The Keys to Effective Bankruptcy and Repossession Strategies As consumers struggle to make payments,...

Bankruptcy

BK 105 – Preparing, Filing and Updating Bankruptcy Proofs of Claim A Live NorthLegal...

Hard Choices When it Comes to Attending the Best Bankruptcy and Collections Training in...

A Live NorthLegal Webinar on February 15, 2024 Most bankruptcy training focuses on handling...

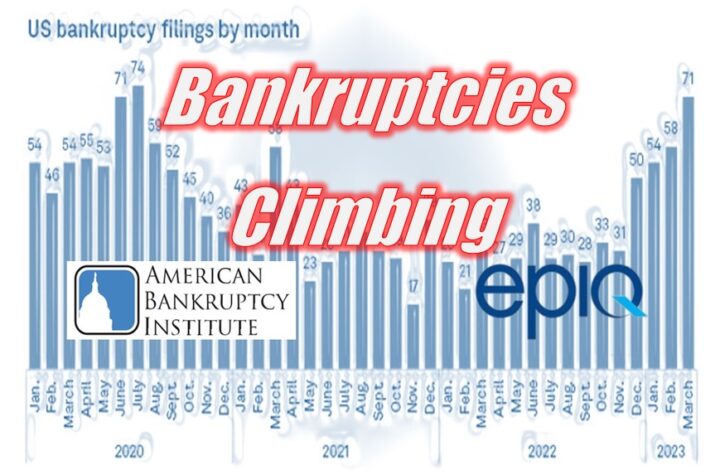

Chapter 7 Bankruptcy Filings Increase 17 Percent in 2023 Chapter 13 bankruptcy filings rose...

A NorthLegal Live Webinar January 18, 2024 10:00 PST | 11:00 MST | 12:00...

After the 1st quarter of the year’s NCUA’s combined credit union 5300 FPR financials,...

Our training courses are designed to strengthen your collection staff by increasing their knowledge...

Do you know — The “automatic stay” is one of the most important (and...

Live Online Bankruptcy Training November 16th, 2023 A Live NorthLegal Webinar Bankruptcy law affects every consumer...

Your Solution for Bankruptcy and Repossession Services It’s important for financial institutions to be...

July Commercial Chapter 11 Filings Increase 71 Percent Over Last Year, Total Filings Up...

ffThe Gen Y – The Ticking Debt Timebomb Earlier this month, the Federal reserve...

Commercial Chapter 11 Filings Doubled Over Same Period Last Year Inflation and rising interest...

Commercial Filings Up 79 Percent Year-over-year – Total filings exceed 40,000 for first time...

With consumer delinquencies and bankruptcies projected to rise significantly in the new year, training...