Trustee Issues Order Compelling His Attendance

–

Dallas, TX – January 9, 2026 – I suppose if I were likely to spend the rest of my life in prison, one of the last things I would want to do with what’s left of my free time is sit through an uncomfortable court hearing before the thousands whose debts I’d defaulted on. And that appears to be exactly the case with Tricolor CEO Daniel Chu

As if the Tricolor bankruptcy isn’t messy enough, CEO Daniel Chu has failed to appear at the required 341 bankruptcy meeting of creditors. This does not appear to have been a simple missed appointment as the trustee has filed a motion “compelling” him to appear.

–

Failure to Attend

On December 9th, Counsel to the Chapter 7 Trustee, Anne Elizabeth Burns, filed a motion to the attendance of Daniel Chu or, if he refuses to cooperate, Jerry Kollar at the Section 341 meeting of creditors (the “341 Meeting” or “Meeting”), which has been rescheduled from November 18, 2025 to January 13, 2025 due to the failure of any representative from the Debtors to attend.

Read the Motion Here!

In the motion it was stated:

As the Court is well aware, a Section 341 meeting of creditors is an integral part of a chapter 7 bankruptcy proceeding. It allows a lawfully appointed trustee and creditors to question the debtor in order to gather key information regarding the financials of the debtor.

A meaningful section 341 meeting may therefore be critical to permitting a trustee to maximize estate funds for the benefit of creditors.

Here, the Clerk of the United States Bankruptcy Court for the Northen District of Texas properly provided notice of, and the Trustee held, the 341 Meeting on November 18, 2025.

In advance of that meeting, the Trustee specifically requested that counsel to the Debtors remind Daniel Chu – who was the Chief Executive Officer (“CEO”) and founder of the Debtors, and who personally signed each of the Debtor’s bankruptcy petitions – of his need to attend the Meeting.

The Trustee did so because of Mr. Chu’s deep involvement in all aspects of the Debtors’ business since founding those companies nearly two decades ago, including serving as both the public face and voice of the Debtors throughout that time period.

Nonetheless, Mr. Chu failed to attend the 341 Meeting and did not communicate with the Trustee regarding his absence. And now Mr. Chu has indicated through counsel that he will not voluntarily attend the rescheduled Meeting. Mr. Chu’s refusal to participate in the 341 Meeting threatens to obstruct the resolution of these bankruptcy matters, requiring the Court’s intervention to compel his attendance and participation.

In addition, should Mr. Chu refuse to cooperate with the Court order, the Trustee further requests that the Court order Jerry Kollar, the Debtors’ former Chief Financial Officer (“CFO”), to appear as the Debtors’ representative at the rescheduled 341 Meeting.

–

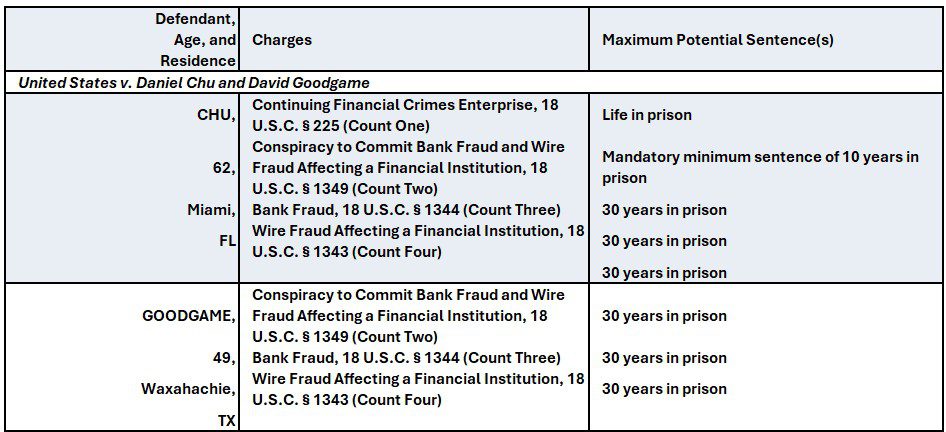

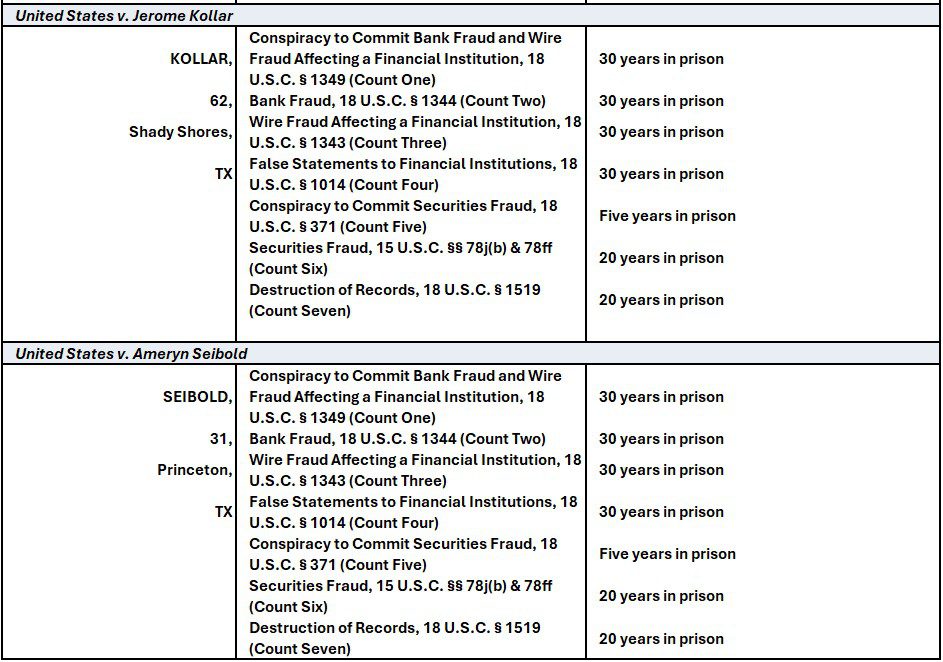

The Charges

The U.S. Attorney General’s Office of New York, the FBI and the FDIC’s Office of the Inspector General have concluded their initial investigations and have found evidence enough of fraud perpetrated by Tricolor’s CEO and many members of its executive staff to file charges.

Read the Unsealed Indictment Here!

The primary charges laid against the four named are:

- Statutory Allegations

- Conspiracy to Commit Bank Fraud and Wire Fraud on a Financial Institution

- Bank Fraud

- Wire Fraud Affecting a Financial Institution

The individual charges against each are:

Guilty pleas from JEROME KOLLAR, Tricolor’s former CFO, and AMERYN SEIBOLD, a former finance executive at Tricolor, in connection with their participation in the conspiracy. KOLLAR and SEIBOLD pled guilty to fraud charges before U.S. District Judge Lewis J. Liman on December 16, 2025. Both are cooperating with the Government.

“As alleged in the indictment, CEO Daniel Chu was the leader of an elaborate scheme to defraud creditors of Tricolor,” said U.S. Attorney Jay Clayton. “At his direction, Tricolor repeatedly lied to banks and other credit providers, including by falsifying auto-loan data and ‘double pledging’ collateral. Fraud became an integral component of Tricolor’s business strategy. The resulting billion-dollar collapse harmed banks, investors, employees and customers. It also undermines confidence in our financial system. New Yorkers and all Americans want continuing criminal enterprises shut down and their leaders brought to justice whether they are on our streets or in our markets.”

“These four executives allegedly conspired to defraud lenders based on bogus collateral,” said FBI Assistant Director in Charge Christopher G. Raia. “The defendants’ alleged manipulation not only ripped off multiple banks but also violated the integrity of our credit markets. The FBI will never tolerate any company that makes fraud part of its business.”

“As alleged, the defendants in this case participated in a years-long fraudulent scheme that deceived the lenders of Tricolor,” said FDIC-OIG Special Agent in Charge Patricia Tarasca. “The FDIC-OIG stands firm in its commitment to working with our law enforcement partners to investigate all allegations of fraud that target financial institutions, as we seek to preserve the integrity of our Nation’s financial system.”

According to the allegations contained in the Indictment unsealed today in Manhattan federal court:[1]

From in or about 2018 through in or about 2025, CHU, GOODGAME, KOLLAR, and SEIBOLD conspired to defraud the lenders and asset-backed securities investors of Tricolor Holdings, LLC and its affiliates (“Tricolor”), a subprime auto retailer and financing company. CHU, Tricolor’s founder and chief executive officer; GOODGAME, Tricolor’s chief operating officer; and others operated Tricolor through systematic fraud. At CHU’s direction, multiple Tricolor executives repeatedly double-pledged collateral to multiple lenders and manipulated the characteristics of collateral to make ineligible, near-worthless assets appear to meet lender requirements. By in or about August 2025, Tricolor had pledged approximately $2.2 billion of collateral to lenders and investors, but Tricolor had only approximately $1.4 billion of real collateral. The difference—consisting of approximately $800 million in bogus collateral—resulted from the series of schemes and the conspiracy in which CHU, GOODGAME, KOLLAR, SEIBOLD, and others participated. Over time, this series of fraudulent schemes had a profound effect on Tricolor, which obtained hundreds of millions of dollars in cash advances; on CHU, who used a portion of the funds to enrich himself; and on Tricolor’s lenders, who extended billions in loans based on fabricated data and false statements.

In or about the summer of 2025, lenders confronted CHU and others at Tricolor about problems with Tricolor’s collateral. In a series of secretly recorded phone calls, CHU and his conspirators concocted plans to conceal or explain away the fraud. For example, on or about August 17, 2025, CHU proposed blaming certain loan data discrepancies on fictitious deferment policies. CHU acknowledged, however, that “where we would have an issue is if, if they sent an auditor and they said, pull this up on your screen, right, that would be a problem.” KOLLAR agreed, stating, “Yes. That would be bad.” These efforts to conceal failed.

–

Realted:

Arrests and Federal Fraud Charges Filed Against Tricolor Executives

Hundreds of Repo Agencies Listed in Tricolor Bankruptcy

Tricolor CEO Fails to Attend Required Bankruptcy Hearing – Tricolor CEO Fails to Attend Required Bankruptcy Hearing – Tricolor CEO Fails to Attend Required Bankruptcy Hearing

Tricolor CEO Fails to Attend Required Bankruptcy Hearing – Repossession – Repossession Agency – Repossessor – Credit Union Collections – Credit Union Collectors – Lending – Bankruptcy

More Stories

NC Man Charged with ID Theft and Auto Loan Fraud

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions