Market Insights- 8/1/23

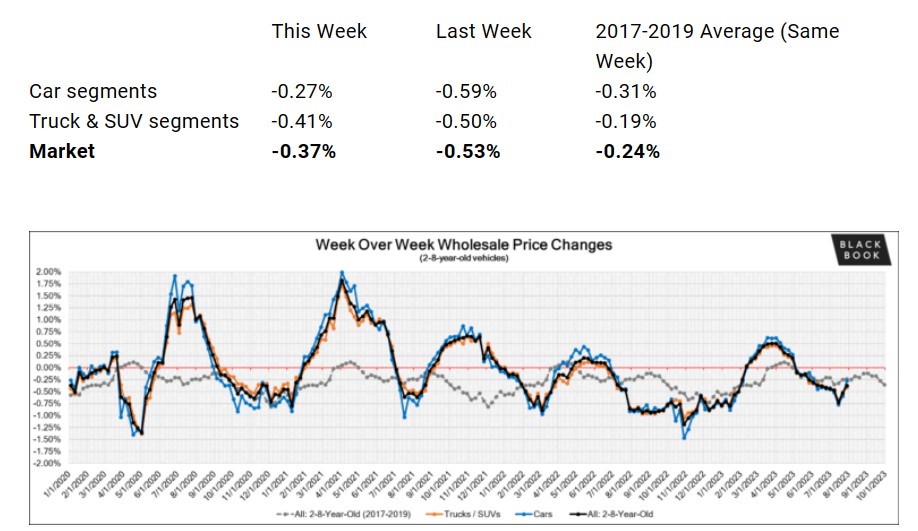

Wholesale Prices, Week Ending July 29

After a few weeks of heavy declines across the board, the market appears to be leveling off. This is particularly true for some of the Car segments; Full-Size Cars declined a very minimal -0.001%. In sharp contrast, the Full-Size Trucks (-0.64%) reported their largest single week decline since December 2022.

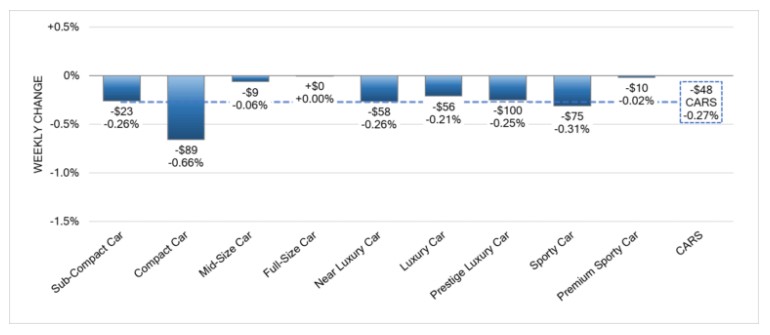

Car Segments

- On a volume-weighted basis, the overall Car segment decreased -0.27%. For reference, in the previous week, cars decreased by -0.59%.

- The 0-to-2-year-old Car segments were down -0.23% and 8-to16-year-old Cars declined -0.40%.

- All nine Car segments decreased last week.

- Full-Size (-0.001%), Sporty (-0.02%), and Mid-Size (-0.06%) Car segments all reported stability last week. In sharp contrast, the Compact Car segment had the largest decline at -0.66%. Despite being the largest Car segment decline, it was still less than the prior week’s decline of -0.94%.

- The luxury segments also reported smaller declines than seen in recent weeks. For example, Premium Sporty was down -0.02%, compared with -0.24% the week prior and Near Luxury Car was down -0.26%, compared with -0.58% the previous week.

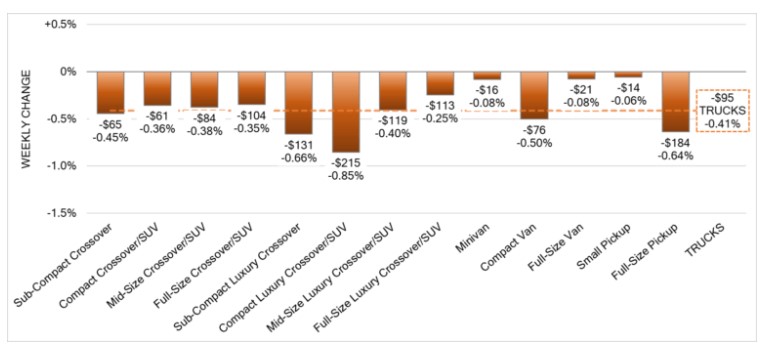

Truck / SUV Segments

- The volume-weighted, overall Truck segment decreased -0.41%, smaller than the prior week’s decrease of -0.50%.

- The 0-to-2-year-old Truck segments reported a smaller decline last week (-0.36%), but the 8-to-16-year-olds declined more, depreciating by -0.46%.

- All thirteen Truck segments reported a decrease last week.

- Compact Luxury Crossovers reported the largest decrease last week, with a decline of -0.85%. This marks the ninth consecutive week of declines for the segment with an average weekly change of -0.74%.

- Full-Size Pickups have been declining for eight consecutive weeks, but last week, the segment had the largest single week decline (-0.64%) since December 2022. Over the past eight weeks, the segment has averaged a weekly decline of -0.36%.

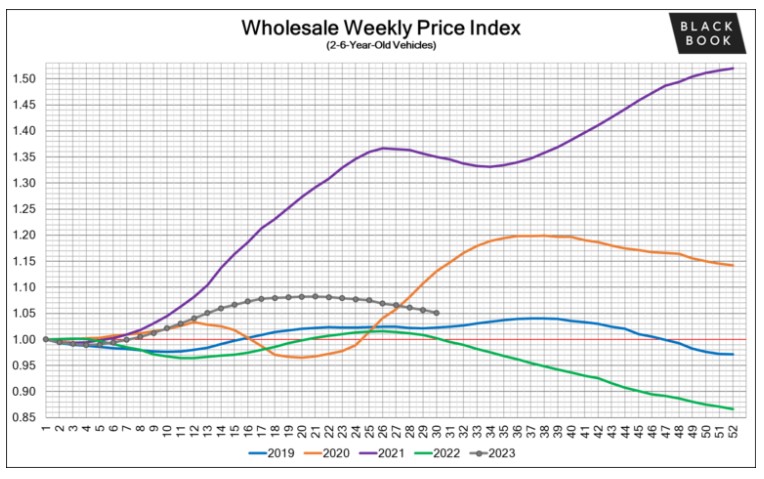

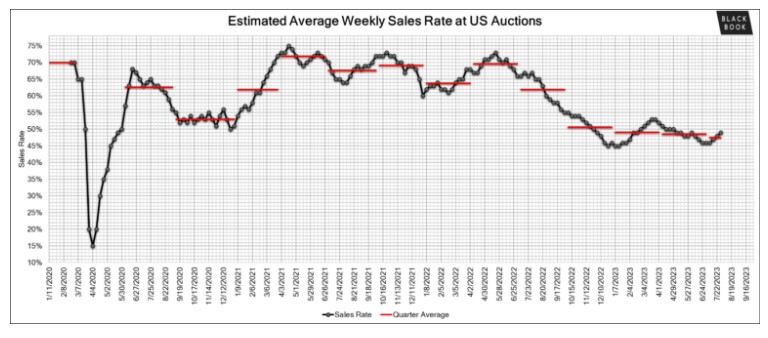

Weekly Wholesale Index

The graph below looks at trends in wholesale prices of 2 to 6-year-old vehicles, indexed to the first week of the year. The index is computed keeping the average age of the mix constant to identify market movements.

Wholesale

In the auction lanes, demand picked up for some of the Car segments that have lower supply. With many manufacturers pulling away from production of sedans, the demand at auction is higher than in some of the SUV segments that are seeing larger depreciation rates.

Last week, conversion rates continued to show improvement, despite dealers’ days to turn remaining in the 50+ day range. Additionally, the condition of units is a challenge for buyers that are looking for retail-ready units.

As always, the Black Book team of Analysts will keep their eyes on the market, watching for developing trends and insights.

The estimated Average Weekly Sales Rate continued to improve and increased to 49% last week.

Wholesale Auction Values Level Off – Black Book – Remarketing – Credit Union Collections

More Stories

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions

Talk Derby to Me at the NWCUCA 51st Annual Conference