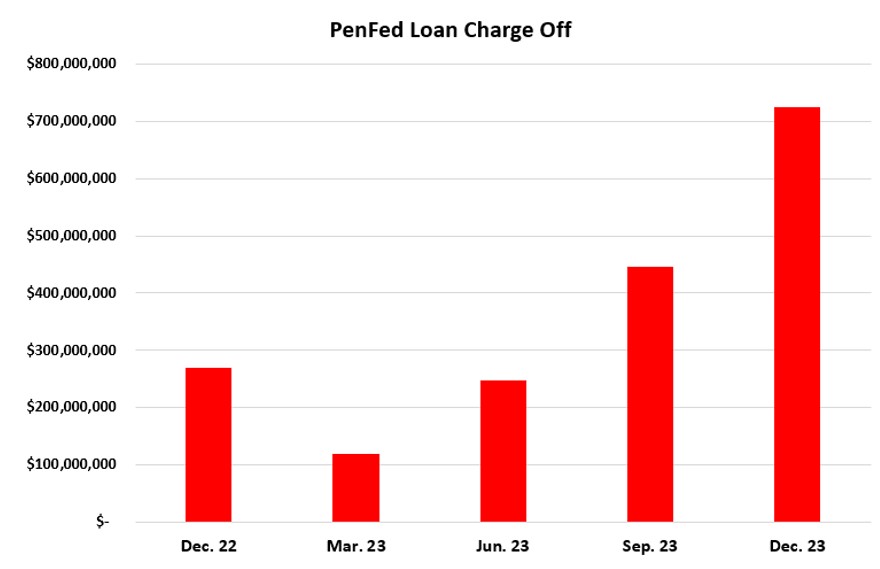

From $269M to $724M – Charge Off More than Doubled in 2023

If you think your credit union had a rough fourth quarter in 2023, just take a peek at the nation’s third largest credit union, $34.8B PenFed Credit Union’s end of year NCUA 5300 Financial Performance Report. With a tightening of provisions for loan loss and charge off policy, they more than doubled their losses.

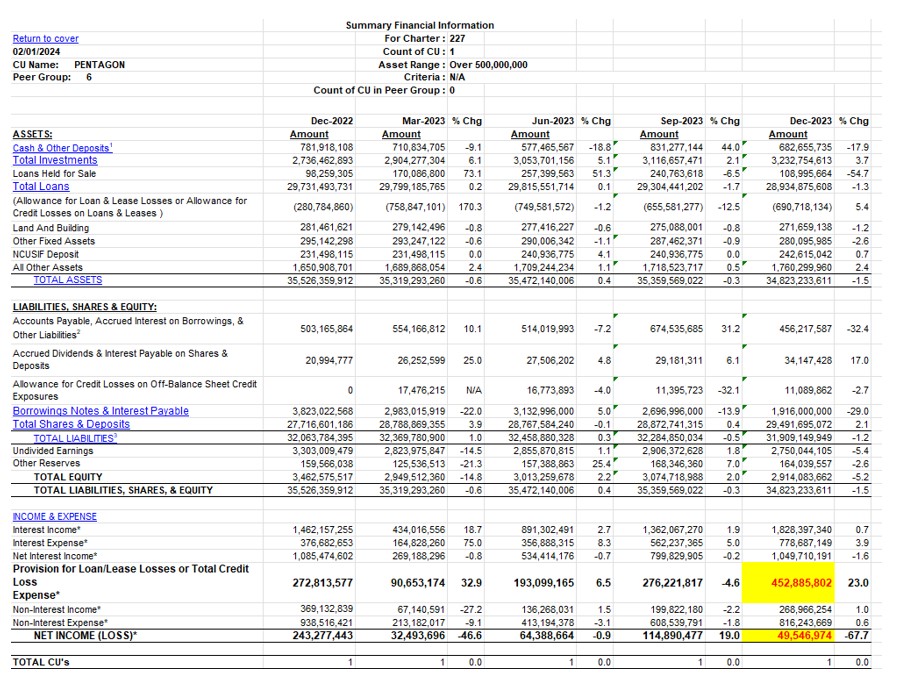

Late last month, the NCUA posted the Call Report for $34.8 billion in assets PenFed CU of Mclean, Va., the third largest credit union in the nation. Looking at their front-page Summary Financials, the first noticeable sign of stress showed in their Net Income of a mere $49M. This is down dramatically from the third quarter when they were up to $114M, a $65M loss in one quarter!

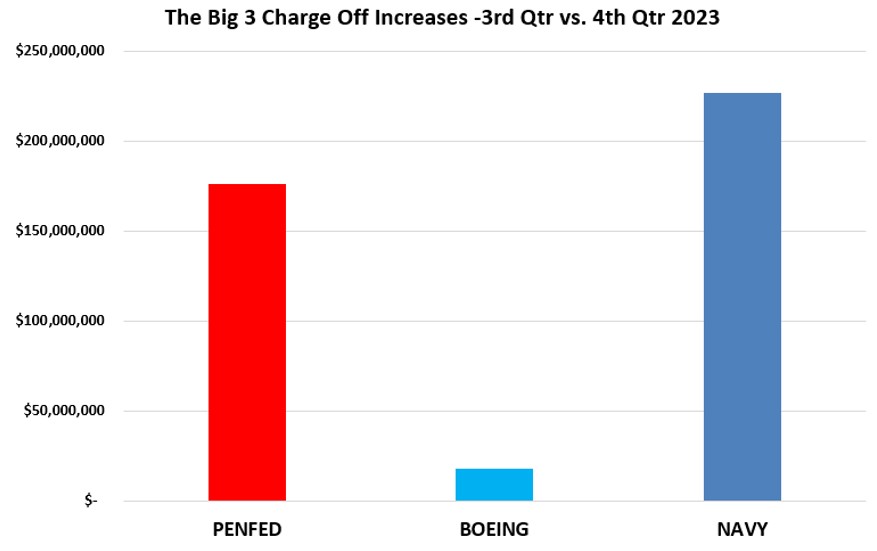

If you look up on the page a couple of lines, you can see one of the culprits, Provision for Loan Losses (PLL). In the 4th quarter, they posted a PLL of $452M, a $338M increase in just one quarter. This is $180M more than they posted in 2022, a 60% increase. While the next largest credit unions, Navy FCU and Boeing Employees CU, likewise showed increases, increases in PLL, theirs were far more modest at 49% and 33% respectively.

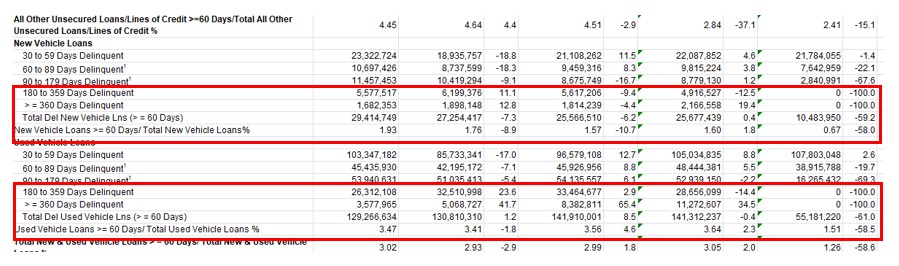

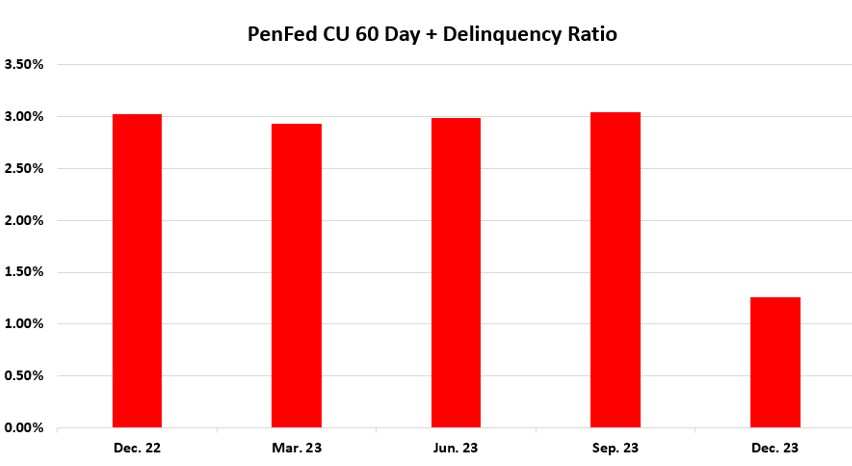

On the bright side, PenFed’s reportable delinquency (60 days and greater) came down to 1.19% from the 3rd quarters 1.52%. Nowhere was this more dramatic than in their auto loan delinquency with finished at a combined 1.26% in reportable, a massive improvement from their 2022 finish of 3.02%, but still well above Navy at 1.06% and Boeing at 0.33%. But there’s a catch.

Most of this was driven by charge off.

In 2022, Penfed posted $269M in gross charge off, in 2023 they charged off $724M. That an increase of $455M year over year with $269M of that happening in the fourth quarter alone. $206M of this was from auto loans which had charged off $186M at the end of the 3rd quarter already and was a $177M increase from 2022.

Running off an extra $177M in delinquent auto loans into charge off will quickly reduce your delinquency. But with only 18% of their loan portfolio being the source of 28% of their charge off losses, it does appear as though they are experiencing some pretty serious issues.

With a 4% charge off ratio on auto loans, it’s pretty hard to make a profit in a 5% cost of funds environment.

Why Does This Matter?

As mentioned, PenFed, is the third largest CU in the nation. And while their top two peers also shows strain, neither was as dramatic. Combined, the big three showed an average combined charge off increase of 180%.

Combined, these three credit unions make up about 11% off all CU assets and loans. And while we wait for the NCUA’s Aggregate NCUA 5300 FPR’s for q4 2022 to come out, I suspect this give us a pretty good preview of how the credit unon industry fared as a whole.

In PenFed’s defense, this was a financial “event” and not business as usual as stated in a January 31st press release their $3B in net worth year end finish in which PenFed President and CEO James Schenck admitted; “Loan loss rates increased in 2023 as PenFed revised its loan charge-off policy.

He is making reference to the NCUA’s required 2023 adoption of the new more stringent CECL (Current Expected Credit Loss) reserve methodology. This new reserve requirement is likely to show many credit union 5300 Call reports with some pretty extreme shifts in charge off, PLL and net incomes for the end of 2023.

That said, it would not surprise me to see some softer than expected increases in delinquency resulting from the charge offs for year end 2023. Short term, these may mask the delinquency ratios in a historical comparison, but not the actual problems in the long term.

In December, I predicted that year end 2023 auto delinquency would finish with an aggregate 60 day plus (reportable) delinquency ratio of .93%, a .18% increase from the third quarter. Seeing how even after all the new CECL reserves and charge offs had taken place, Navy showed a .19% increase in reportable delinquency, tells me that things are actually worse than they appear.

Time will tell.

2024 Charge Off Blows Up at PenFed CU – 2024 Charge Off Blows Up at PenFed CU – 2024 Charge Off Blows Up at PenFed CU

2024 Charge Off Blows Up at PenFed CU – Delinquency – Credit Union Collections – Credit Union Collectors – NCUA

Facebook Comments