and totaled $13.07 trillion at the end of September.

Balances on home equity lines of credit (HELOC) rose by $11 billion, the fourteenth consecutive quarterly increase. There is now $422 billion in outstanding HELOC balances, $105 billion above the low reached in the first quarter of 2022.

Credit card balances rose by $24 billion during the third quarter and now total $1.23 trillion outstanding and are 5.75% above the level a year ago.

Auto loan balances held steady, remaining at $1.66 trillion. Other balances, which include retail cards and consumer finance loans, rose by $10 billion and now total $550 billion.

Student loan balances rose by $15 billion and now stand at $1.65 trillion. In total, non-housing balances increased by $49 billion, a 1.0% increase from 2025Q2.

–

Originations

The volume of mortgage originations, measured as appearances of new mortgages on consumer credit reports and including both refinance and purchase originations, increased slightly with $512 billion newly originated in 2025Q3, an uptick from the $458 billion seen in the previous quarter.

There were $184 billion in new auto loans and leases appearing on credit reports during the third quarter, a small dip from the $188 billion observed in the second quarter of 2025.

Aggregate limits on credit cards continued to rise, with a $94 billion (1.8%) uptick in the third quarter. Home equity lines of credit (HELOC) limits rose by $8 billion, continuing the growth in HELOC limits that began in 2022.

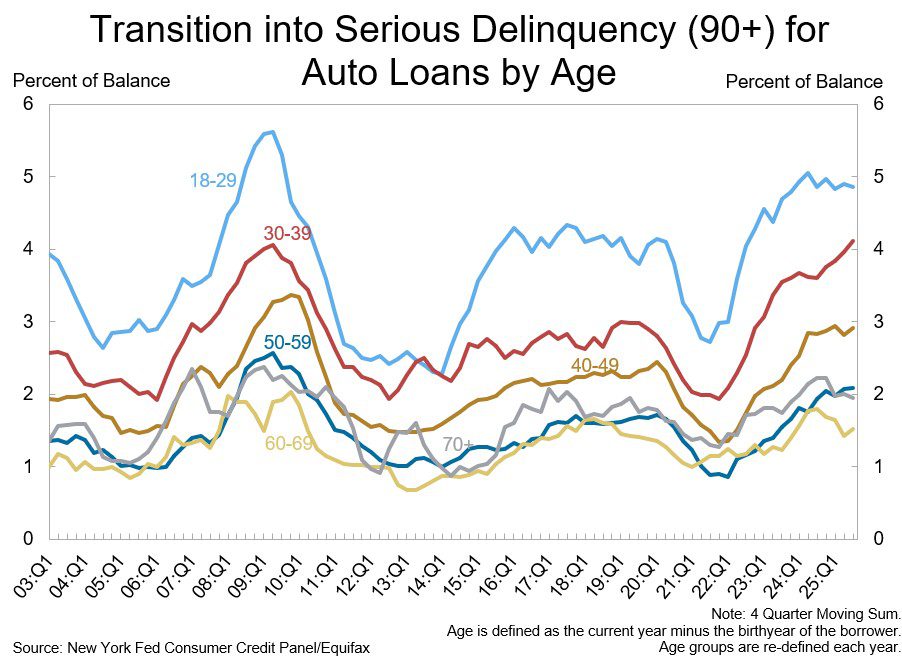

Credit quality of newly originated loans was mixed. The median credit score of newly originated auto loans remained steady, although the tenth percentile score for auto loan originations increased by 9 points, suggesting some tightening of subprime lending standards.

There was a slight decline in the credit quality of mortgages, as the median score of newly originated mortgage loans decreased by 2 points and the tenth percentile score decreased by 3 points.

–

Delinquency & Public Records

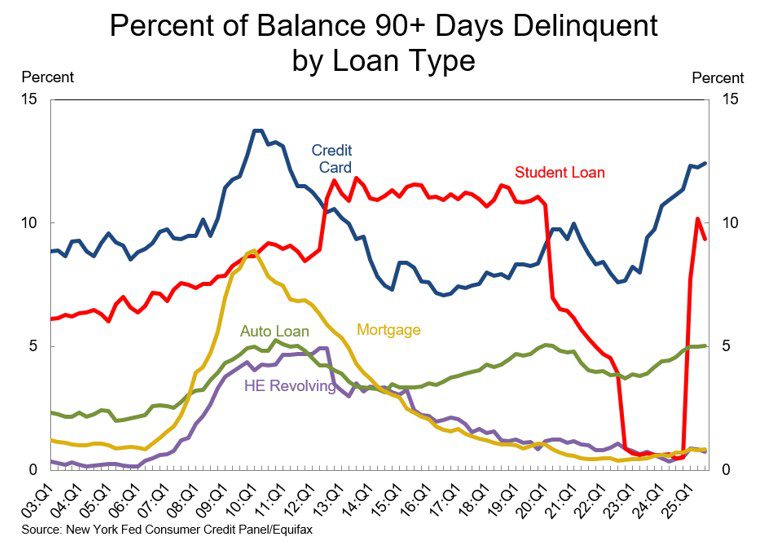

Aggregate delinquency rates remained elevated in the third quarter of 2025. The share of outstanding debt balances in some stage of delinquency was largely flat in 2025Q3; 4.5% of outstanding debt was in some stage of delinquency, 0.1 percentage points higher than the previous quarter.

Transition into early delinquency held steady for nearly all debt types.

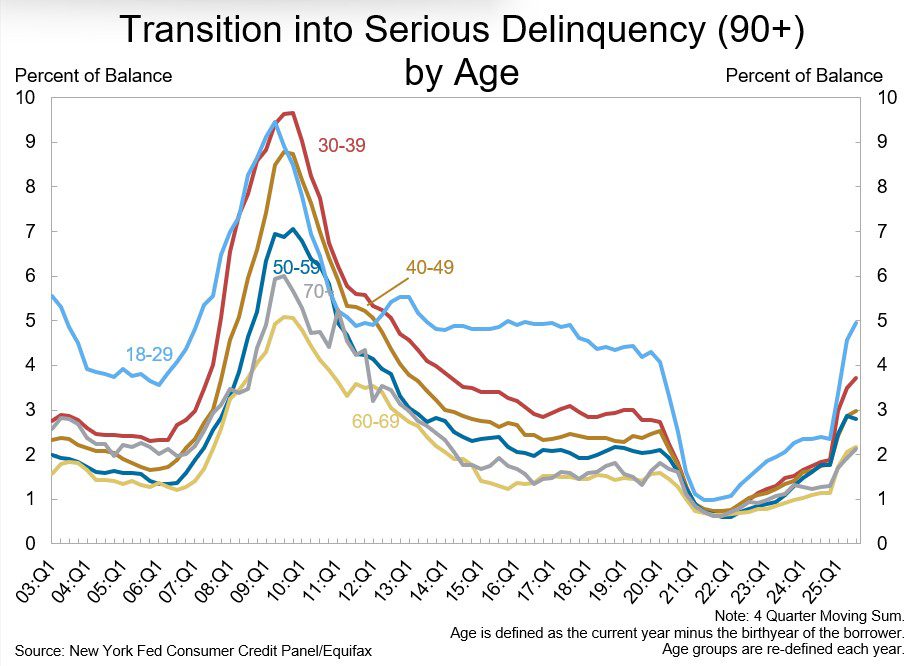

Transition rates into serious delinquency, defined as 90 or more days past due, were largely stable for auto loans, credit cards, and mortgages, and edged up slightly for HELOCs.

Delinquency transitions continued to rise for student loans, but stock delinquency for student loans has largely stabilized since the 4-year pause on reporting.

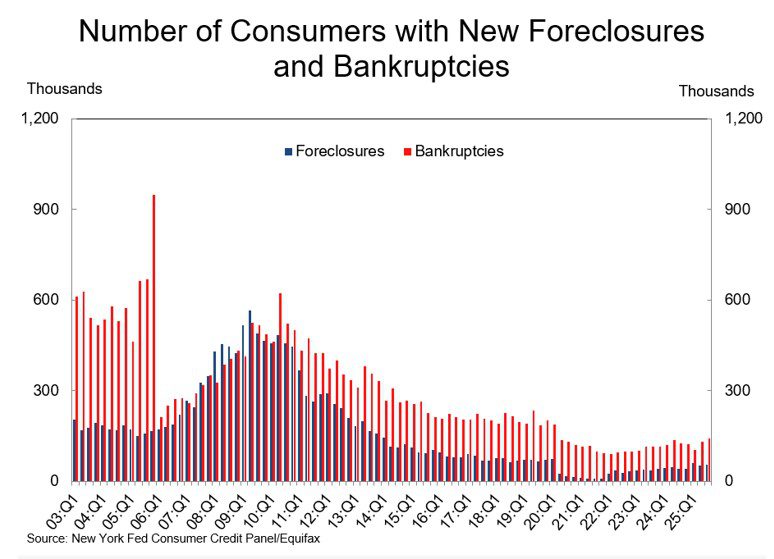

About 141,000 consumers had a bankruptcy notation added to their credit reports in 2025Q3, a modest increase from the previous quarter.

Housing Debt

- There was $512 billion in newly originated mortgage debt in 2025Q3.

- About 55,000 individuals had new foreclosure notations on their credit reports, an increase from the previous quarter.

Student Loans

- Outstanding student loan debt stood at $1.65 trillion in 2025Q3.

- Missed federal student loan payments that were not previously reported to credit bureaus between 2020Q2 and 2024Q4 are now appearing in credit reports. Consequently, student loan delinquency rates remained elevated after a sharp rise in the first half of 2025. In 2025Q3, 9.4% of aggregate student debt was reported as 90+ days delinquent, as compared to 7.8% in 2025Q1 and 10.2% in 2025Q2.

Read the Full Report Here!

Findings

In a press call Wednesday, researchers at the New York Fed said that overall household balance sheets remain “pretty strong,” though there are some signs of weakness among younger borrowers.

Bankrate senior industry analyst Ted Rossman reported in a research note Wednesday; “Student loan delinquencies are at a record high, but auto loan and credit card delinquencies aren’t as high as they were in the middle of 2024,”.

The report also shows that outstanding credit card balances increased by $24 billion to $1.23 trillion in the third quarter of this year, an all-time high and is up nearly 6% compared to one year ago.

In addition, the report also shows that student loan debt hit a new record high, at $1.65 trillion. With nearly 10% of all student debt reported as 90 days delinquent, or more, there are a lot more borrowers missing their payments, as well.

–

- This report is based on the New York Fed Consumer Credit Panel, an anonymized, nationally representative sample drawn from Equifax credit report data.

Source: FRBNY

Household Debt Hits Record High $18.59 Trillion in Third Quarter – Household Debt Hits Record High $18.59 Trillion in Third Quarter – Household Debt Hits Record High $18.59 Trillion in Third Quarter

Household Debt Hits Record High $18.59 Trillion in Third Quarter – Credit Union Collections – Credit Union Collectors – Lending – Bankruptcy – Foreclosure – Delinquency – Equifax – Auto Loan

More Stories

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions

Talk Derby to Me at the NWCUCA 51st Annual Conference