Allegedly defrauded car dealers and financial institutions of over $500,000

_

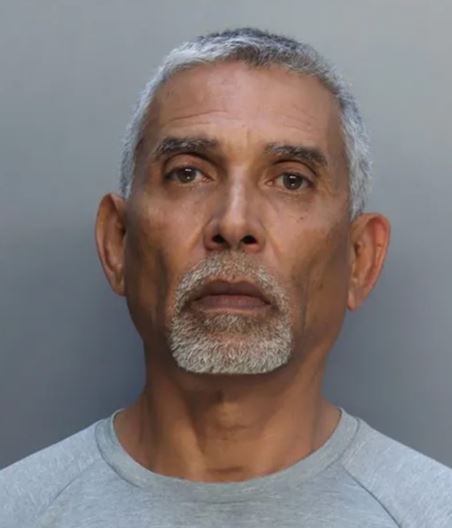

Miami, FL – May 13, 2025 – In Miami’s shadowy underworld, 56-year-old Omar Guardia allegedly masterminded a daring $500,000 “credit bust out” fraud, snapping up 20 vehicles in a single month. Allegedly linked to the notorious South Beach Bust Out Syndicate, his scheme unraveled when a stolen Chevrolet Silverado sparked a police investigation. Is Guardia a lone fraudster or a key player in a $24 million auto fraud empire?

A 56-year-old Miami-Dade man, Omar Guardia, was arrested on Wednesday May 7th, charged with orchestrating a sophisticated “credit bust out” fraud scheme that allegedly defrauded car dealers and financial institutions of over $500,000. The arrest marks a significant development in what authorities believe could be one of the largest organized auto fraud operations in the country, potentially tied to the notorious South Beach Bust Out Syndicate.

The Scheme: A Systematic Fraud Operation

Guardia faces charges including organized fraud of $50,000 or more, grand theft of a vehicle, unlawful vehicle subleasing, and obtaining property by false statement. According to police reports, Guardia was involved in a “systematic organized scheme known as a credit bust out,” where multiple dealerships and lenders are misled to approve vehicle purchases fraudulently.

The scheme came to light when Bomnin Chevrolet in Miami reported suspicious activity in March. Guardia had submitted a credit application to purchase a 2025 Chevrolet Silverado, which was later reported stolen. Due to a recent spike in fraud at the dealership, authorities were contacted and discovered Guardia had 17 vehicles registered in his name, 10 of which were purchased in March alone.

A broader records check revealed he had nearly 20 vehicles, including an Acura, two BMWs, a Honda, two Mercedes, five Toyotas, a Kia, a Ram truck, a motorcycle, and two Yamaha vessels.

Police noted that Guardia’s failure to disclose his vehicle stockpiling was central to the fraud. “If the defendant had provided the correct information and disclosed the other vehicles he had purchased, the dealership would have never sold him this vehicle,” the arrest report stated. Investigators estimate the total losses from Guardia’s scheme exceed $500,000.

Connection to the South Beach Bust Out Syndicate

Guardia’s arrest may be linked to a larger organized crime network known as the South Beach Bust Out Syndicate, which has been tied to over $24 million in fraudulent auto loan applications. According to fraud analysts at Point Predictive, the syndicate employs a highly specific approach to auto fraud, involving:

- Straw Borrower Recruiting: The syndicate recruits individuals with good credit to act as fronts, allowing the scheme to operate longer than those using stolen identities.

- Targeted Application Fraud: Fraudulent applications target high-value vehicles ($65,000-$100,000), report inflated incomes (averaging $284,000), and use suspicious self-employed business names, often LLCs tied to trucking companies.

- Monetization Schemes: After acquiring vehicles, the syndicate profits through methods such as shipping cars overseas (notably to the Dominican Republic), altering VINs to create “ghost cars,” illegal subleasing via platforms like Turo, fraudulent lien releases, and mechanics liens facilitated by complicit Florida shops.

Point Predictive’s 2025 Auto Lending Fraud Trends Report highlights the syndicate’s role in a growing national crisis, with auto lenders facing an estimated $9.2 billion in fraud loss exposure—a 16.5% increase from 2023 and the highest level ever recorded.

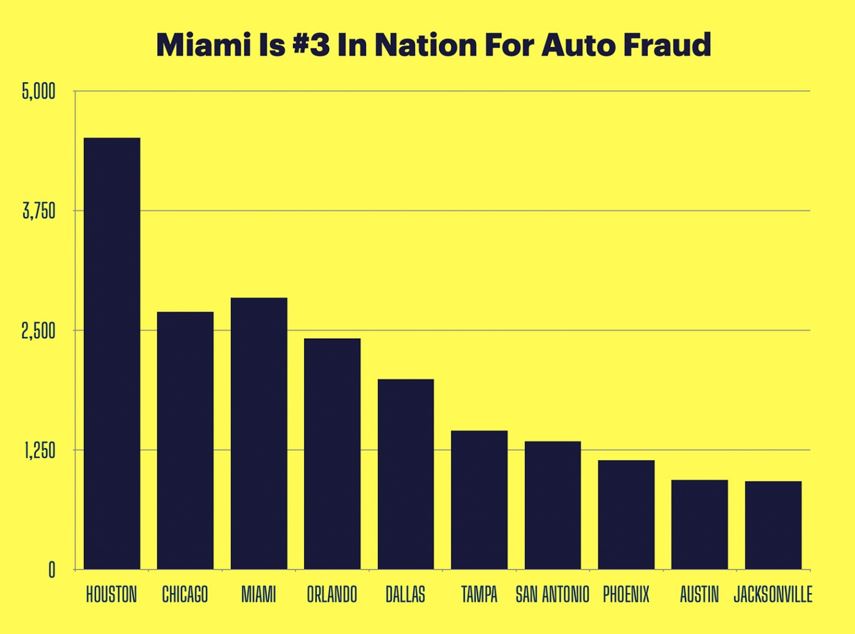

Florida: A Hotbed for Auto Fraud

Florida, particularly South Florida, is ground zero for sophisticated auto fraud schemes. Miami ranks third nationally for auto lending fraud, with four Florida cities in the top 10, according to Point Predictive. The region’s proximity to major shipping ports, strong international connections, and history of financial crime create an ideal environment for fraud rings. Florida also leads the nation in identity theft and general fraud complaints per capita.

Guardia’s Arrest and Legal Proceedings

When questioned by investigators, Guardia provided inconsistent statements and claimed he had no knowledge of the Silverado’s whereabouts. A prosecutor revealed during his bond hearing that Guardia has a prior federal conviction for marijuana trafficking, adding to the severity of his case.

Guardia was booked into jail and appeared before a judge on Thursday, who set his bond at $111,000 and ordered him to stay away from vehicle dealerships. Authorities continue to investigate whether Guardia’s actions are part of the broader South Beach Bust Out Syndicate or a standalone operation.

A Growing National Concern

The arrest of Omar Guardia underscores the escalating threat of organized auto fraud in the United States. With losses mounting and fraud schemes growing more sophisticated, law enforcement and financial institutions face increasing pressure to combat these operations.

As Point Predictive’s Scott Ellefson noted, the South Beach Bust Out Syndicate alone has been linked to nearly 500 fraudulent applications worth over $24 million, signaling the need for heightened vigilance in the auto lending industry.

For now, Guardia’s case serves as a stark reminder of the challenges facing dealerships and lenders in South Florida and beyond, as they work to protect themselves from the rising tide of fraud.

Source: Frank on Fraud

Related:

Straw Purchase Bust Out Fraud – Miami’s Multi-Million Dollar Auto Fraud

Miami Man Busted in $500,000 Auto Fraud Scheme Tied to South Beach Syndicate – Miami Man Busted in $500,000 Auto Fraud Scheme Tied to South Beach Syndicate – Miami Man Busted in $500,000 Auto Fraud Scheme Tied to South Beach Syndicate

Miami Man Busted in $500,000 Auto Fraud Scheme Tied to South Beach Syndicate – Police – Police – Arrest – Arrest – Credit Union Collections – Credit Union Collectors – Lending – Fraud

More Stories

NC Man Charged with ID Theft and Auto Loan Fraud

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

Chinese National Caught in International Auto Loan Fraud Ring