DO NOT USE This Company and share this information with all relevant staff.

For a California based credit union, a repossession assignment to a company advertising online as operating in California, turned into a nightmare, with the company refusing to release the vehicle unless they pay a $3,087 “Contingency Fee.”

A northern California credit union, who prefers not to be named, recently assigned an account to a claimed repossession company named “Speedy Repo” when they had trouble finding available repossession companies in the south San Francisco Bay Area (which is a bigger issue than anyone outside of the SF Bay Area could imagine).

“Speedy Repo” claims on their website; “Speedy Repo has repossessors and repossession agents throughout the State of California.” The credit union requested their licensing and insurance documents as they prepared their provided repossession order on “Speedy Repo’s” form.

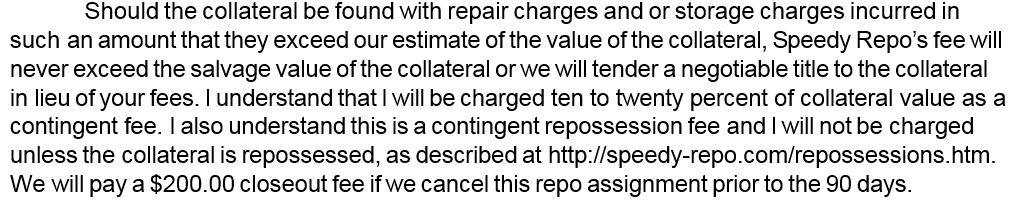

While still awaiting the requested information, they unfortunately, missed the detail in the contract, which stated;

“I understand that I will be charged ten to twenty percent of collateral value as a contingent fee.”

The requested license and insurance documents never transpired and the assignment was sent early in error.

After the recovery was completed, that’s when things went really screwball. “Speedy Repo” refused to show their license or insurance, as was originally requested, and refused to provide the vehicles storage location until the invoice was paid by wire or cashiers check with a 4-6 day wait for payment to clear, in the amount of;

($350 repo + $90 Lockout Fee + $3,087.72 contingency = $3,487.72!)

As insane as the “contingency fee” is, things became even more confusing as the invoice came from a “Jay Carter” at “ICU Inc.”, with a British Colombia, Canada address!

In correspondence from Jay Carter at ICU, Inc., he stated;

“All i can provide is our W8 Tax form, once we are paid the rest will be provided to you upon release of the vehicle at the yard.”

After some very adversarial conversations with the reportedly rude, “Speedy Repo”, the credit union eventually discovered the vehicle was repossessed by a completely different, but legitimate and established, San Francisco Bay Area repossession agency.

The legitimate agency, whose name we prefer not to publish, and the credit union discussed the situation and agreed to release the vehicle back to the credit union for the repossession fees with a hold harmless.

The legitimate agency is not directly affiliated with “Speedy Repo” and, according to sources, has not worked an assignment from them in over 6 years.

For the record, I have never advocated boycotting a repossession agency or forwarding company. But, under this situation, I feel a responsibility to help lenders avoid this nightmare and advise repossession agencies to avoid accepting their assignments.

“Speedy Repo” claims on their website; “Speedy Repo has repossessors and repossession agents throughout the State of California.” This is a major misrepresentation. They have no physical location.

This is not a licensed repossession company in California.

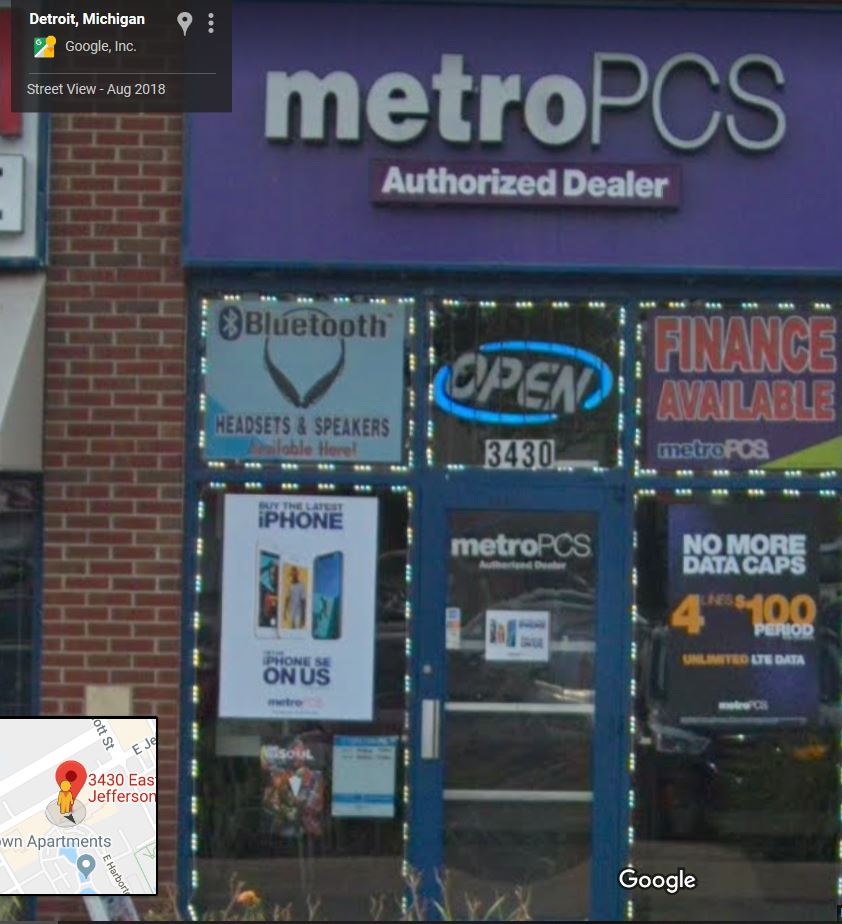

The legitimate agency, reported receiving the assignment from “Collateral Locators Services” at 3430 E. Jefferson Ave., Detroit, MI 48207. A Metro PCS store.

The invoice provided to the credit union from “ICU Inc.” at 800-15355 24th Ave., Ste. 460, Surry, BC Canada address, is a UPS store.

This company is not new, they have been around for many years and pulling the same scam on unsuspecting lenders, leaving borrowers and repossession companies at odds against each other, while they attempt to extort lenders for insane fees.

Read the Complaints on this company. They go back many years.

IMPORTANT NOTE! – “Speedy Repo” IS NOT TO BE CONFUSED WITH “Speedy Recovery, Inc.” of Nevada. “Speedy Recovery, Inc.” of Nevada is a legitimate and well established company to work with. I’ve known and worked with it’s owner, Peggy Chapman for many years.

Please Share this information with all collections and repossession staff regardless of industry. Let’s keep others from falling into this trap.