How Credit Unions Can Optimize Their Indirect Auto Lending Collection Strategy

Credit unions currently hold the largest share of the total US auto lending market. According to a recent report by Point Predictive, in Q4 2022, credit unions surpassed banks and captive lenders, accounting for 27% of auto loan originations.

The indirect lending space allows credit unions to grow their auto lending portfolios further, especially as competition has lessened, with several financial institutions choosing to exit the space. CUInsights reported that balances in the indirect auto lending sector grew by more than 24% in 2022, marking the largest growth rate observed since 2017.”

The Opportunities and Challenges with Indirect Lending

Indirect loans with credit unions appeal to borrowers due to competitive rates, flexible terms, personalized service, and community focus – especially with the emphasis on ‘people over profits’ that credit unions stand for.

For credit unions, indirect lending offers a great potential to contribute to overall profitability. It creates an opportunity to convert borrowers into full-service members or entice them into multi-product members.

As appealing as indirect programs can be, there are apparent complexities in balancing the right strategy to build a successful indirect lending program. These loans come with collection challenges – especially in a time of high vehicle prices, extended loan terms, and rising delinquencies.

Mitigating Risk in Indirect Lending:

Because dealerships serve as intermediaries between borrowers and lenders, like credit unions, they primarily assess creditworthiness based on credit scores, which can result in overlooking other vital financial indicators. This reliance on credit scores can lead to risky approvals, and the lack of visibility in loan performance can delay detecting delinquency patterns.

4 Strategies Lexop can help with to Optimize Indirect Lending Collections

Indirect and direct loans need to be looked at differently.

Indirect borrowers, focused on vehicle purchase rather than credit union loyalty, require tailored collection approaches. Historically, indirect lenders use strategic collection tactics to mitigate losses, including frequent contact with delinquent borrowers, assigning experienced staff to serious delinquencies, swift collateral repossession, and limited loan extensions. These efforts, though effective, are labor-intensive and costly to ensure the profitability of indirect programs.

What can credit unions do to be proactive in their collection approach and increase the chances of collecting on a borrower while optimizing resource allocation? Let’s explore four strategies that Lexop’s collection software can help with.

1. Proactive and Frequent Digital Communication

Recognizing the unique characteristics of indirect borrowers, credit unions should implement early intervention and communication strategies in the preferred communication channel to address late payments promptly. Remember, indirect borrowers don’t have the same relationship as your existing members, and they may need more nudges and reminders to drive them into action.

Establish a communication plan that includes an introduction from your credit union to build a relationship and be top of mind with future communication reminders.

Leverage our pre-designed email and SMS templates branded with your credit union colors and logos for business continuity and set up automatic campaign deployment schedules to increase contact rates and repayment success.

With Lexop’s automation capabilities, you can easily adjust the cadence of reminders and frequency without adding more manual work. By letting technology do the heavy lifting in early delinquency management, you’re freeing up your agent’s time to focus on those higher-risk accounts.

2. Provide a Simple Repayment Experience

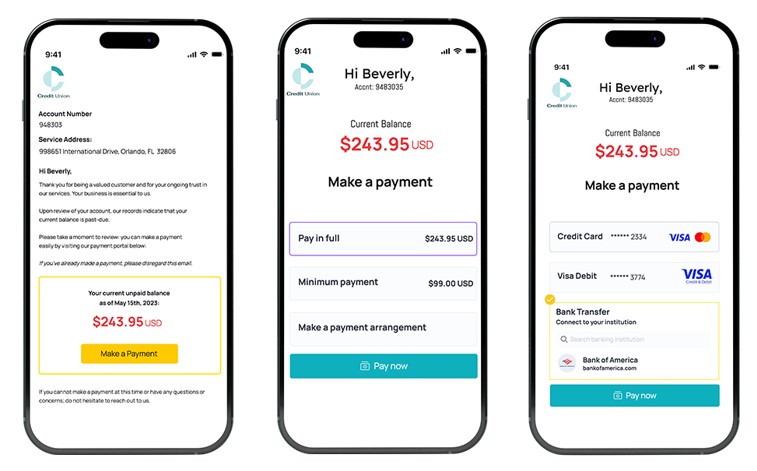

Because the borrower will likely only have this one loan with you and won’t have a website login portal or app as your members do, they need the simplest repayment experience – one that requires a straightforward path to resolution.

By providing more accessible digital payment tools and, most importantly, more payment options as they bank with other institutions, you are improving the overall loan servicing. Our self-service payment portal lets borrowers resolve their payments independently, without speaking to an agent.

3. Create a Positive Experience to Convert Indirect Borrowers

Empathetic collections and digital communication are vital in fostering positive experiences and transforming indirect borrowers into loyal credit union members. While these borrowers may never physically visit the branch or interact directly with the credit union, it’s essential to establish a robust collections strategy that prioritizes ongoing communication and exceptional service.

By meeting borrowers where they are and extending the credit union’s brand personality into their preferred communication platforms, credit unions can significantly enhance the overall collection experience and increase the likelihood of repeat business.

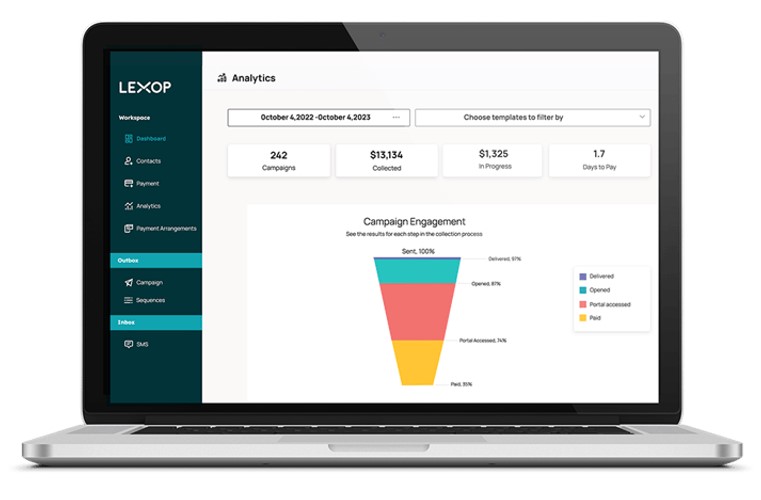

4. Leverage Data and Analytics

Leveraging alternative data outside the typical credit score can help better understand payment activity, campaign engagement, and contact preferences. These insights can help credit unions make smarter, informed decisions to achieve greater collection success.

We also know thatcompliance with indirect loans can be tricky,particularly concerning fair and unfair lending practices. In addition to analyzing various insights on collection campaign metrics, Lexop’s platform provides a proof of delivery report with a complete audit trail. This is extremely important for documentation, especially for later stages of delinquency and car repos.

Optimize your Indirect Lending Collection Strategy

By facilitating convenient payment tools, optimizing resource allocation, and implementing early intervention strategies, credit unions can enhance collection effectiveness, reduce loan servicing costs, and mitigate losses in the indirect lending portfolio. Embracing these strategies will position credit unions to successfully navigate the challenges of indirect auto lending while delivering value to their borrowers and future members.

See how our platform works and what the repayment experience could look like for your indirect borrowers. View Demo

Related Articles:

Lexop – 2024 Trends & Predictions for Credit Union Collections

Lexop and Allied Solutions Announce Strategic Partnership!

Fed’s G-19 Report Highlights Credit Card Collection Challenges for Credit Unions

How Credit Unions Can Optimize Their Indirect Auto Lending Collection Strategy – How Credit Unions Can Optimize Their Indirect Auto Lending Collection Strategy – How Credit Unions Can Optimize Their Indirect Auto Lending Collection Strategy – How Credit Unions Can Optimize Their Indirect Auto Lending Collection Strategy

How Credit Unions Can Optimize Their Indirect Auto Lending Collection Strategy – Fair Debt Collection Practices Act – FDCPA – Bankruptcy – Credit Union Collections – Delinquency – Lending – Credit Union Collections – Credit Union Collectors

More Stories

Talk Derby to Me at the NWCUCA 51st Annual Conference

The Auto Lending Surge is Here: How Lenders Can Navigate Rising Demand and Growing Risk

Market-Responsive Growth for High-Volume Lenders