Point Predictives 2024 Auto Lending Fraud Trends Report

Our 2024 Annual Fraud Report is our most comprehensive fraud report yet.

The report is based on intelligence gleaned from over 180 million historical loan applications from which we have derived 27 billion unique insights, spanning billions of dollars in unsuccessful and successful fraud attempts across the nation. The level of insight we can capture by analyzing the fraud patterns deep within the data allows us to continuously keep lenders and dealers apprised of the latest threat vectors.

This year’s report highlights

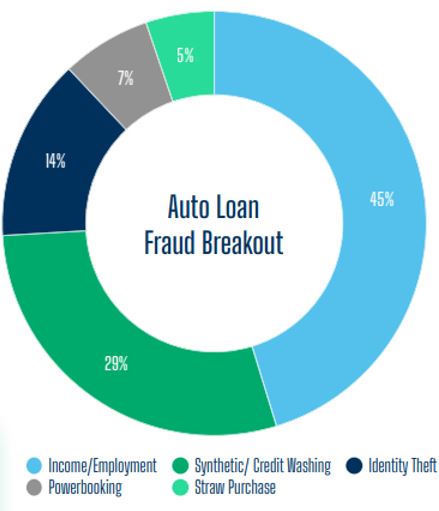

• An estimated fraud loss exposure of over $7.9 Billion to the industry.

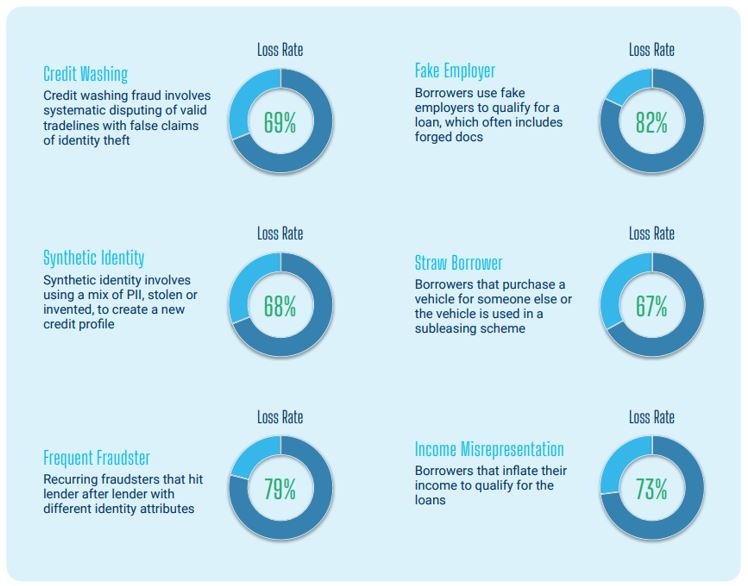

• A 98% growth in synthetic identity attempts as auto lending becomes a prime target.

• A 30% increase in credit washing, driven by an increase in illicit credit repair activity.

• A 27% increase in bust-out reports as the economy tightens.

• The threat of rising fraud and defaults due to rising affordability risk.

• The growing threat of Fraud as A Service as social media method sharing increases online.

As fraudsters continue to adapt their tactics, we have identified emerging patterns and trends that underscore the importance of vigilance and proactive risk mitigation strategies. That is one of the reasons why Point Predictive expanded our solution portfolio to serve not only auto lenders but also auto dealers and dealer groups nationwide.

As fraudsters continue to adapt their tactics, we have identified emerging patterns and trends that underscore the importance of vigilance and proactive risk mitigation strategies. That is one of the reasons why Point Predictive expanded our solution portfolio to serve not only auto lenders but also auto dealers and dealer groups nationwide.

By bringing our patented AI and vast data resources to the front lines, we know we can make even bigger strides in kicking fraud out of auto finance. Through our data consortium, shared fraud intelligence, and regular industry roundtables, we are happy to have lenders, dealers and stakeholders participate in those efforts with Point Predictive.

Frank McKenna

Chief Fraud Strategist, Point Predictive

Click the button below to begin reading. We hope you enjoy the insights!

Walk-Through Offer

If you’d like to better understand these fraud insights, we can offer a complimentary one time walk-through of the report’s findings from a member of our team.

Contact us to arrange a walk-through.

PointPredictive, Inc., 350 10th Ave, Suite 800, San Diego, California 92101, USA, + 1 (858) 829-0839

Point Predictives 2024 Auto Lending Fraud Trends Report – Point Predictives 2024 Auto Lending Fraud Trends Report – Point Predictives 2024 Auto Lending Fraud Trends Report

Point Predictives 2024 Auto Lending Fraud Trends Report – Fraud – Auto Loan – Credit Union Collections – Credit Union Collectors – Delinquency – Lending

More Stories

Former CU Loan Officer Sentenced for Million-Dollar HELOC Scheme

Credit Unions at a Crossroads: Shifts, Risks, and Opportunities — Part 2

NC Man Charged with ID Theft and Auto Loan Fraud