Income misrepresentation, synthetic identity risk, and dealer fraud amongst top lender concerns for 2023

To get a deeper sense of fraud’s recent impact on the automotive space, Point Predictive, a nationwide risk management and scoring solutions provider analyzing and scoring more than $2 trillion in applications since 2018, reached out to some prominent leaders in automotive and banking. Their sentiments and insights on the economic trends surrounding fraud are shared their 2023 Auto Lending Fraud Survey and reveal an increasingly pessimistic view of the auto lending landscape to come.

Enclosed in the report are the results of a series of twenty questions on auto loan fraud posed to 35 different lenders across all types of originations including sub-prime and prime, captive and indirect and mid-market category leaders. The topics range from perceptions of fraud risk, early payment default risk, dealer risk, and misrepresentation across the lifecycle of the loan.

The report provides an analysis of the perceptions and sentiments across the industry as well as how lenders plan to respond to it this year.

Among the findings are some of the Key Survey Highlights

• Lenders Believe Economy Will Worsen — 70% of auto lenders are preparing for a worsened economy in 2023. Economic conditions could push fraud and default risk higher this year impacting lenders’ bottom lines.

• Lenders Are More Concerned With Fraud — Lenders are more concerned about fraud entering 2023 than they were last year; 75% of lenders consider fraud more of a concern this year with 1 in 4 lenders citing they are much more concerned about fraud this year.

• Income Misrepresentation Is Lenders Biggest Concern — Lenders most often cited income misrepresentation as their biggest fraud concern, followed by synthetic identity risk, and dealer fraud as significant concerns as well.

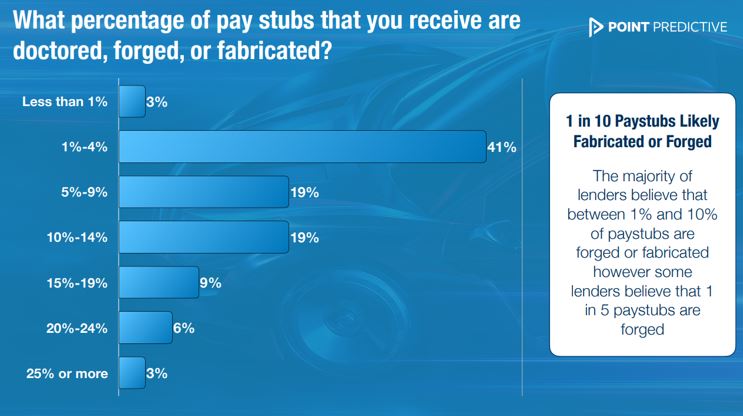

• Paystub Forgery Is Very Common — Paystub forgery continues to plague lenders. The majority of lenders believe that between 1% and 10% of paystubs are forged or fabricated, while some lenders believe that up to 20% of paystubs are altered.

About Point Predictive

Point Predictive Inc. powers trust in lending by delivering powerful artificial intelligence (AI) and machine learning solutions and combining those solutions with the power of our expert fraud analysts. Point Predictive has developed more than 21 billion unique consumer risk attributes from its risk data consortium.

Point Predictive enables lenders to fund more loans, mitigate risk more effectively, and improve the borrower experience. The company helps automotive, mortgage, retail and personal loan finance companies to identify the consumer applications with truthful and reliable information without the intense documentation, stipulations, and verification of data required by legacy solutions.

More information about PointPredictive can be found at www.pointpredictive.com. If you are interested in getting in touch, please contact us at info@pointpredictive.com

Point Predictive’ s 2023 Auto Lending Fraud Survey – Fraud – Home – Point Predictive

More Stories

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions

Talk Derby to Me at the NWCUCA 51st Annual Conference