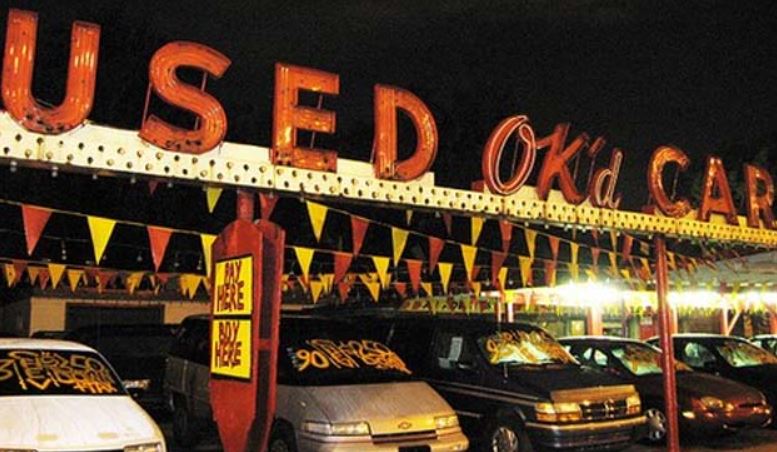

Subprime auto lending has faced intense regulatory scrutiny over the past year, and one name that’s consistently part of that focus is Credit Acceptance, a Michigan-based lender that’s known as the pioneer of financing vehicles for people with shaky credit. Here’s a fact I learned about Credit Acceptance today: every year, it expects to repossess 35 percent of the cars it finances.

More Stories

Court Upholds Lenders Right to Report Vehicle Repossession in FCRA Dispute

The Shadowy Authorized User Tradeline Market: Revenue, Legality and Credit Risk Implications

TrueSpot and PassTime® Announce Strategic Partnership to Deliver Next-Level Location and Asset Tracking Solutions to Automotive Dealers