Well, let’s just start with saying, this was my third NARS convention and every year I enjoy myself more and more. While I enjoy the presenters and their topics, the highlight for me is always just getting together with my many friends from all across the nation who, under most circumstances don’t get the opportunity to mingle due to their differing association affiliations. With that said, I’ll go on with some details of the event before making some special mentions to a great time had.

Day 1 – Day one actually began on Thursday the 25th with the first annual NARS Golf Tournament, which due to my late arrival, I was unable to attend, but word has it was a great time had by all. Maybe next year.

My first day began on Friday with the actual summit. After a brief welcome and layout of the rules by Mary Jane Hogan, President of the ARA and Les McCook, Board Member.

A rumor had been circulating that the merger between the ARA and NFA was not final and that there were still unresolved issues. Well, that was put to rest as Mary Jane Hogan announced that the documents finalizing the merger had been signed. Once again, congratulations to all, and from all that I talked to, this was a “win win” for both and a major step toward industry unification.

The first session was titled “5 Key Truths to Riding the Digital Wave to Success” presented by Rick Gilman, owner of RGG  Communications. His focus was primarily on presenting the value of visual media versus oral, and was well illustrated with his cell phone camera broadcast of the session, which we were all able to access during the show. Perhaps the most memorable and valid statement he made was in reference to advertising and electronic media “If your brand is not out there, (speaking of the internet) you don’t exist.

Communications. His focus was primarily on presenting the value of visual media versus oral, and was well illustrated with his cell phone camera broadcast of the session, which we were all able to access during the show. Perhaps the most memorable and valid statement he made was in reference to advertising and electronic media “If your brand is not out there, (speaking of the internet) you don’t exist.

The next session was presented by Doug Duncan, President of Your HR Solutions titled, “Why Smart Employees Under Perform.” He presented a very good and educational presentation on interviewing techniques, “do’s and don’ts“ as well as retention tools and the ever present requirements of well documented and escalating corrective actions before termination. While I didn’t personally agree with his view point, he did have a unique view of incentives and compensation. Regardless, he was a very good speaker and had a lot of great information

The next session was presented by Doug Duncan, President of Your HR Solutions titled, “Why Smart Employees Under Perform.” He presented a very good and educational presentation on interviewing techniques, “do’s and don’ts“ as well as retention tools and the ever present requirements of well documented and escalating corrective actions before termination. While I didn’t personally agree with his view point, he did have a unique view of incentives and compensation. Regardless, he was a very good speaker and had a lot of great information

The next speaker at bat was Paul Kulas, owner of Belles Camp with his presentation titled “Compliance Is No Longer an Option – It’s Required”. Mr. Kulas had command of a topic that is near and dear to everyone in the industry that wants to know what they’re going to need to do about. The CFPB. His view on this topic was very similar to my own. “It’s not going away!”, so get used to it and adapt. He seemed to feel that the CFPB, despite massive hiring budgeted for 2013 and 2014, intends to make the Lenders police the vendors. This, in my opinion would be a nightmare for all. His view of the repossession industry was that the current model is killing everyone and that perhaps a business model known as “Coopetition” based upon a study by two Yale professors, might offer some insight of how he industry might be able to better control its own destiny. I really liked this speaker. Great ideas.

Next up was Alex Price covering “Skip Tracing and Certification”. I don’t think I’d seen Alex speak live in a year or two and forgot what a great speaker he is. Yeah , maybe I’m a little biased since I do consider him a good friend and editorial contributor to the site. What can I really say, he’s the top of the trade too.

great speaker he is. Yeah , maybe I’m a little biased since I do consider him a good friend and editorial contributor to the site. What can I really say, he’s the top of the trade too.

This year, Brett Balint of DRN, invited me to their users meeting titled “The Strong Getting Stronger: Generating Revenue with LPR”. I wasn’t at this separate meeting last year, but heard it was a little unruly with some disgruntled users being a little vocal on then, new President, Chris Metaxas. Well, they’ve had a year to turn things around and seem to have spent it well, as illustrated by a number of very positive statistics showing improved user service and revenue. Overall, the atmosphere was loose and nothing like the year before from what I’d heard. I was impressed. A great Job by Chris and Brett and all the folks at DRN!

And of course, the evening really began at the annual Cocktail Party hosted by PRA Location Services. I crawled into bed around 1am after shooting the breeze with a lot of you folks out in front of the Hotel. When I came out in the morning, some of you were still there. Did you guys get rooms or sleep in the bushes?

Day Two – After a great breakfast provided to all by Scott Jackson and the fine folks at MVTRAC, Jim  Bass, CEO of Auto One Acceptance opened up the day with his presentation titled “Fast Track to Profitability”. Honestly, kind of a misnomer, the title wasn’t very relevant to the audience, but the subject matter was as it pertained much to the subprime auto market and it’s cycles, most specifically, recessionary cycles and the unusual tightening that has occurred as the result of this last tragic one. Unfortunately, Jim believes the next slump in sales, or recession is just around the corner in 2015. I tend to believe him. They do occur about every 7-8 years apart.

Bass, CEO of Auto One Acceptance opened up the day with his presentation titled “Fast Track to Profitability”. Honestly, kind of a misnomer, the title wasn’t very relevant to the audience, but the subject matter was as it pertained much to the subprime auto market and it’s cycles, most specifically, recessionary cycles and the unusual tightening that has occurred as the result of this last tragic one. Unfortunately, Jim believes the next slump in sales, or recession is just around the corner in 2015. I tend to believe him. They do occur about every 7-8 years apart.

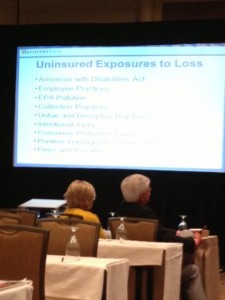

The next topic, “Understanding Additional Insured, Waiver of Subrogation, Hold Harmless and Other Lender Insurance Contract Issues”, was presented by Jim Deason, owner of Recovery First Insurance. I’ve got to tell you, a lot of people in that room will be calling their insurance agents. The list of uninsured claim types that are arising is startling.

The next topic, “Understanding Additional Insured, Waiver of Subrogation, Hold Harmless and Other Lender Insurance Contract Issues”, was presented by Jim Deason, owner of Recovery First Insurance. I’ve got to tell you, a lot of people in that room will be calling their insurance agents. The list of uninsured claim types that are arising is startling.

One of the panel discussions I had been waiting for was, “How to Evaluate the Health of Your Company and Your Clients.” The guest panelists were John Ziebro of Relentless Recovery, Bob Stankovitch of The Peak Service  Corporation; Clark Thomas, PHD, owner of Texas Hide and Seek, Inc.& Premier Recovery Service; Andy Robinson, SVP of PRA Location Services. The presentation started with a video presentation by John Ziebro illustrating his insane mastery of company and account level analytics. I assure you all, you wish you had as much access to the minutia of your businesses.

Corporation; Clark Thomas, PHD, owner of Texas Hide and Seek, Inc.& Premier Recovery Service; Andy Robinson, SVP of PRA Location Services. The presentation started with a video presentation by John Ziebro illustrating his insane mastery of company and account level analytics. I assure you all, you wish you had as much access to the minutia of your businesses.

Confirming what I knew at the Lender level and intuitively from working in the field and managing a company, the majority of repossessions occur within three days of assignment. This as one panelist pointed out was where the most profitable account activity occurs. Which brought up a good question of pricing modeling to myself.

Clark Thomas, PHD was quick to point out the power of data in account and lender negotiations, which was an almost mirror of a conversation John Ziebro and I had the evening before. On the topic of the CFPB compliance costs helping to elevate rates, all agreed that the market itself will determine the rates and it was the duty of all agencies to make lenders recognize this as an added cost that must be addressed in pricing.

“It’s All in the Numbers: Where is the Industry Heading?“ was presented by Thomas Webb, Chief Economist of Manheim Consulting. Great data and a great insight into the direction that the auto sales and remarketing industry is heading. He projects that sales have peaked as the result of purchased vehicles being held longer. This coupled with a tightening of Lender policies by the CFPB are expected to reduce the incomes of the F&I people at the dealerships and that wholesale prices will drop due to reduced capital purchase requirements.

Unfortunately, travel plans got in the way and I had to bug out for he airport after this. What I missed three topics I really wanted to attend, “Navigating the Terrain of the CFPB” Michael McCulley, Partner of Weltman, Weinberg & Reis, which promised to be an illuminating look at the direction the CFPB may be taking the industry, either directly or indirectly.

The state level panel, “Expanding the Value of the State Associations” with guest panelists: Michael Simpson, Rocky Mountain Repossessors Association; Jamie Blackburn, Florida Alliance of Certified Asset Recovery Specialist; Al Janus, Illinois Recovery Association; Jeff Ramirez, California Association of Licensed Repossessors, was another I unfortunately missed. The state level is, as of now in eh absence of a unified national association, in my opinion, the most effective level in which to create and acquire meaningful repossession legislation. This I really missed.

The final panel titled, “Compliance Will Determine the Future of Your Business” with Guest panelists: Stamatis Ferarolis, President of RISC; Dave Kennedy, CEO of First Credit Resources, Inc.; Tom Haas, Ally Financial must have been a great one and I’ll need to follow up with someone for some details or see if the ARA can let me borrow the tapes of these last three.

Overall, I had a great time. Dinner on Thursday night at “Trevi’s” with Max Pineiro, his lovely wife Rita, Chris Dodson, Jim Bryan and Mike and Kelly Ripka was definitely a highlight. We had some great conversation and laughs and as usual, I learned a lot from all of them. Great folks.

Dinner on Friday with Jamie Blackburn, Peggy Chapman, Ryan, Michael and Mee Ae at “Papa Brothers” Steakhouse was also great. Incredible steak! Judging from the large number of NARS attendees at the restaurant, this was obviously the place to be in Dallas. Although we packed into the back of a rental car like sardines on the way there, the ride back was better as Ryan volunteered to ride in the trunk on the way back to the hotel. When we pulled into the foyer of the hotel, he popped out of the trunk like Mr. Chow in “The Hangover.” Luckily, he was dressed!

Dinner on Friday with Jamie Blackburn, Peggy Chapman, Ryan, Michael and Mee Ae at “Papa Brothers” Steakhouse was also great. Incredible steak! Judging from the large number of NARS attendees at the restaurant, this was obviously the place to be in Dallas. Although we packed into the back of a rental car like sardines on the way there, the ride back was better as Ryan volunteered to ride in the trunk on the way back to the hotel. When we pulled into the foyer of the hotel, he popped out of the trunk like Mr. Chow in “The Hangover.” Luckily, he was dressed!

I could go on all day saying thank you to each and every one of you who I had the pleasure to meet and talk with but I’ll spare you. You know who you are and you know we can all plan on meeting again next year in Dallas for this outstanding event.

Until then, keep in touch and stay safe!

Kevin Armstrong

Editor

CUCollector.com

Thank you Tom! It’s a pleasure and an honor.

Kevin, it is always great to see you. You have a unique view and presence in the industry and I am thankful for you and the role you have!

Scott, as always, it was a pleasure talking with you and thank you again for all you’ve taught me.

Kevin, As always it was great seeing you. Thanks for taking time to visit and offer “words of wisdom” Thanks for all you do for this industry!

Scott Patterson