Your Solution for Bankruptcy and Repossession Services

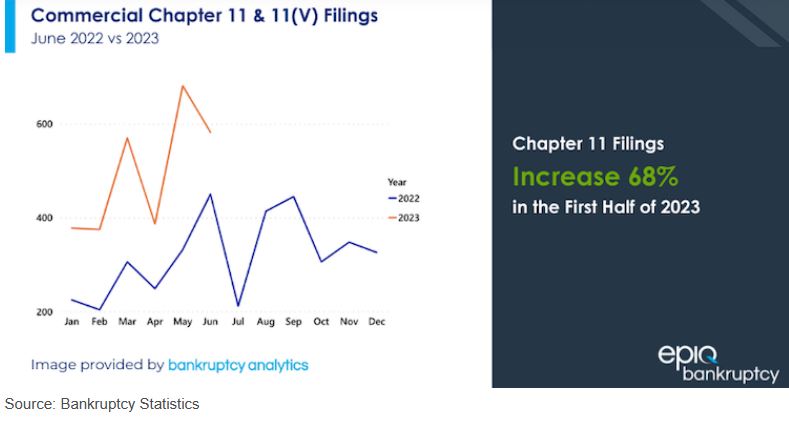

It’s important for financial institutions to be prepared for the increase in delinquencies, repossessions, and bankruptcies. In fact, individual bankruptcy filings increased 18% from the 30,307 filed in June 2022, according to Epiq Bankruptcy Analytics.

Our team offers expertise and assistance in managing repossessions and bankruptcies more efficiently, which will lead to a higher rate of recovery for your financial institution.

Expertise: Our team is comprised with professionals who excel in handling complex debt scenarios, including repossessions and bankruptcies.

Recovery rate optimization: Our processes are designed to maximize recovery rates and our persistent efforts will significantly increase your chances of recovering the outstanding debt in full or part.

Time and resource efficiency: Redirect your internal resources to more strategic functions while we handle the time-consuming tasks associated with these processes to improve productivity, reduce overhead costs, and achieve better overall operational efficiency.

Compliance assurance: In an industry governed by strict regulations and guidelines, staying compliant is paramount to avoid legal complications. You can trust our team to navigate the complex legal requirements, mitigating any potential risks to your institution’s reputation or financial standing.

Interested in learning more? Check out our demo video.

If you have any questions, contact your Sales Representative or Account Executive today!

TriVerity & The Loan Service Center

26263 Forest Blvd

Wyoming, MN 55092

Unlocking Efficiency and Mitigating Risk: – Unlocking Efficiency and Mitigating Risk: – Unlocking Efficiency and Mitigating Risk:

Unlocking Efficiency and Mitigating Risk:– Repossess – Repossession – Bankruptcy – Credit Union Collections – Triverity – The Loan Service Center

More Stories

Talk Derby to Me at the NWCUCA 51st Annual Conference

The Auto Lending Surge is Here: How Lenders Can Navigate Rising Demand and Growing Risk

Market-Responsive Growth for High-Volume Lenders