4th Quarter 24’ Credit Union Auto Loan Delinquency at Record Levels

Last year I predicted that we could expect that the fourth quarter credit union auto loan delinquency would be brutal. And it did not disappoint. Looking forward, 2024 will be no cake walk either.

Over the last year I’ve been summarizing the auto loan delinquency data from the NCUA’s combined credit union 5300 FPR financials. And as usual, the National Credit Union Administration (NCUA) released their quarterly combined credit union 5300 FPR financials for the fourth quarter of 2023 late.

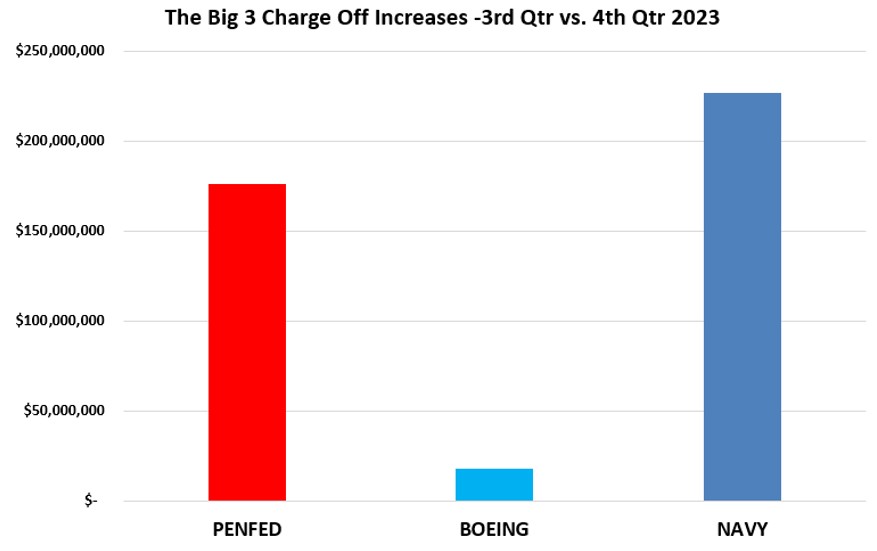

We’ve already had a sneak peek at the delinquency ratios for Pen Fed, Navy and Boeing CU’s fourth quarter auto loan delinquency issues in February. Combined, they make up about 11% off all CU assets and loans.

Their results were a pretty credible canary in a coal mine of what the rest of the industry was going through.

Most of my projections were pretty close to the actual results and mostly on the conservative side compared to the actual results.

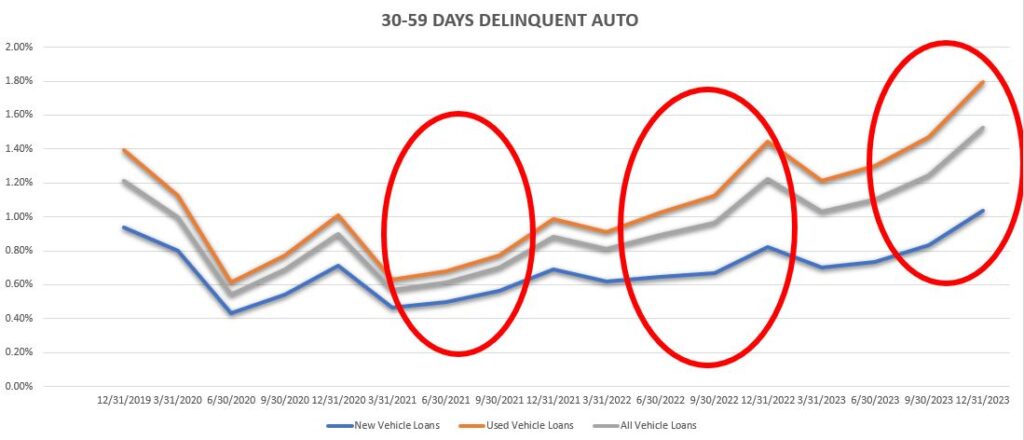

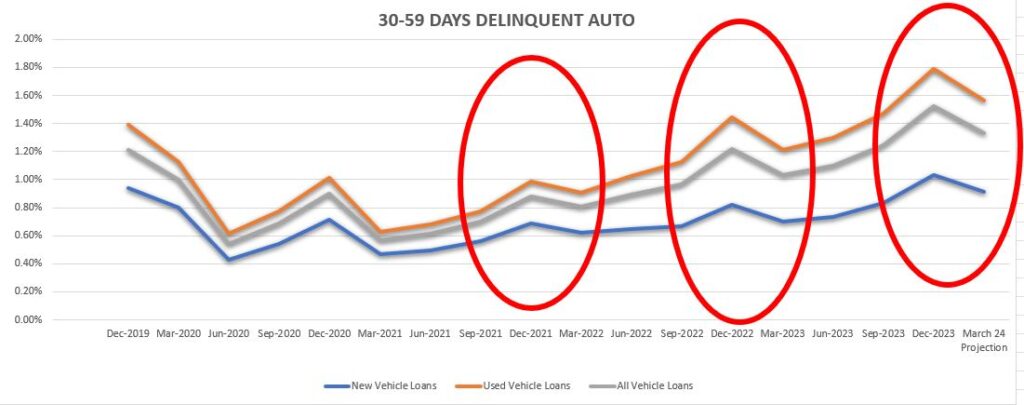

It’s pretty clear, pre-pandemic seasonal trends are in full force and If this pattern continues as it is, the first quarter of 2024 (almost over!) isn’t going to offer much relief.

Download the Data Here!

The first sign of trouble was auto loan balances. They went down. If this continues as predicted, it will add significantly to already rising delinquency ratios.

30 Day Delinquencies

I had predicted that the combined new and used auto 4th quarter 30-day delinquency tranche would rise to $6.8BM with a 1.50% delinquency ratio. I just about nailed it. It finished at $7.6B with a ratio of %1.53%.

With December historically the worst month of any normal year for delinquency, I expect that traditional seasonality impacted by tax returns and yearly bonuses will resume and show some relief for the end of the 1st quarter of 2024, but not much. I predict that the 1st quarter will come down to a combined used and new auto balance of $6.7M with a ratio of 1.33%.

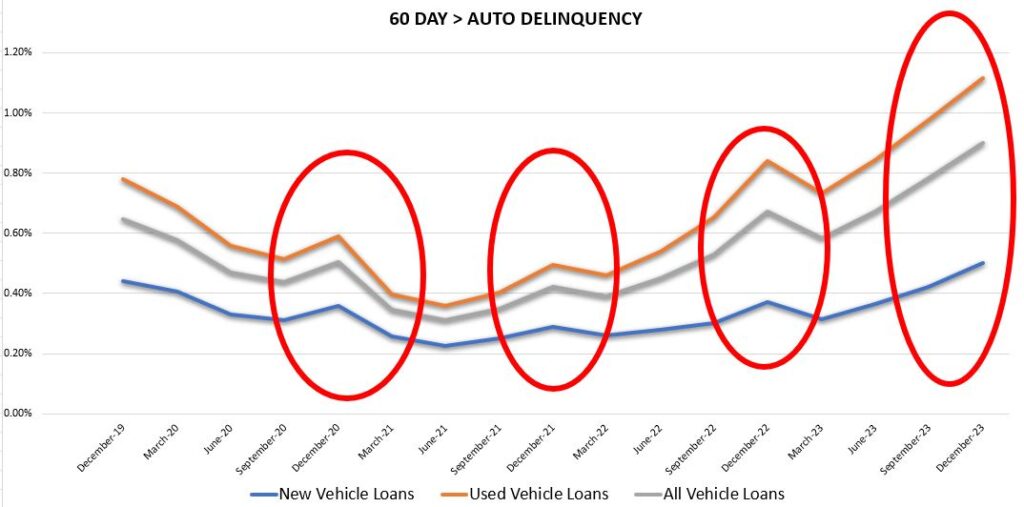

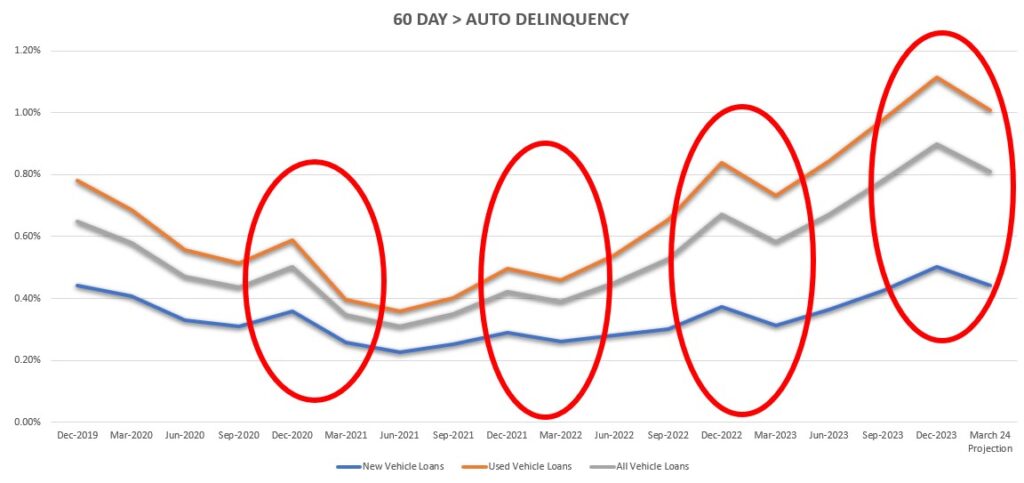

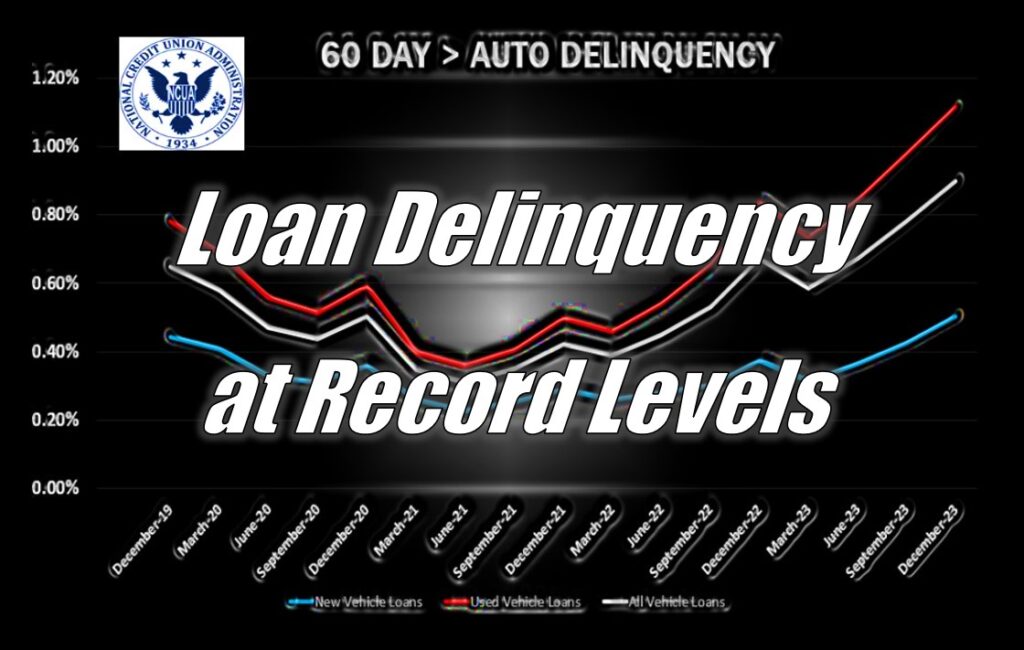

60 Day Delinquencies

The 60-day delinquency tranche is where “reportable” delinquency begins and really the cutting edge of repossession activity and losses. Back in December I had predicted that 4th quarter delinquency would finish at $4.1B and have a ratio of .80%. Again, I was wrong, it was much and finished at $4.5B and had a ratio of 0.90%.

Considering the spike in 30 day delinquencies in the end of the 4th quarter, it is hard not to believe that we could actually see the 60 day delinquency bucket climb north of 1%. But as you can see, like clockwork, the first quarter of each of the past five years as shown a reduction. So, I predict that delinquency will some relief in the 1st quarter and predict a finish of $4.1B and a ratio of 0.81%, just above the end of the 3rd quarter in 23′.

As typical is it is that reportable 60 day+ delinquency goes down in the fourth quarter is, it is also predictable that it will rise in the next two quarters. Should delinquency rise or hold flat in the 1st quarter of 2024, it will most likely be a brutal year.

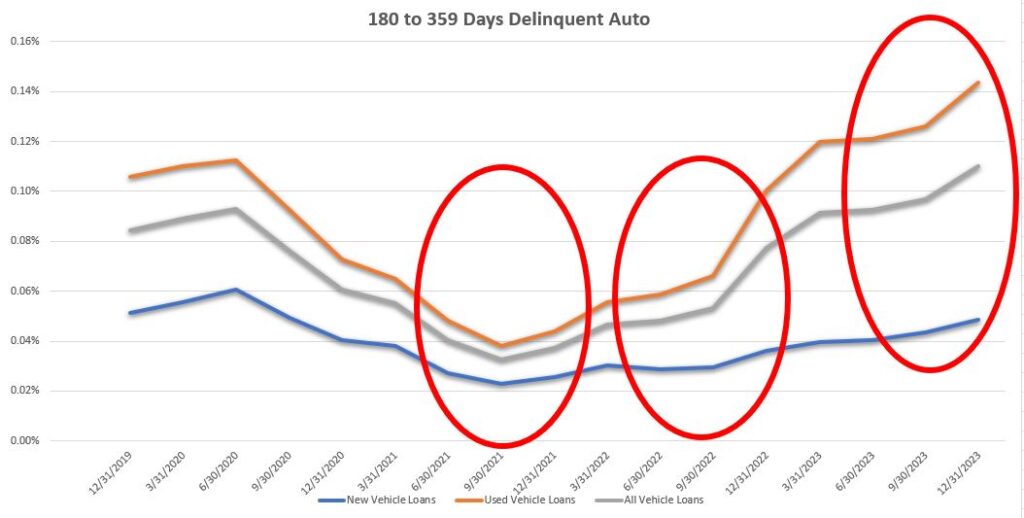

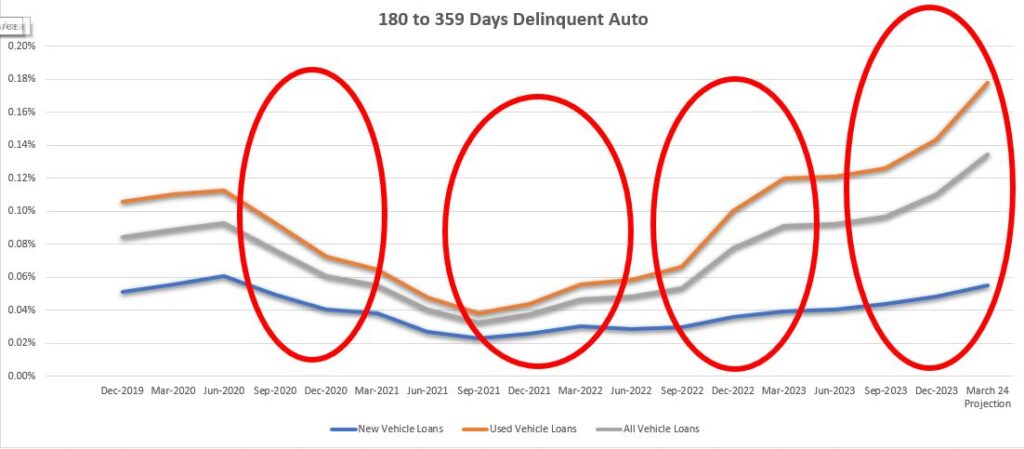

180+ Days Delinquent

The 180-day auto loan delinquency tranche is a graveyard of losses with minimal financial impact to lenders and would have already been taken in reserves and the majority of reduction created by charge off.

I had predicted that the combined new and used auto 4th quarter would finish at $585M with a ratio of 0.12%. It was again much lower and finished at $549M with a ratio of 0.11%.

Looking forward, I see this tranche rising to $623M with a delinquency ratio of 0.13%.

As we saw earlier with PenFed’s Q4 charge off losses, the end of the year is a period when a lot of credit unions take some early charge off losses to soften their start for the coming year. I suspect that this seasonal tactic may have had some bearing here.

Summary

Auto loan originations have slowed dramatically over the past quarter. So much so, that combined auto loan balances for all FICU’s dropped from $501B at the end of Q3 to $498B at the end of the year. With high interest rates and tighter underwriting, I suspect this trend will continue at worst and best remain basically flat for most of the year as credit union market penetration is dulled by manufacturer special financing terms that have fallen back to 0%.

Obviously, loan portfolio balances are a denominator that weighs heavily on delinquency ratios. So much so, that even if delinquency balances decreased slightly, if the total loan balances declined, the delinquency ratios could actually rise.

Inflation has slowed down, but consumers are still feeling the pressure. While I don’t usually report on credit card and unsecured loans, they showed an increase of $3.3B in balances while at the same time their reportable delinquencies rose to 1.85%. Had those credit card balances remained flat, that ratio would have spiked even harder. But of course, it was the holiday shopping season, so this was predictable behavior.

Wholesale auto values have actually been holding up pretty well this year. If repossession volume was really that brisk the extra inventory would be driving these down. But with low lease originations in the 2020-2022 period, there are far less lease returns at the auctions as in previous years. This lacking may be holding up the overall wholesale auction values.

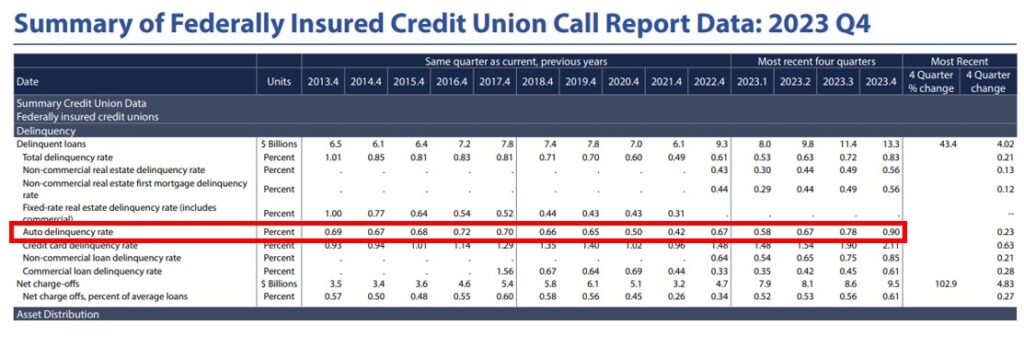

Supporting the combined data, the NCUA provided a summary finding of the 4th quarter results which included Delinquencies down to the product level. Unfortunately, the data only goes back to 2013. Either way, auto loan delinquency is easily the highest it’s been during this timeframe. I would find it easy to assume it hasn’t been this high since at least 2010.

Different product, but credit card delinquency is more than twice what it was in 2013 (see in chart above). If the data was available, I would venture to say it is the highest it’s been since sometime during the Great Recession (2007-2009).

2024 is definitely going to be a challenging year for collections. With inflation still an issue, record high negative equity in auto loans, record high credit card balances and their record delinquency levels in over a decade, it is difficult to say that the worst is over. While Q1 of the year may offer some hope, the economy is teetering on the edge of going either way. I suspect that it will be its greatest challenge inn almost fifteen years.

Kevin Armstrong

Publisher

Related Articles;

Credit Union Auto Loan Delinquency Climb Continues

Credit Union Auto Loan Delinquency Surges

Credit Union Auto Loan Delinquency Pattern Back to Normal

Credit Union Auto Loan Delinquency Sill Rising – Credit Union Auto Loan Delinquency Sill Rising – Credit Union Auto Loan Delinquency Sill Rising

Credit Union Auto Loan Delinquency Sill Rising – NCUA – Delinquency – Lending – Credit Union Collections – Credit Union Collectors

4th Quarter 24’ Credit Union Auto Loan Delinquency at Record Levels – 4th Quarter 24’ Credit Union Auto Loan Delinquency at Record Levels – 4th Quarter 24’ Credit Union Auto Loan Delinquency at Record Levels

4th Quarter 24’ Credit Union Auto Loan Delinquency at Record Levels – NCUA – Delinquency – Lending – Credit Union Collections – Credit Union Collectors

More Stories

Court Upholds Lenders Right to Report Vehicle Repossession in FCRA Dispute

The Shadowy Authorized User Tradeline Market: Revenue, Legality and Credit Risk Implications

TrueSpot and PassTime® Announce Strategic Partnership to Deliver Next-Level Location and Asset Tracking Solutions to Automotive Dealers