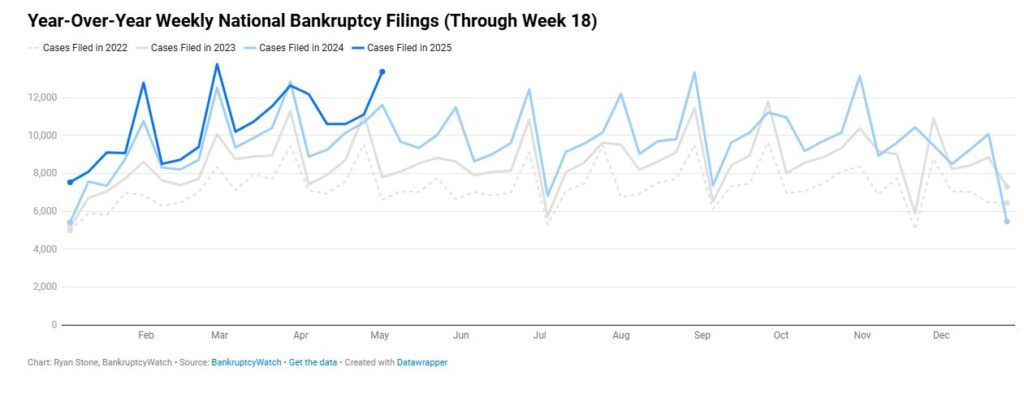

529,080 cases were filed in the 12 months ending March 31, 2025—a 13.1% jump – Administrative Office of the U.S. Courts,

2024 was one of the highest years in consumer delinquency since the Great Recession. So far, 2025 is shaping up to be about the same or higher. Rising with it are bankruptcy filings, and according to data new bankruptcy filings are up 13% year over year. So, what can collectors do to manage this?

Introduction

As collectors, your ability to recover debts hinges on understanding the financial landscape. The first quarter of 2025 has brought a sharp rise in bankruptcy filings, creating new hurdles for your work. This article dives into the latest trends, breaks down what’s driving them, and offers actionable insights to help you adapt. Whether you’re chasing individual or business debts, knowing how bankruptcy affects your efforts is key to staying ahead in 2025.

Key Trends in Bankruptcy Filings

The numbers tell a clear story: bankruptcy filings are up. According to the Administrative Office of the U.S. Courts, 529,080 cases were filed in the 12 months ending March 31, 2025—a 13.1% jump from the 467,774 cases recorded the previous year. For you, the focus should be on two types of filings:

- Chapter 7 (Liquidation): More individuals are wiping out their debts entirely through this chapter. Once filed, your collection efforts hit a wall—most unsecured debts get discharged, leaving little to recover.

- Chapter 13 (Repayment Plan): Filings here are also climbing. These cases involve a court-approved plan to repay debts over three to five years, giving you a shot at recovering some funds, though often less than the full amount.

Beyond individual debtors, commercial Chapter 11 filings spiked by 20%, and large corporate bankruptcies hit 188 cases in Q1 2025—a 35% increase from Q1 2024 and the highest first-quarter total since 2010. While these business filings don’t always directly involve your accounts, they signal broader economic trouble that could push more individuals into default.

What’s Driving the Increase?

Economic headwinds are fueling this surge, and they’re hitting your debtors hard:

- High Interest Rates: Borrowing costs are up, making it tougher for people to juggle existing debts or refinance. More missed payments mean more risk of bankruptcy.

- Persistent Inflation: Rising prices are squeezing budgets, leaving less money for debt payments.

- Increased Labor Costs: Businesses paying higher wages might cut jobs or hours, reducing the income your debtors rely on to settle what they owe.

- Post-Pandemic Fallout: The safety net of COVID-19 relief is gone, and shifts in spending habits have left many financially exposed.

These factors aren’t just hurting small borrowers—big companies are buckling too. That ripple effect could mean more of your accounts end up in bankruptcy court.

Implications for Collectors

This wave of filings changes the game for you:

- Chapter 7 Filings: When debtors file here, your chances of collecting drop fast. The discharge process halts your efforts, and unsecured debts vanish. Speed is critical—get ahead of these filings when you can.

- Chapter 13 Filings: These offer a silver lining. Debtors commit to a repayment plan, so you might see some money trickle in over time. Stay engaged with the process to maximize what you recover.

- Economic Strain: Even outside bankruptcy, debtors facing inflation and high rates are less likely to pay up, increasing your risk of write-offs.

Tailoring your approach to the type of bankruptcy—or the warning signs leading up to it—can make all the difference. For Chapter 7 risks, push hard before the filing hits. For Chapter 13, patience and persistence could pay off.

Historical Context: How Does 2025 Stack Up?

To gauge where we’re at, let’s look back:

- 2005 Peak: Over two million filings flooded the system as people raced to file before tougher laws kicked in.

- Post-2005 Drop: New rules slashed filings to 600,000 in 2006.

- Pandemic Low: Government aid drove filings down to 380,634 in June 2022.

- Pre-Pandemic Norm: In 2019, filings hit 774,940.

Today’s 529,080 cases are above pandemic lows but well below the million-plus peaks of the Great Recession (2007–2009). Things are heating up, but we’re not in full crisis mode—yet.

What to Expect for the Rest of 2025

The trend lines point up, and 2025 could keep you busy. Here’s why:

- Economic Pressures: High rates, inflation, and looming student loan burdens will likely keep filings elevated.

- Expert Outlook: The steady climb from 2024 is expected to roll into 2025 unless major relief arrives.

Total filings might hit 550,000–600,000 by year-end, depending on a few wild cards:

- Policy Shifts: Rate cuts or new aid programs could slow the pace.

- Economic Recovery: If inflation cools or spending picks up, filings might stabilize.

Either way, expect more bankruptcy cases clogging your pipeline. Plan accordingly.

Practical Advice

Here’s how to tackle this rising tide:

- Stay Informed: Track Chapter 7 and Chapter 13 trends—they dictate your next moves. Court data and industry reports are your best friends.

- Adjust Your Game Plan: For Chapter 7 risks, hit the gas early—reach debtors before they file. For Chapter 13, play the long game and work the repayment plans.

- Gear Up: More filings mean more workload. Make sure your team can handle the volume without dropping the ball.

- Use the Data: Watch economic signals—rate hikes, inflation spikes—to predict debtor behavior and shift your tactics ahead of the curve.

Conclusion

The Q1 2025 bankruptcy surge is a wake-up call for loan debt collectors. With economic forces like high interest rates and inflation pushing more debtors over the edge, your job’s getting tougher. Historically, we’re not at peak crisis levels, but the steady climb suggests 2025 will test your adaptability. Stay sharp, tweak your strategies, and brace for a busy year—your success depends on it.

Navigating the Surge in Bankruptcy Filings – What Collectors Need to Know – Navigating the Surge in Bankruptcy Filings – What Collectors Need to Know – Navigating the Surge in Bankruptcy Filings – What Collectors Need to Know

Navigating the Surge in Bankruptcy Filings – What Collectors Need to Know – Repossession – Repossess – Bankruptcy – Credit Union Collections – Credit Union Collectors – Delinquency – Lending

More Stories

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions

Talk Derby to Me at the NWCUCA 51st Annual Conference