– A new analysis shows that delinquent car payments are increasing across the U.S.,...

Delinquency

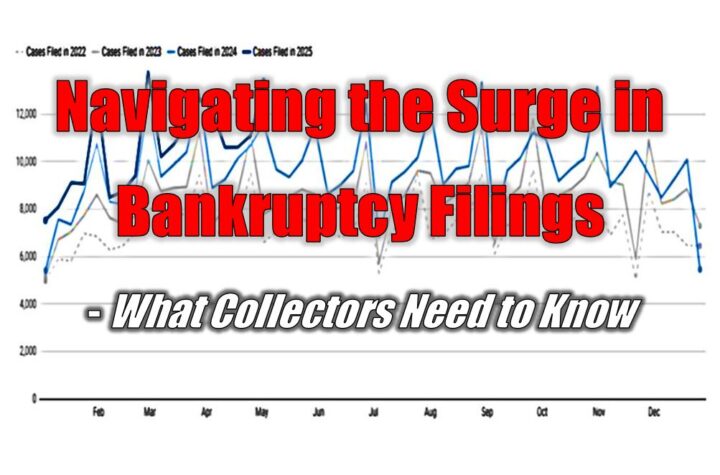

The Worst is Yet to Come Back in March, I predicted the usual seasonal...

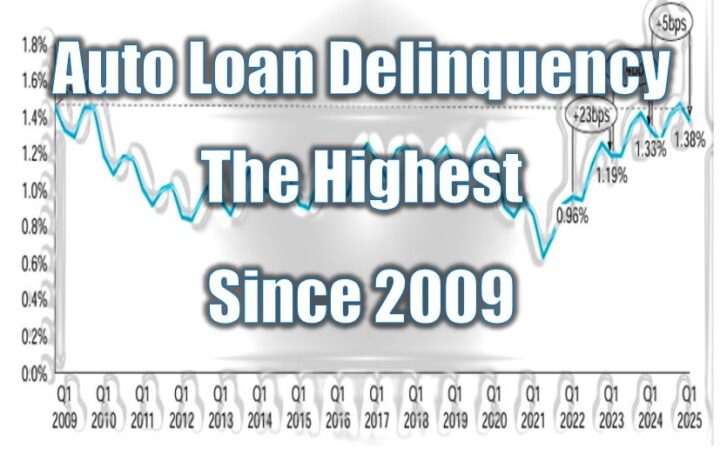

The 60+ DPD delinquency rate increased by 5 basis points YoY in Q1 2025...

529,080 cases were filed in the 12 months ending March 31, 2025—a 13.1% jump...

LITTLETON, Colorado—March 25, 2025—PassTime®, a leading provider of asset tracking solutions announced today that...

The Storm Has Arrived Last year, I warned you that we were experiencing “The...

“… we’ve been moving back the timing of repossession.” In a high-stakes game of...

Household Debt Rose Modestly; Delinquency Rates Remain Elevated Press Release New York, NY –...

Coming off of the much needed 1st quarter 2024 delinquency reduction in auto loans,...

What You Need to Know In the world of auto lending, trends and statistics...

Delinquency rates are unchanged, at least in the second quarter. But debt is still...

Are You Ready for the Worst Delinquency in Your Career? October 24-26th Renaissance Esmeralda...

AutoSquared.AI Prepares Industry for Exponential Growth AutoSquared.AI imagines a world where repossession management is...

The Calm Before the Storm – 1st Quarter 24’ Credit Union Auto Loan Delinquency...

Meet Mike Frost at the TriVerity Collection Academy TriVerity Collection Academy October 1 –...

Fed Reserve Sees Auto Loan and Credit Card Delinquency Worsening in Q1 2024 “In...