Below Prime auto loan stress continues to intensify

Punchline: The theme continues … over past several years, Below Prime auto loan delinquency and losses remain a concern. 2025 started with record high Below Prime delinquency and each month continued to set new highs. Repossessions and losses are rising; both higher in July-2025 vs. July-2024 and pre-pandemic July-2019.

Images in this article were created using loan-level data submitted monthly to the SEC by lenders with U.S. publicly offered auto asset-backed securities (ABS). 2019 used for a pre-pandemic comparison to 2025 and 2024.

Dataset consists of up to 72 data elements for each loan … sourced from 15,754 files submitted to the SEC by 20 auto lenders, of which 18 had loans with outstanding principal, as of July-2025. Active lenders listed at end of article.

It is the most extensive, readily available, collection of auto loan-level detail available for benchmarking and exploration.

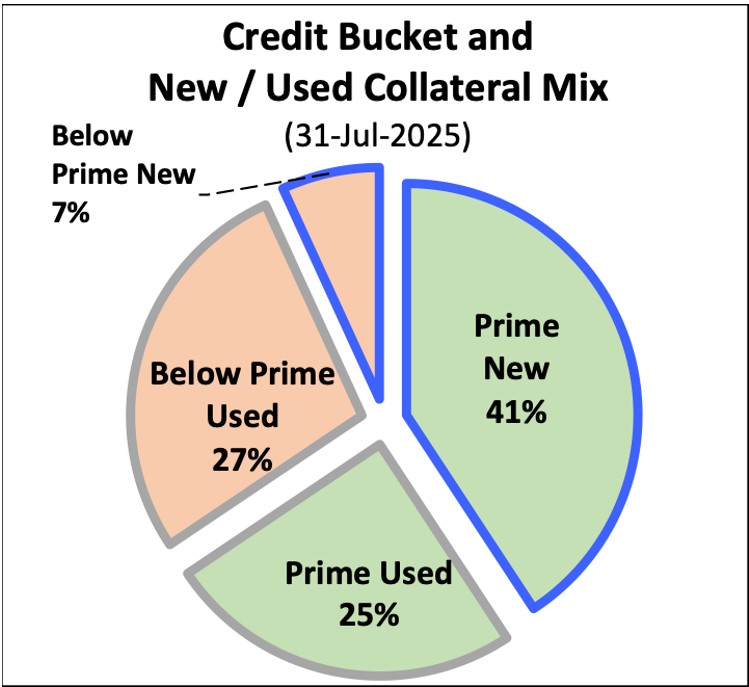

Thus far, 17 of 18 active lenders submitted, to the SEC, their July-2025 loan level detail comprised of 7.6 million loans ($138 billion). Two credit buckets are used in analysis: Below Prime (>= 300 <=660) and Prime (>660 <=850). Scores outside these ranges are classified as “no score.” Pie chart below depicts mix of 7.6 million outstanding loans in database, based on credit bucket (Prime – green/ Below Prime -red) and collateral type (new – blue border / used – gray border). Vast majority of Below Prime obligors finance used vehicles.

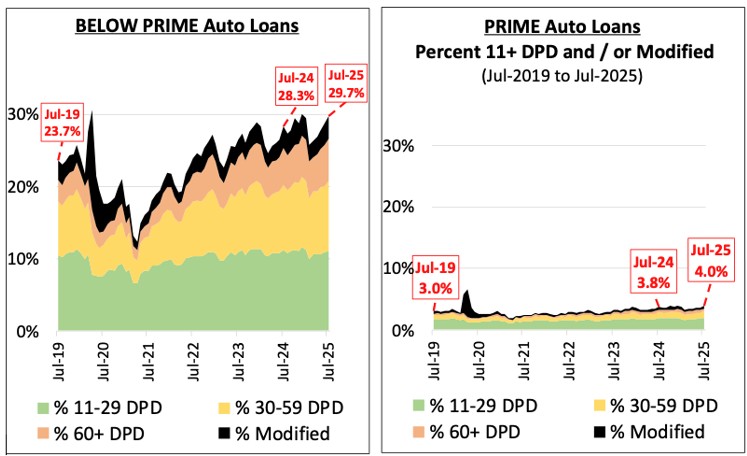

Stacked area charts below show loans under stress trend from July-2019 to July-2025 for Below Prime bucket and Prime bucket. Top two charts use same Y-axis for easy comparison of Below Prime to Prime. Bottom chart zooms in on Prime loans by reducing Y-axis range from 30% to 7%.

In July-2025, Below Prime accounts remained under considerably more stress than in pre-pandemic period; 5% (137 bp) higher YoY, and 25% (603 bp) higher vs. pre-pandemic July-2019.

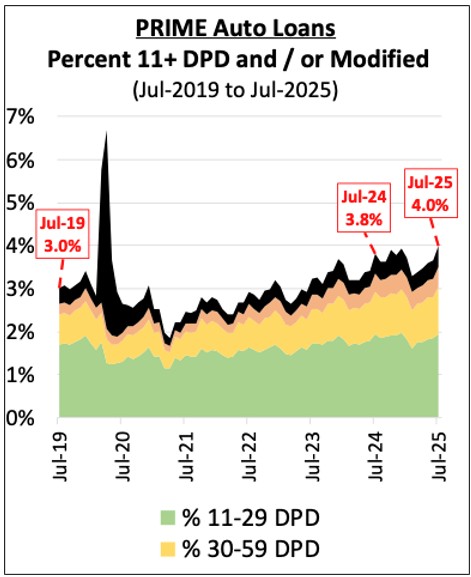

Percent of Prime accounts under stress were 5% (21 bp) higher YoY, and 32% (98 bp) higher vs. pre-pandemic July-2019 … but are not an issue, at this point.

Image below reflects same data as right-hand image above … while reducing vertical (Y-Axis) scale.

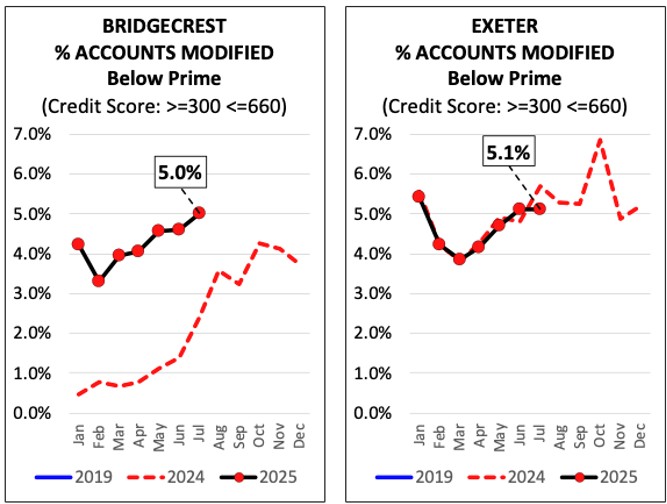

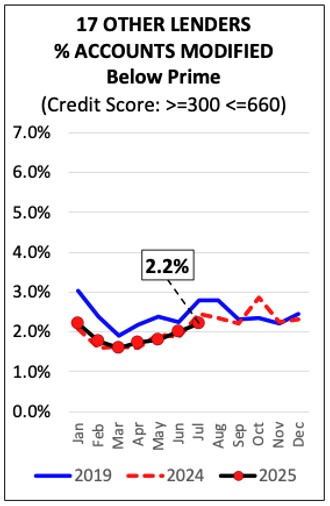

Following top-two charts reflect loan modification trends for two lenders with highest percentage of Below Prime loans modified in July-2025 (Bridgecrest and Exeter). Bottom chart reflects loan modification trend of the other 17 lenders in the dataset. Note: No trend for Bridgecrest and Exeter in 2019 as they did not have publicly offered ABS auto loans outstanding at that time. The 2019 trend is included for the bottom chart which reflects all 17 other lenders with outstanding loans in 2019.

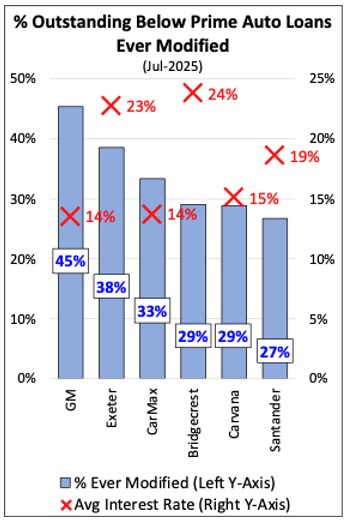

Chart below reflects lenders with greatest percent of Below Prime accounts currently outstanding that were ever modified. While GM’s ever-modified rate exceeds Exeter’s and Bridgecrest’s rate, the impact of loan modifications, specifically extensions, is not as severe for GM’s obligors collectively given its loan interest rates are lower than Exeter’s / Bridgecrest’s on average (14% vs. 23% / 24%, for loans modified in July). Also, given Bridgecrest weighty use of loan modifications, it is anticipated they will “move up the scale” over time … they moved up two spots in July vs. June.

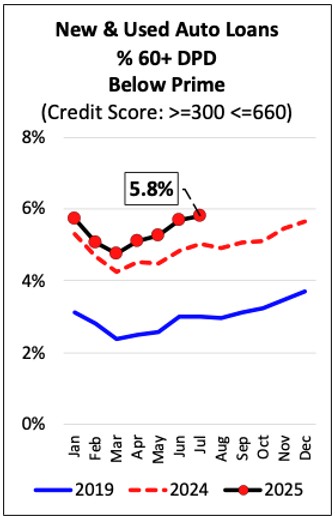

Below Prime delinquency is at, or above, record high levels based on data from multiple sources (e.g., NY Fed, Fitch Rating, FFIEC Call Reports, Experian, Equifax, TransUnion, etc.).

Following chart reflects 60+ days past due (DPD) delinquency rates based on number of loans outstanding in the dataset … Numbers continue to represent record high rates. In July-2025, Santander had highest Below Prime 60+ DPD delinquency rate (7.1%), followed by Bridgecrest (6.8%) and Exeter (6.7%).

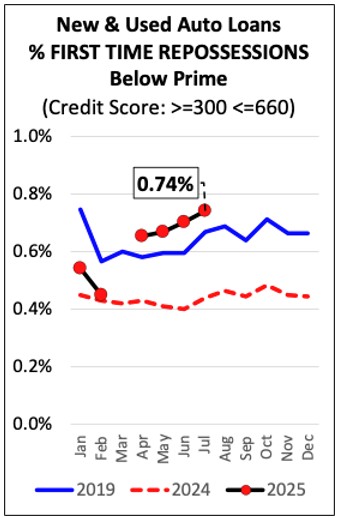

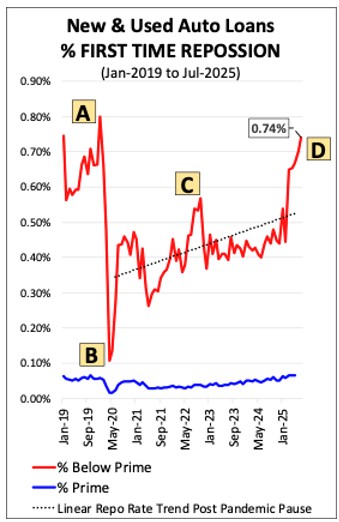

Following chart reflects Below Prime first-time repossession rate. Numerator: Number of first-time repossessions in month. Denominator: Total number of auto loans outstanding at month end.

July-2025 repossession rate at 0.74% is 68% (30 bp) above July-2024, and 11% (7 bp) higher than pre-pandemic July-2019. March-2025 data point removed from trend line given Exeter’s error correction action resulting in a significant March-2025 spike (not shown). The lenders with the highest repossession rates for the month of July were: Bridgecrest (1.03%), Exeter (0.93%), and Santander (0.79%).

In terms of repossessions, vast majority (84% in July) involve obligors with Below Prime credit scores, at time of loan origination. Chart below displays monthly first-time repossession rate of Below Prime (red line) and Prime (blue line) accounts from the ABS database. Punch line … There is an undeniable, slowly rising rate of repossession since the pandemic pause; and, repossessions of Below Prime accounts display an erratic (saw-tooth like) month-to-month pattern.

Footnotes for next chart:

- [A] Pre-pandemic spike in repossessions is Santander driven. Also, Ally’s repossession numbers were excluded from chart for seven-month period (Jan-2020 to Jul-2020). Reason: Loan-level detail reveals a noteworthy spike in monthly repossessions during noted period … from about 200 per month to 12.6K – 14.9K. Likely a loan-level detail data error in data submitted via SEC form ABS-EE exhibit 102.

- [B] Reflects industry-wide pandemic pause in repossessions.

- [C] Spike driven by Exeter’s rapid growth in repossession production leading up to Nov-2022 when it ceased reporting nearly all repossessions on form ABS-EE exhibit 102.

- [D] Second spike driven by Exeter’s return to reporting repossessions on a monthly basis. Chart excludes Exeter’s reporting of nearly 86K repossessions in Mar-2025, but it does include their repossessions from May forward.

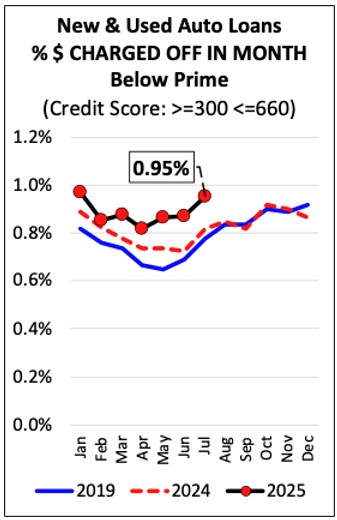

The final chart, created from the ABS dataset, reflects gross charge-off rates. Numerator: Gross dollars charged-off in month. Denominator: Total dollars outstanding at month-end.

July-2025 Below Prime gross charged off dollars at 0.95% are 17% (14 bp) above July-2024, and 23% (18 bp) higher than pre-pandemic July-2019. Bridgecrest had highest Below Prime gross charged off rate in June-2025 (1.54%), followed by Exeter (1.20%) and Santander (1.10%).

Prudent lenders continually search for and test actions to mitigate delinquencies / losses, support positions with facts, and benchmark.

The currently active publicly offered ABS include the following banks, finance companies, and manufacturer captives:

- Ally Bank, Bridgecrest Acceptance Corporation

- Capital One

- CarMax Business Services

- Carvana

- Exeter Finance

- Fifth Third Bank

- Ford Motor Credit Company

- AmeriCredit Financial Services d/b/a GM Financial

- American Honda Finance Corporation

- Hyundai Capital America

- Mercedes-Benz Financial Services

- Nissan Motor Acceptance Company

- Santander Consumer USA

- Toyota Motor Credit Corporation

- VW Credit

- World Omni Financial Corp.

Active lenders excluded this month, as data not yet available: BMW Financial Services.

All images are originals created using data derived from SEC form ABS-EE Exhibit 102 … As of 31-Aug-2025:

25 entities (counted as 20 due to servicer combos),

427 unique trusts (228 active),

15,574 trust filings retrieved from SEC website,

104 reporting months,

181 loan origination months,

27.1 million unique loans,

746.6 million rows of data (up to 72 data elements per row) …

Data represents the most extensive, publicly available, collection of auto loan-level detail available for benchmarking and exploration.

Commercial and Consumer Auto Finance Industry Knowledge

Full monthly report (98-pages of auto loan information) is $1,500 per month; additional queries and analysis available.

Subprime Auto Loan Repossessions and Charge Offs at Record Levels – Subprime Auto Loan Repossessions and Charge Offs at Record Levels – Subprime Auto Loan Repossessions and Charge Offs at Record Levels

Subprime Auto Loan Repossessions and Charge Offs at Record Levels – Repossession – Repossess – Repossession – Lending

More Stories

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions

The Auto Lending Surge is Here: How Lenders Can Navigate Rising Demand and Growing Risk