The Calm Before the Storm – 1st Quarter 24’ Credit Union Auto Loan Delinquency

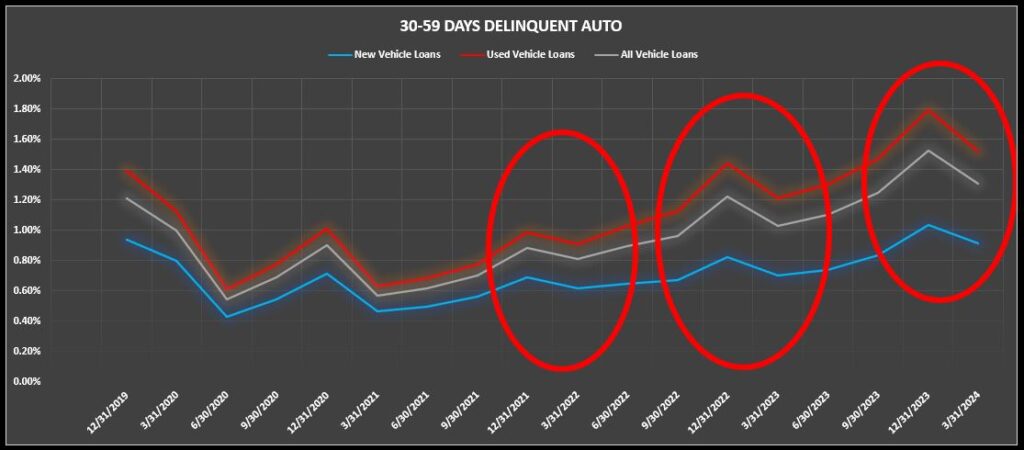

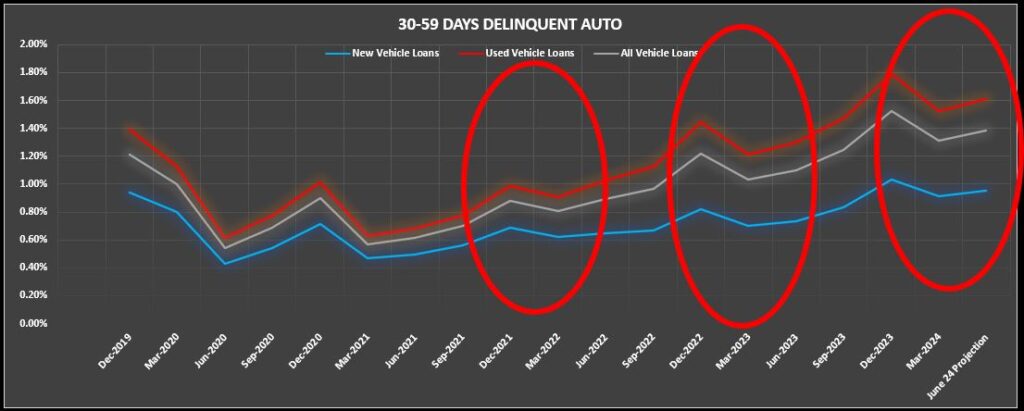

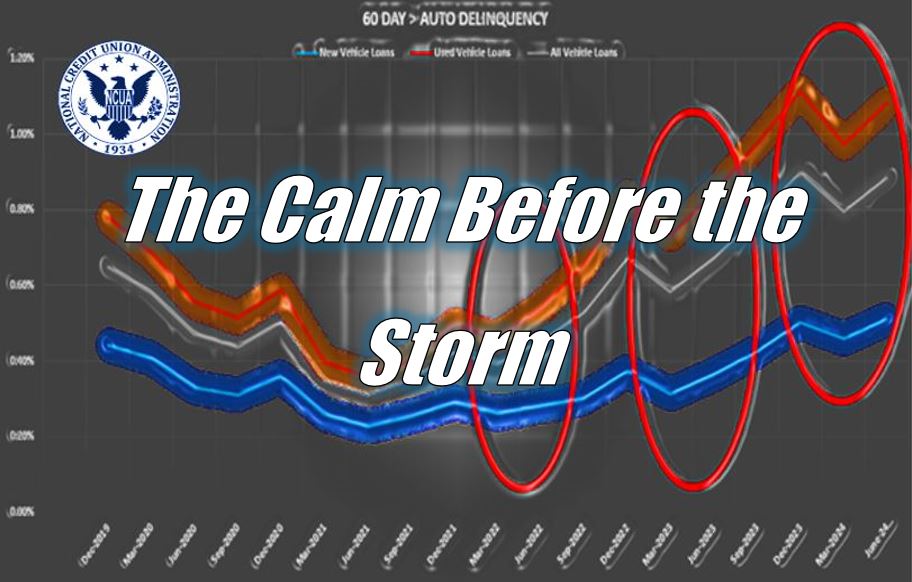

For a little over a year, I’ve been tracking credit union auto loan delinquency and waiting for the normal seasonal trends interrupted by the pandemic to resume. Well, they have and, as expected, Q1 of 2024 showed some relief from Q4 23’s peak. Unfortunately, as the seasonal trend resumes, there is every reason to expect the rest of the year will be a rough one.

Last week, the National Credit Union Administration released their aggregate credit union 5300 FPR financials report. Considering they only started publishing this report publicly at the beginning of 2020, they’ve got some work to do on their timing and it’s been coming out only a few weeks before the end of the next quarter. So, we’re already up to our necks in what I am about to project from the data provided.

As the seasonal trend of a 4th quarter spike in delinquency continues, it was predictable that the 1st quarter would provide some healthy reductions. As predicted, it did not disappoint. That’s the good news. The bad news, get ready for a three month climb to auto loan delinquency levels no one has seen since the great recession.

Download the Data Here!

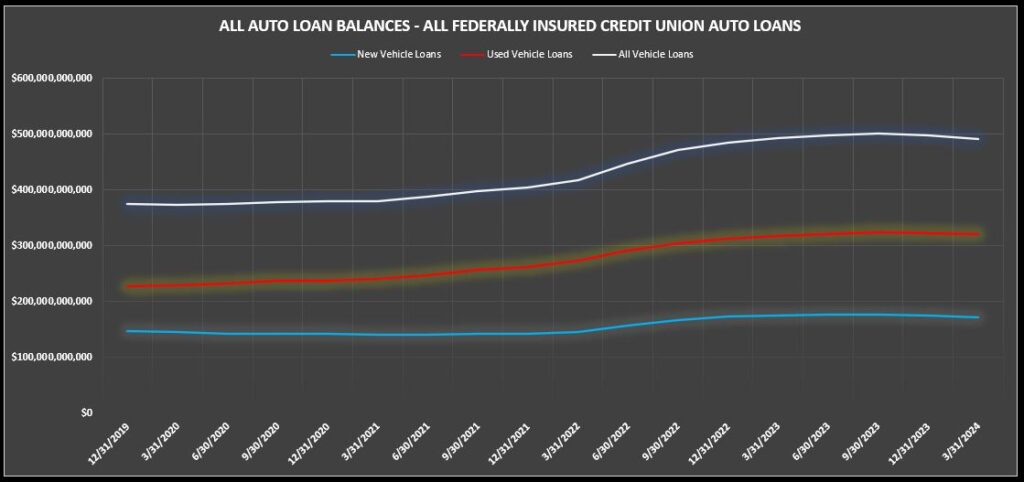

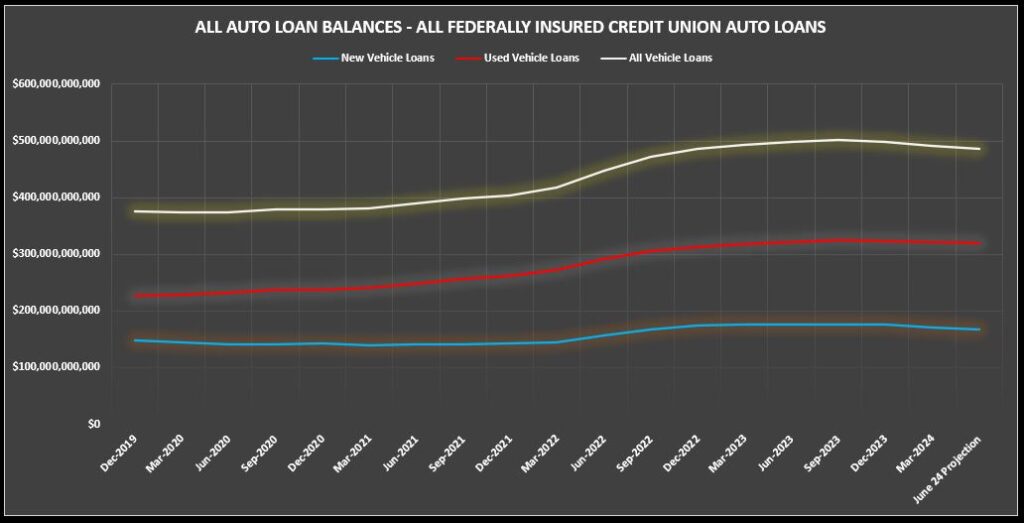

Portfolio Balances

One major factor affecting delinquency ratios is portfolio balance. While we saw a slight reduction in new loan originations in Q4 24’, I had expected that portfolio balances would grow to $505B from the year end $491B. Boy was I wrong!

Portfolio balances dropped by $6.3B. While new auto loans only account for 35% of all auto loan balances in the credit union space, they accounted for 69% of the reduction. Manufacturer promotional rates and discounts have sucked the new auto loan volume practically dry from all other lenders.

While this effects portfolio balances, it also affects delinquency ratios and worse, increases the weight of used auto loans and their higher delinquency ratios on credit union auto loan performance. Prediction, expect more of the same. I suspect we’ll see this trend continue with a $6B combined reduction in auto portfolio balances at the end of Q2, perhaps worse.

30 Day Delinquencies

Back in March, when this data was released, late as always, I had predicted that the combined new and used auto loan delinquency for the 30-day delinquency tranche would drop to $6.7B with a delinquency ratio of 1.33%. Mixed bag in results. It finished at $6.4B with a ratio of %1.31%.

With the traditional seasonality impact of tax returns and yearly bonuses behind us, I predict that Q2 will rise to o$6.8B with a combined used and new auto balance of $6.8B with a ratio of 1.38%. 7 basis points isn’t a huge figure, but that equated to over $400M in additional delinquency.

Keep in mind, a large amount of what flows upward from here rolls into serious delinquency. In reality, this is really where the most meaningful collections occur; where they are only down two payments and there is greater chances of curing the member’s problem. Beyond this line the odds of cure shift dramatically.

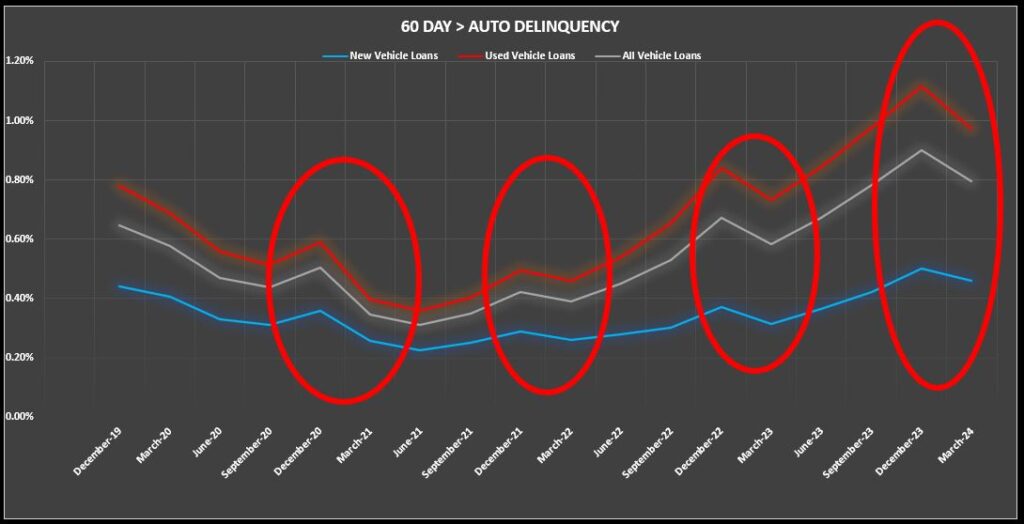

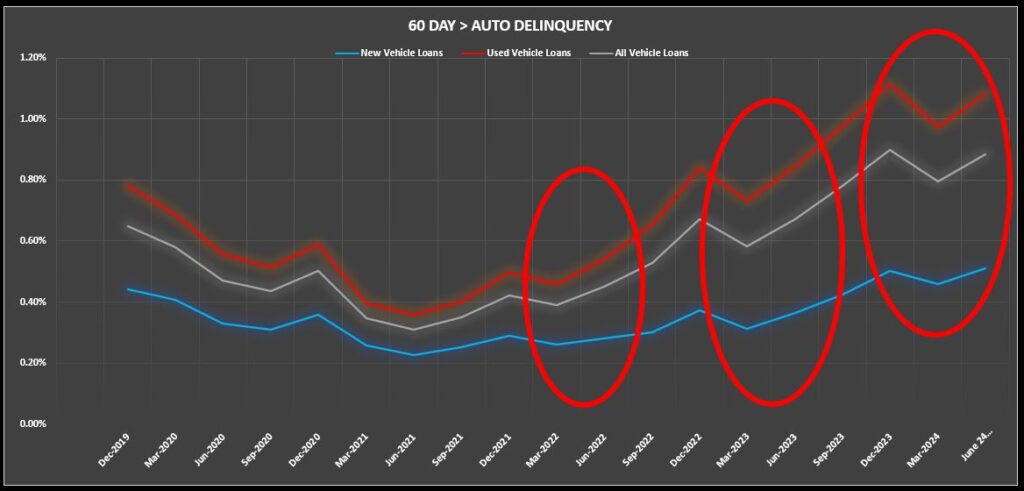

60 Day + Delinquencies

Reportable delinquency. This is where all the repossession activity and losses start. In March, I had predicted that the 1st quarter’s delinquency would finish at $4.09B and have a ratio of .81%. As it turns out, I was a little off by -$185M. It was lower and finished at $3.9B and had a ratio of 0.79%. Two basis points, not too bad.

Knowing that Q2 is the start of the annual delinquency climb, I predict we’ll return to almost exactly where we were at the end of Q4 of 24’. Assuming all trends remain, we can expect a finish of $4.3B and a ratio of 0.90%.

I know that’s a steep increase, but keep in mind, it climbed by about the same number in Q4 and dropped almost the same in Q1. Exasperating the ratios in all of this is loan originations. I am basing this upon a $6B decrease in auto loan balances. If it’s worse, that ratio climbs even more.

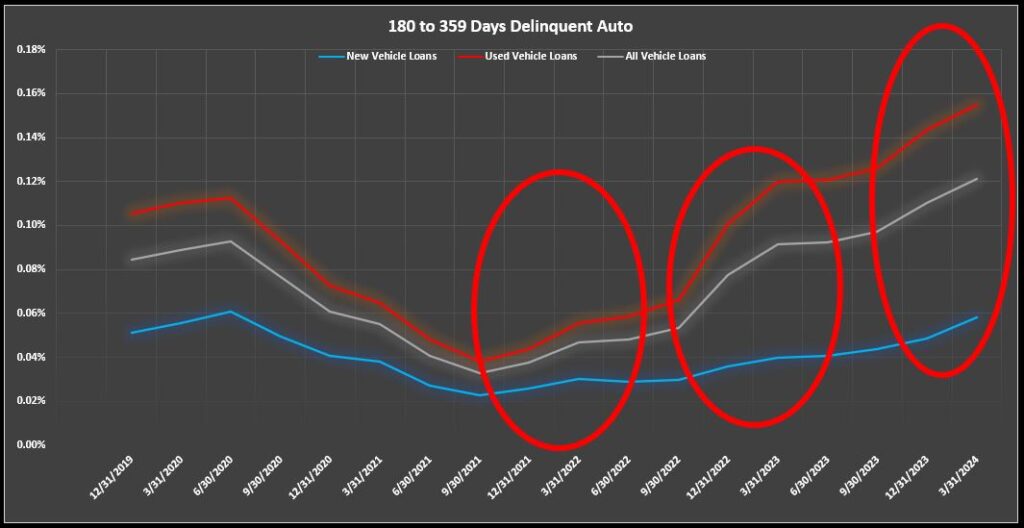

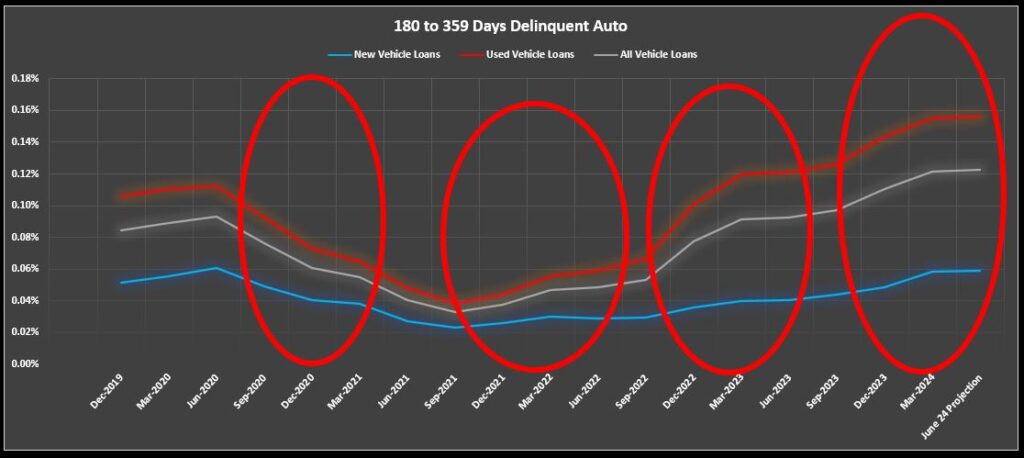

180+ Days Delinquent

The 180-day auto loan delinquency bucket is the “boneyard” of loans. It’s like quicksand, not many loans are cured from this tranche. The greatest reductions from this category come from repossession sales and charge off. One intersting note; this bucket of delinquency has been on a constant climb. Possibly because of bankruptcy increases and held repossession inventory. It hasn’t shown a decrease since Q3 of 21′.

I had predicted that the 1st quarter would finish at $623M with a ratio of 0.13%. It was again much lower and finished at $596M with a ratio of 0.12%.

For Q2, I predict that we will see a minor increase to $606M with a ratio of 0.12%. As previously mentioned, if portfolio balances decrease, the ratio will be heavily affected.

Summary

Welcome to the “New Normal”. While everyone watched inflation data for signs of improvement, we’re already seeing the effects of higher interest rates on loan originations. While these numbers wouldn’t be high for a large bank or finance company, they’re higher than the credit union industry has been accustomed to in many years.

One portfolio that doesn’t seem to have trouble growing is credit cards. Their balances are growing at records levels. Of course, along with this are rising delinquencies and charge-offs which are increasing at a rate of 14% quarter over quarter over the past year. Revolving credit may be the line of last resort for many trying to make ends meet and when those credit limits max out, many more borrowers may lose that lifeline in covering daily expenses to make room for their car payments, but that’s a different story.

With all of this auto loan delinquency comes increases in repossession activity. Obviously these are good times for the repossession industry, but not for lenders. Slow lending and increased repossession inventory at the auto auctions leads to reduced wholesale values.

Reduced wholesale values on vehicles purchased during the 22’-23’ periods, when rates were still low and retail values were through the roof, equate to higher charge off losses. This creates increased negative equity on new loan trade-ins and decreased sales.

Rinse, wash, repeat.

Data lags behind reality. We’re almost halfway through 2024 and all comparisons of pre-pandemic era delinquency should be over. We’re already well beyond that. The ghosts of great recession delinquency levels are the most relevant comps that we have. Unfortunately, the NCUA doesn’t share aggregate data going back that far.

While the risk of recession is always there, I think everyone needs to understand that recessions used to occur every 5-7 years as a norm. After the great recession, we hadn’t seen a recession since the height of the pandemic, and that was not a normal recession. Had lenders not handed out extensions and loan modifications like free candy, it would have been far worse. This beaver dam has been building up for years and I don’t expect it to suddenly burst so much as become a steady increase, much as it grew.

I know this is a challenging year for collections. For over a decade, no one really paid much attention to the collections departments. Lending was strong and the economy was in great shape.

Fast forward five years. Members that had been spoiled with no questions asked loan mods during the pandemic are now expecting the same with nominal results. Let’s face it, you can’t simply extend and pretend loan delinquency forever. At some point lenders simply can’t provide anymore and the chickens come home to roost.

Something has got to give and I am not optimistic about a “soft landing” as economists hope for. Much like the slow climb up in delinquency from the lows at the peak of the pandemic, I suspect this will linger and I’m confident that we’re nowhere near the peak.

I hope that I’m wrong.

Kevin Armstrong

Publisher

Related Articles;

4th Quarter 24’ Credit Union Auto Loan Delinquency at Record Levels

Credit Union Auto Loan Delinquency Climb Continues

Credit Union Auto Loan Delinquency Surges

Credit Union Auto Loan Delinquency Pattern Back to Normal

The Calm Before the Storm – 1st Quarter 24’ Credit Union Auto Loan Delinquency – The Calm Before the Storm – 1st Quarter 24’ Credit Union Auto Loan Delinquency

The Calm Before the Storm – 1st Quarter 24’ Credit Union Auto Loan Delinquency – The Calm Before the Storm – 1st Quarter 24’ Credit Union Auto Loan Delinquency – The Calm Before the Storm – 1st Quarter 24’ Credit Union Auto Loan Delinquency

The Calm Before the Storm – 1st Quarter 24’ Credit Union Auto Loan Delinquency – NCUA – Delinquency – Lending – Credit Union Collections – Credit Union Collectors – Repossession – Wholesale – Auto Loan

More Stories

Credit Unions at a Crossroads: Shifts, Risks, and Opportunities — Part 2

Talk Derby to Me at the NWCUCA 51st Annual Conference

The Auto Lending Surge is Here: How Lenders Can Navigate Rising Demand and Growing Risk