The Storm Has Arrived

Last year, I warned you that we were experiencing “The Calm Before the Storm,” and unfortunately, I was right. The National Credit Union Administration (NCUA) finally released their aggregate credit union 5300 FPR financials report for Q4 2024, and it was indeed ugly. Brace yourselves for a challenging 2025.

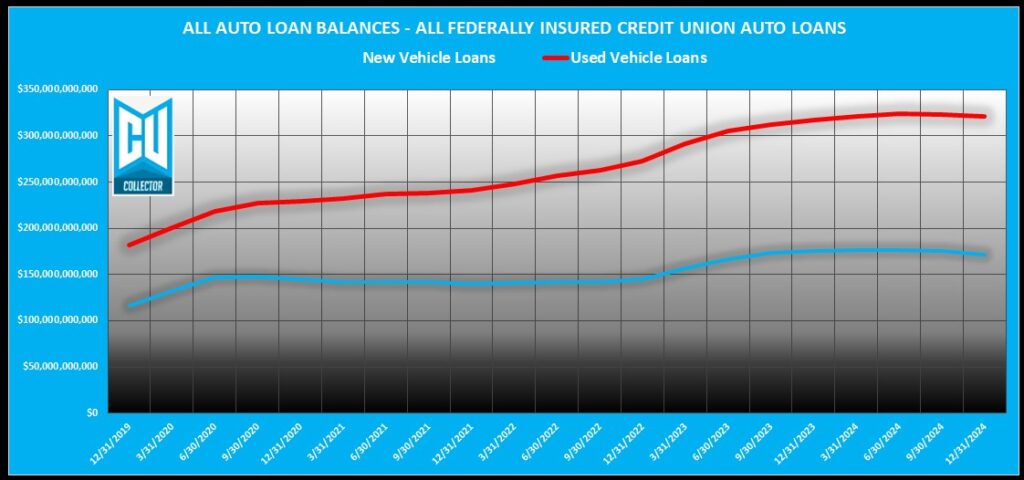

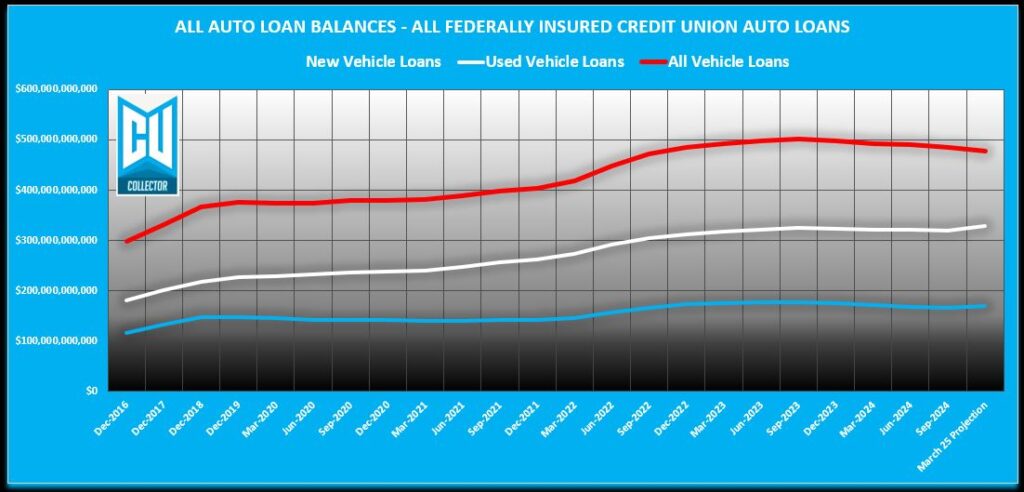

Portfolio Balances: A Shrinking Slice of the Pie

With the Fed cutting prime rates twice in 2024, credit unions struggled to keep up with captives and big banks in acquiring new auto loans. The result? A staggering $16.7B drop in portfolio balance year-over-year, with Q4 alone shedding $4.3B.

While the credit union industry had enjoyed a 4% average growth over the past five years, I predict Q1 2025 will see another 1% reduction, landing at $477B. While lending is on the upswing, it is still a challenging market to compete in. Regaining that growth will require risks.

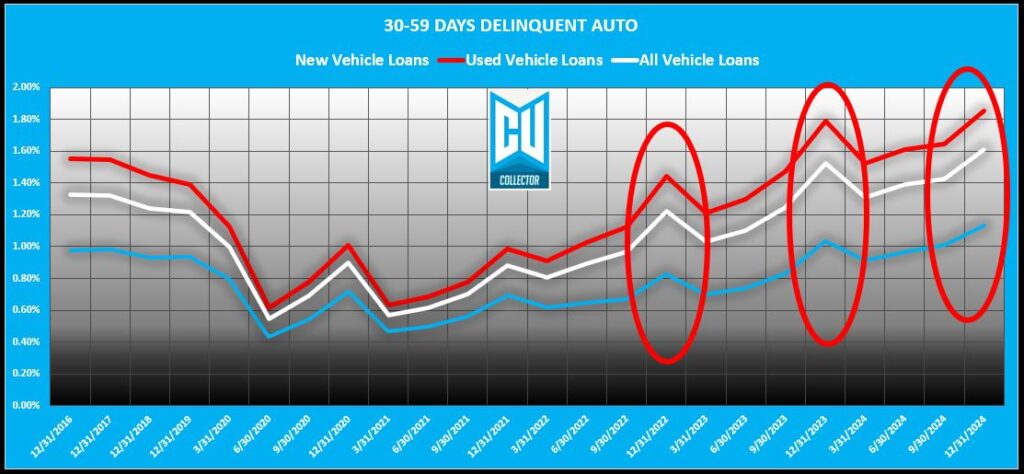

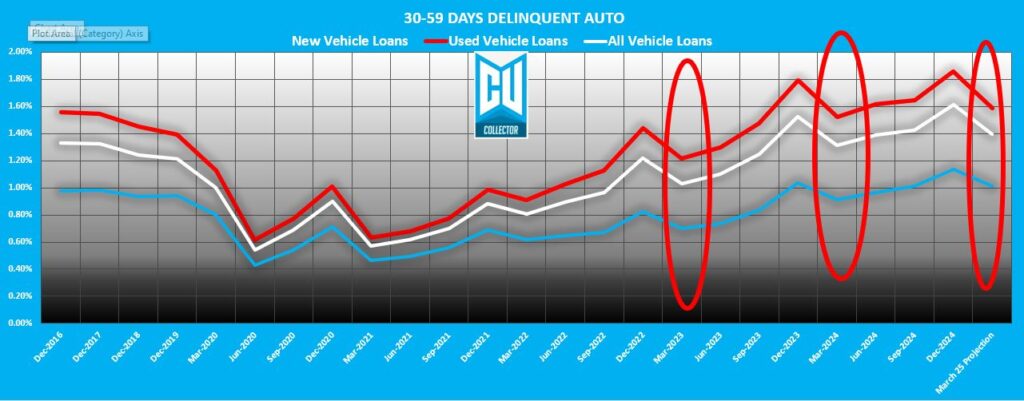

30-Day Delinquencies: A Mounting Challenge

Q4 2024 closed with a 1.61% 30-day delinquency ratio, the highest in over a decade. This means Q1 2025 started with a flood of loans rolling into the 60+ day bucket. On a positive note, tax refunds and bonuses typically bring an 18% reduction in Q1.

I expect Q1 2025 to finish at $6.3B, a modest $82M improvement from Q1 2024. By focusing proactively on creating high clearance ratios in this tranche you can help make this a reality.

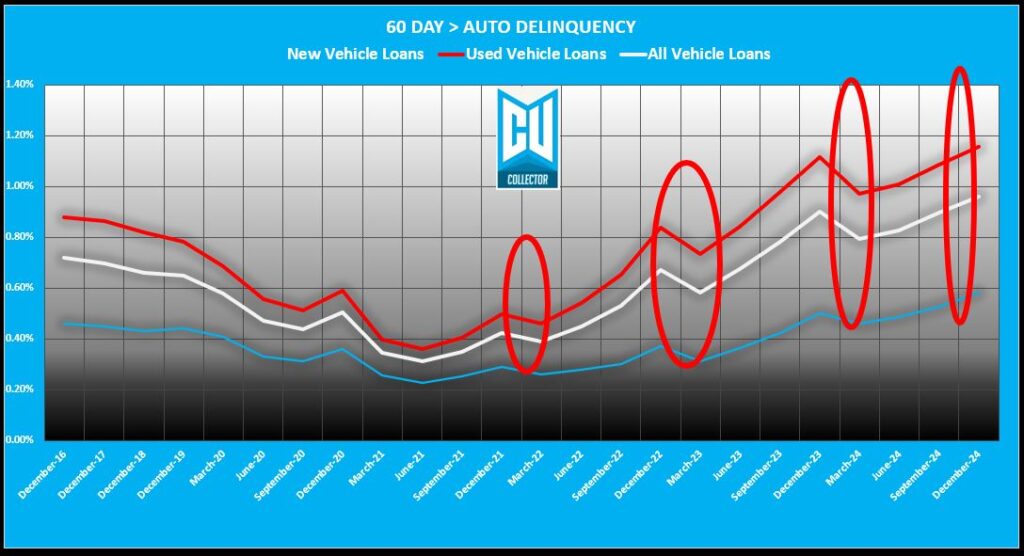

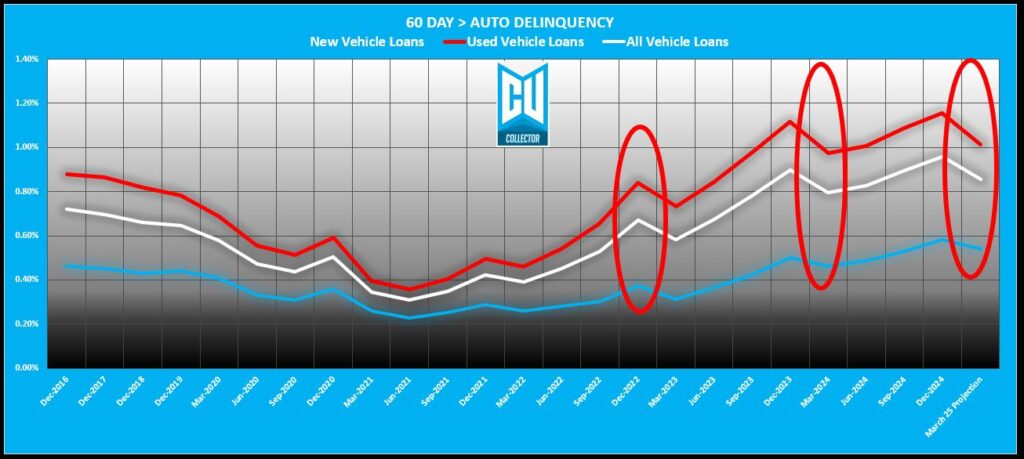

60+ Day Delinquencies: The Number That Matters

The reportable 60+ day delinquency hit $4.6B in Q4 2024, with a 0.96% ratio, another decade-high figure.

While Q1 usually sees a 14% drop, I predict it’ll end at $3.9B, right where 2024 began. Past Q1, as the months go by, this bucket traditionally shows incremental growth. Once a loan passes this point, it’s usually a lost cause.

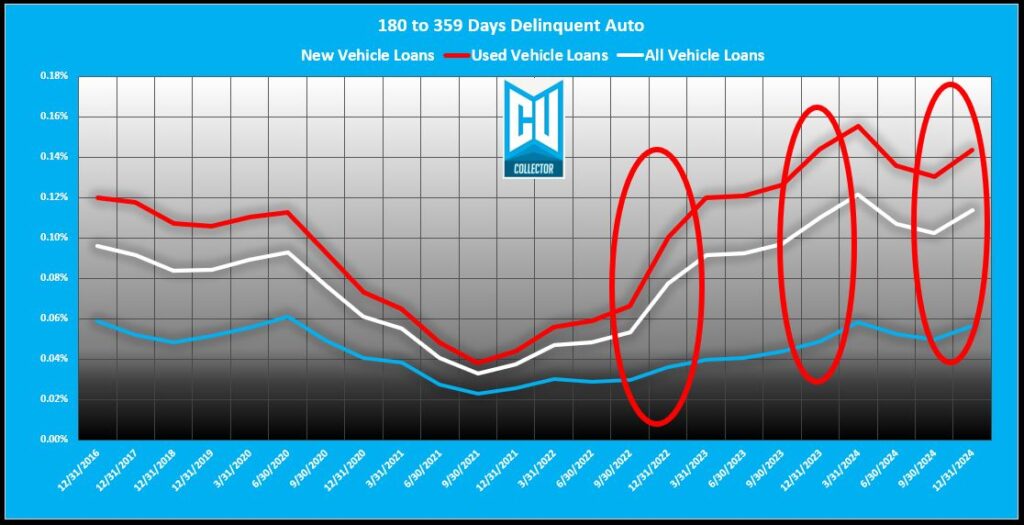

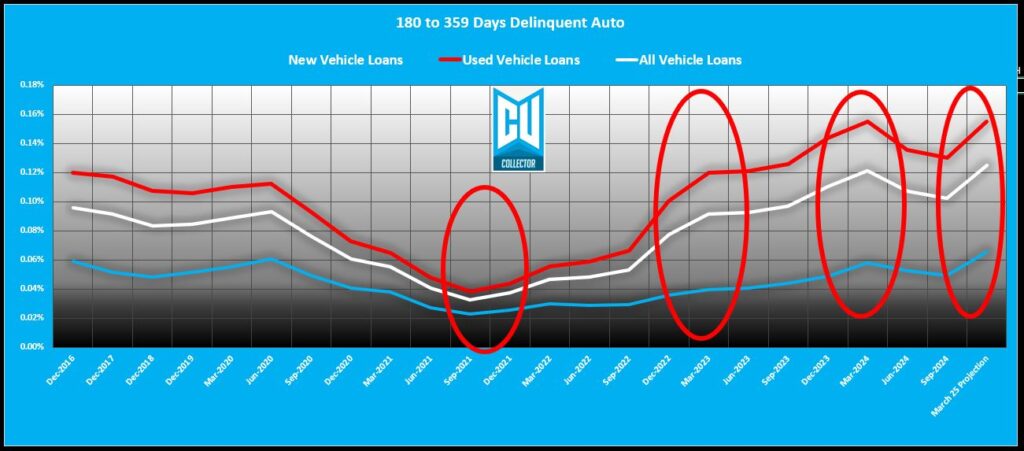

180+ Days Delinquent: The Collection Graveyard

The 180+ day bucket, filled with bankruptcies, repos, and deficiencies, reached $547M in Q4 2024, up $270M in the quarter alone.

With a 13% average Q1 increase over five years, I expect it to hit $606M. There’s not a lot of meat left on these bones once they get here, but by expediting ancillary product refunds, improving sales results and realizing losses appropriately, rather than being over optimistic in chances of resolution, it can be kept under better control.

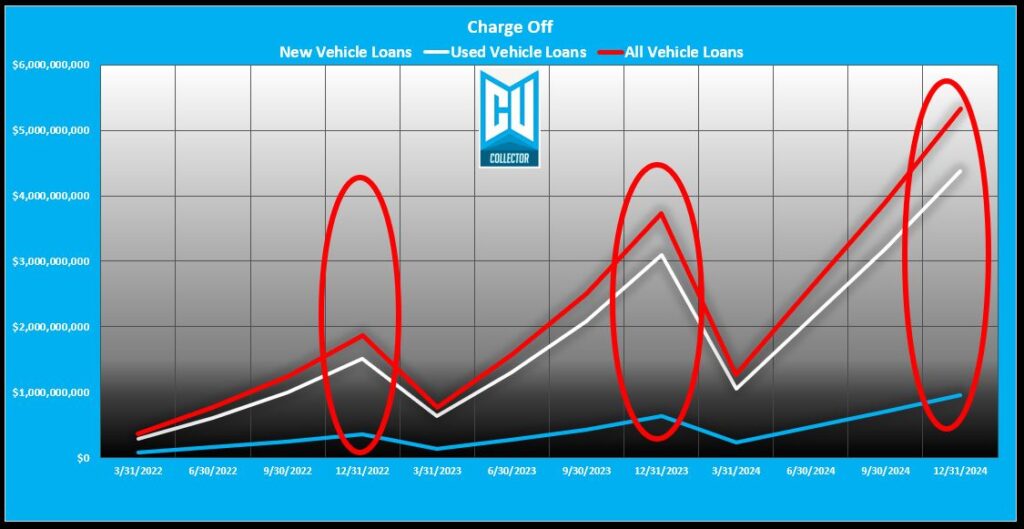

Charge-Offs: A Record Wipeout

Charge-offs hit a record $5.3B in 2024, up $1.6B from the prior year. As you know, this is an aggregate growing bucket whose slate gets wiped clean each year, but this high watermark signals the intensity of the delinquency problem the auto lending world is facing.

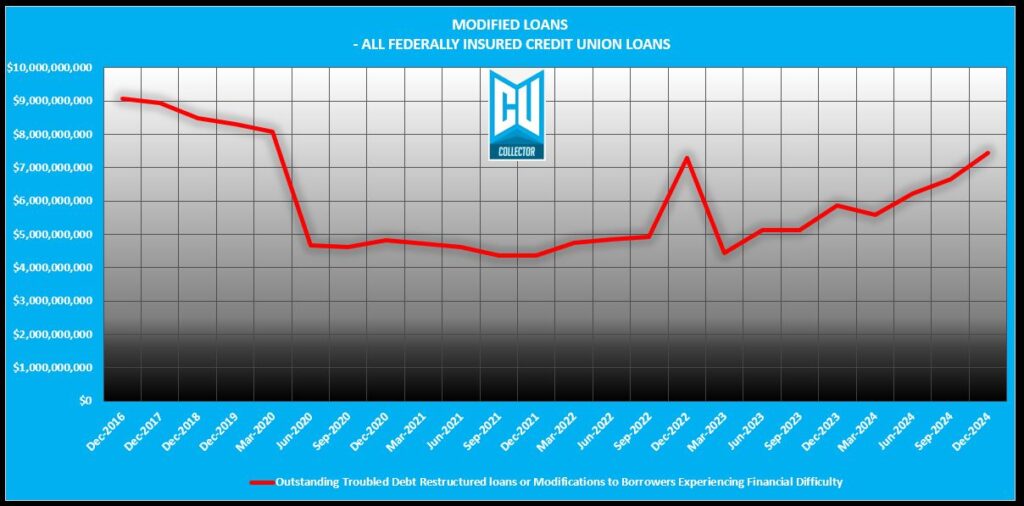

Loan Modifications: A Rising Tide

Loan modifications (TDRs) spiked 127% from Q4 2023 to Q4 2024, a $1.6B increase. While not all are auto loans, many likely are.

Are credit unions delaying repos and modifying loans to mask true delinquency? Back in February I posted an article titled; “Are Lenders Masking the True State of Auto Loan Delinquency?” authored by, Principal Owner of Commercial and Consumer Auto Finance Industry Knowledge, Bill Ploog. In his article, he demonstrated a strategic delay in repossessions and an increase in loan modifications by lenders to hold the line in charge offs and delinquency.

If this “extend and pretend” strategy was employed too aggressively in 2024, expect to see more of these modified loans in your queues sooner rather than later. Sometimes a modification is just a Band-Aid on a bullet hole solution.

The Bottom Line

Back in Q1 2024, I sounded the alarm, and the storm has indeed arrived. Record inflation, plummeting auto values, and tighter underwriting have fueled this delinquency surge.

With competition squeezing loan production, reducing delinquency ratios will be an uphill battle. If Q1 2025 reportable delinquency exceeds 2024’s, the worst may still lie ahead.

Wildcards like rate cuts, tax refunds, and cooling inflation could ease the pain, while tariffs, recession, or stagnant rates could worsen it. My advice: prepare for a rough ride until the tide turns. Preparation, skill and tenacity will be the keys to weathering this storm.

Download the Data Here!

Stay vigilant,

Kevin Armstrong

Publisher

Related Articles;

The Calm Before the Storm – 1st Quarter 24’ Credit Union Auto Loan Delinquency

Credit Union Auto Loan Delinquency Climb Continues

Credit Union Auto Loan Delinquency Surges

Credit Union Auto Loan Delinquency Pattern Back to Normal

Q4 2024 Credit Union Auto Loan Delinquency – An Ugly Year – Q4 2024 Credit Union Auto Loan Delinquency – An Ugly Year – Q4 2024 Credit Union Auto Loan Delinquency – An Ugly Year –

Q4 2024 Credit Union Auto Loan Delinquency – An Ugly Year – NCUA – Delinquency – Lending – Credit Union Collections – Credit Union Collectors – Repossession – Wholesale – Auto Loan

More Stories

Former CU Loan Officer Sentenced for Million-Dollar HELOC Scheme

Credit Unions at a Crossroads: Shifts, Risks, and Opportunities — Part 2

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted