A NorthLegal Live Webinar

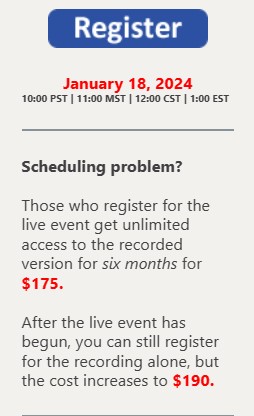

January 18, 2024

10:00 PST | 11:00 MST | 12:00 CST | 1:00 EST

May you call one borrower on a loan to ask for payment if a different borrower on the same loan is a debtor in a pending bankruptcy? Does the type of bankruptcy make a difference?

What about after the bankruptcy is over? What may you do to collect from a nonbankrupt coborrower and what does bankruptcy law prohibit you from doing?

Do privacy laws prohibit you from telling the nonbankrupt coborrower about the debtor’s bankruptcy? What if they ask?

How should you report a nonbankrupt coborrower to consumer reporting agencies during a Chapter 13 case if payments are being made under the plan? Is the non-bankrupt coborrower “current?” Would that be deceptive to any creditor or landlord considering making a loan or renting property to the coborrower?

Communicating with a nonbankrupt coborrower during and after bankruptcy requires careful thought, which, in turn, requires an understanding of complex laws. On January 18, 2024, creditors’ rights attorney Eric North will discuss what those laws are and how they apply to your financial institution. Participants will learn —

• May you return a call to a nonbankrupt codebtor during a Chapter 13 case? What may (and what shouldn’t) you say?

• Does a nonbankrupt codebtor have a right to be kept informed about the debt and he bankruptcy?

• May you return a call to a nonbankrupt codebtor during a Chapter 13 case? What may (and what shouldn’t) you say?

• Does a nonbankrupt codebtor have a right to be kept informed about the debt and he bankruptcy?

• May you repossess collateral owned by a nonbankrupt coborrower?

• If you have judgment, may you levy on assets or wages of a nonbankrupt coborrower?

• May you sue a nonbankrupt coborrower during a bankruptcy? If so, when might that still not be a good idea?

• When is the court required to give you permission to collect from a nonbankrupt coborrower during a Chapter 13 bankruptcy?

• How can you sometimes save the time and expense of getting a court order for permission to collect from a non-bankruptcy coborrower?

• What may you do, and what should you not do, to collect from a nonbankrupt coborrower after the bankruptcy is over?

For more information, call NorthLegal at 623.537.7150.

BK103 – Dealing with Non-Bankrupt Borrowers – A NorthLegal Live Webinar – BK103 – Dealing with Non-Bankrupt Borrowers – A NorthLegal Live Webinar – BK103 – Dealing with Non-Bankrupt Borrowers – A NorthLegal Live Webinar

BK103 – Dealing with Non-Bankrupt Borrowers – A NorthLegal Live Webinar – Credit Union Collections – Credit Union Collectors – Northlegal – Northlegal – Bankruptcy – Repossess

Facebook Comments