All DRN clients receive training on the DRNsights suite when they begin using our platform. This...

Collections

MANAGE RISK SERIES PART 1—3 Reasons Collections Data is Critical to a Risk Management...

The Consumer Bankruptcy Reform Act of 2020 (CBRA) Coming out ahead of what many...

The rule focuses on debt collection communications and gives consumers more control over how...

The Sooner, the Better: How Risk Scoring Became a Powerful Pre-Repo Tool Guest Article...

A FREE Virtual Showcase October 20-22, 2020 Make the right move based on data...

Sacramento, CA – 25 August 2020 – Today at 11:30am PST, an online press...

California Long Term Mortgage Forbearance Bill Goes to Vote August 18 Your Help Needed!...

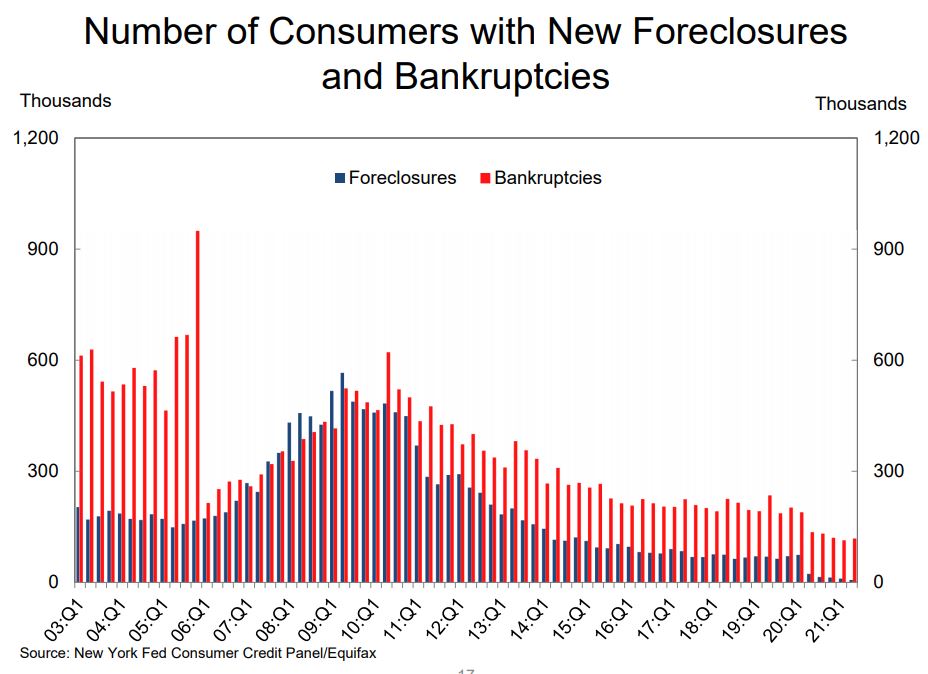

“We anticipate filings increasing in the next few months as more households and companies...

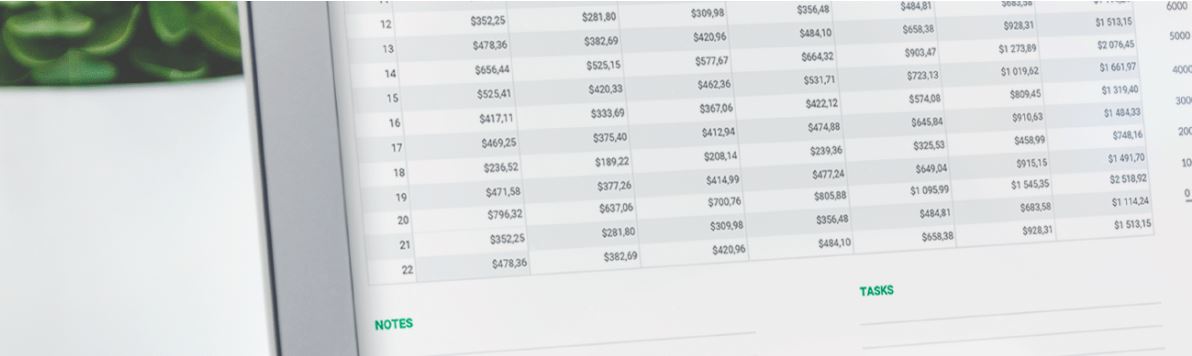

For Collectors Only! In case you missed it, in May, we released the results...

For Collectors Only! In case you missed it, in May, we released the results...

“We bailed the banks out, now it’s their turn to bail us out.” AB...

The Assembly will convene on Wednesday, June 10, 2020 at 10:00 a.m. Sacramento, CA...

If you have not done so already, please submit your “Connect for the Cause”...

“Those forbearance periods shall continue to be extended upon request of the consumer up...

“Those forbearance periods shall continue to be extended upon request of the consumer up...

If enacted as law, all repossession, foreclosure and collections activities would be on hold...

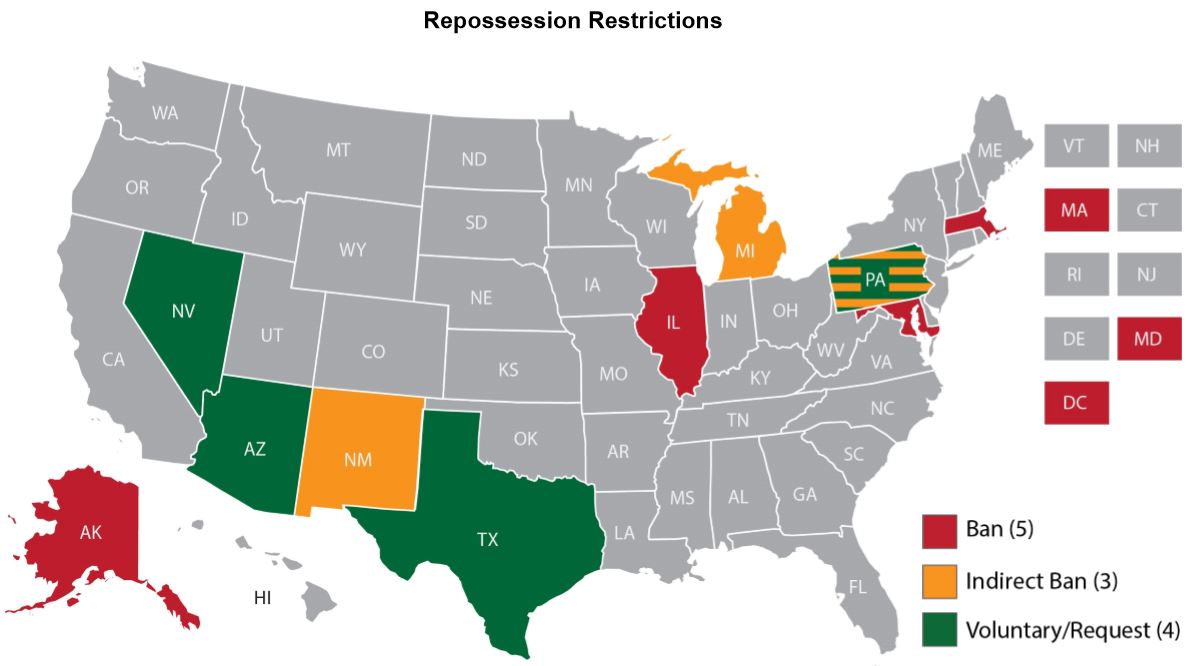

The American Financial Services Association (AFSA) is maintaining a chart of changes to auto...