Now in it’s fifth year, the National Credit Union Collectors Alliance (NCUCA) held its annual national credit union collections conference at the Bellagio in Las Vegas to a packed house of 300 of the nation’s best and brightest credit union collections executives, management and collectors. Filling out the powerful agenda and speaker roster, were some of the most entertaining and informative speakers in the industry.

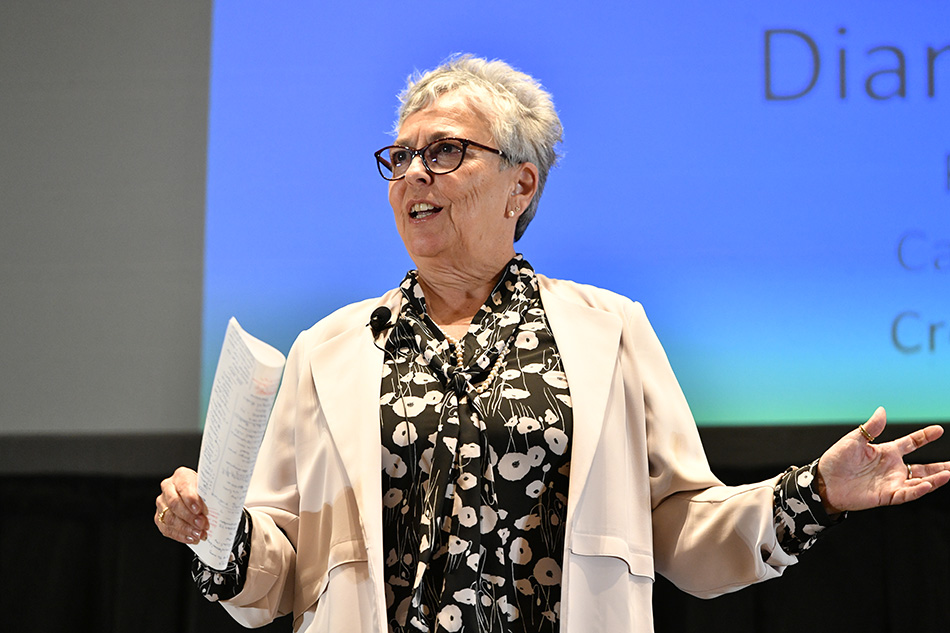

The actual first day of events, was the presentation of a state of the credit union industry update by President and CEO of the California and Nevada League, Diana Dykstra. Attorney speakers Karel Rocha and Thomas Prenevost hosted an FDCPA legal update, while Bruce Pearson presented an always valuable regulatory update for 2019 providing a deep dive into recent examination processes and a look ahead at the future regulatory landscape if dictated by them. In a no cameras allowed presentation, the Las Vegas PD’s Financial Crimes Unit appeared with some very unique insights to their experiences and relative fraud training.

My personal favorite was Brett Christianson, filling the late slot in the day, where most speakers are challenged to entertain a room, Brett called it like it is. His sarcastic humor was evenly applied to both lending and collections issues where he espoused the virtues of lending into deeper credit tiers for higher profitability in the face of higher delinquency. Catch him if you can. A fun speaker.

One unique highlight of the event was the Expert Roundtable event where the attendees rotated around 16 tables in 30 minute intervals hosted by industry experts engaging with the participants on topics like, bankruptcy, CECL, power sports and energy lending, fraud, remarketing, skip tracing, fraud, TCPA and Temenos best practices.

On the final day of the event, legendary credit union collections speaker and attorney, Eric North of Moore, Brewer, Wolfe, Jones, Tyler & North gave a presentation on the constantly evolving bankruptcy laws, applying them to practical and hypothetical scenarios to help the audience use its critical thinking skills in practice. In closing the event, John McNamara, Assistant Director of Consumer Lending, Reporting, and Collections Markets in the CFPB’s Research, Markets, and Regulations division provides an overview of the Bureau’s work in the debt collection space including rulemaking, supervision, and enforcement.

Before the 2019 event was even over, the NCUCA announced it’s date for their 2020 Annual Summit and training event, again at the Bellagio in Las Vegas on April 15-17, 2020. Seat and hotel reservations have not yet been announced, but sponsorship opportunities started filling before the event even closed. Make sure to accommodate this event in your training budget and reserve your seat as soon as possible. This year could sell out. If 2020 is as good as 2019 was, you’re in for the best credit union collections training event in the nation, ever, so far.

If you have never been to this event, it is a must for anyone in the credit union collections industry! Be sure to check in to the National Credit Union Collectors Alliance (NCUCA) website for updates and registration!