Let me tell you a little about “those” people. They are talented professionals that must wear many faces and must be consummate professionals when servicing their clients. A few of the hats “those” people must wear in order to service their clients while managing the potential risks are: Private Detective, psychologist, locksmith, lawyer, technology specialist, communications specialist, professional defensive drivers While willing to work 49 hour days!

“Those” people, both men and women do a job that the courts across the country have ruled have “inherent” risks associated with the work they do so they must have the knowledge and expertise to service their clients while managing those “inherent” risks, complete the job, and return home safely to their family.

They must be knowledgeable of the numerous federal and state laws that impact the potentially risky, and sometimes dangerous services they perform and, as professionals they must continue their training constantly in order to maintain their professional credentials. And now, with the creation of the CFPB, “those” people, as well as the clients they serve must meet numerous new compliance mandates to further ensure the public safety.

perform and, as professionals they must continue their training constantly in order to maintain their professional credentials. And now, with the creation of the CFPB, “those” people, as well as the clients they serve must meet numerous new compliance mandates to further ensure the public safety.

They serve a most critical need in the lending industry. Without “those” people, millions of Americans could not buy a car, or truck, or a lawn mower, start a business, etc., etc., etc. because their financial situation would not allow them to pay cash or a huge down payment. “Those” people’s service to the  financial community creates a balance in the system for such purchases by millions of working Americans who would otherwise be unable to make those purchases and support their families. Without “those” people, our financial system simply would not work the way it needs to work in order to serve the financial needs of most Americans.

financial community creates a balance in the system for such purchases by millions of working Americans who would otherwise be unable to make those purchases and support their families. Without “those” people, our financial system simply would not work the way it needs to work in order to serve the financial needs of most Americans.

The finance contract a consumer signs states, very clearly, that should the consumer fail to make the agreed upon payments the lender has the right to send a representative (usually one of “those” people) to bring the collateral back to the lender. Further, the United States Supreme Court has emphasized and re-emphasized that the act performed by “those” people is not a violation of the Fourteenth Amendment. The work “those” people do is legal but also potentially very dangerous.

“Those” people, regardless of how TV shows portray them as lawless thugs, keep doing a most critical job while ignoring the wannabe TV stars that have no conception of what it takes to actually be one of “those” people.

“Those” people work hard and long hours to serve their clients and provide for their families like most other hard working, tax paying Americans. And, some of “those” people have been viciously attacked, even murdered just for trying to do their job, leaving behind grieving loved ones.

“Those” people are a most unique group known as collateral recovery agents. They persevere in the face the huge potential of the inherent risks  associated with the critically important work they do. They match wits with, and most of the time win against those who intentionally attempt to violate their contracts and default on their financial responsibilities.

associated with the critically important work they do. They match wits with, and most of the time win against those who intentionally attempt to violate their contracts and default on their financial responsibilities.

“Those” people serve the lending industry in a most critical role. They help to keep the financial system functioning while reducing the potential for liability and litigation and ensuring the public safety.

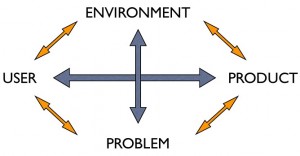

As my good friend, Kevin Armstrong observes about “those” people; “there is an “Ecosystem” in nature. Likewise, there is an “Economicsystem” in society. If one piece of that balanced order is removed, it all comes crashing down eventually. No repos = no loans = no vehicle manufacturers = no auto jobs = depressed economy.”

As my good friend, Kevin Armstrong observes about “those” people; “there is an “Ecosystem” in nature. Likewise, there is an “Economicsystem” in society. If one piece of that balanced order is removed, it all comes crashing down eventually. No repos = no loans = no vehicle manufacturers = no auto jobs = depressed economy.”

The entire RISC team takes this opportunity to salute “those” special men and women for their determination to do their job professionally and then return home safely to their family’s.

Be safe,

The RISC Team