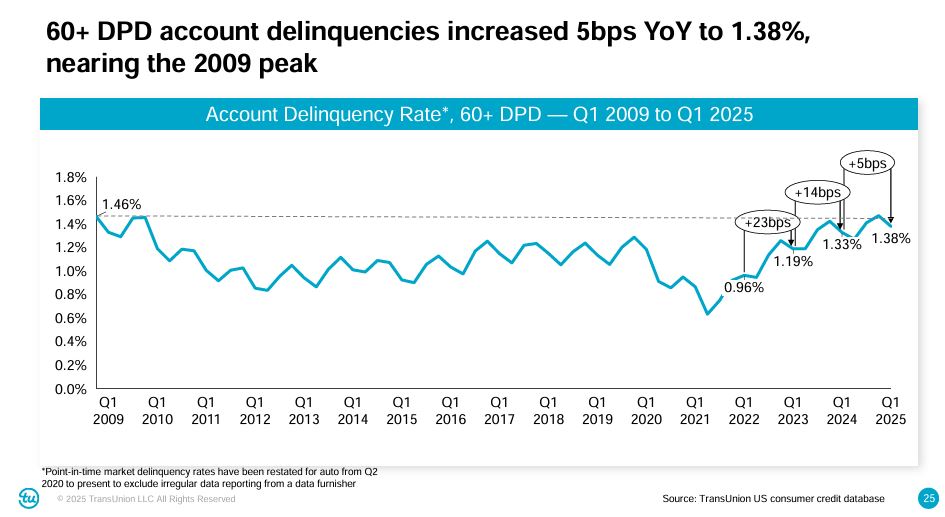

The 60+ DPD delinquency rate increased by 5 basis points YoY in Q1 2025 to 1.38%. This rate exceeds the peak delinquency rate of 1.33% observed in Q1 2009

Chicago, IL – May 22, 2025 – On Thursday, TransUnion, released their Q1 2025 Credit Industry Insights Report (CIIR). Amongst many data sets was their focus on auto loan delinquency for the 1st quarter of the year. Its findings tell us that the surge of delinquent auto loans is far from over.

Q1 2025 CIIR Auto Loan Summary

Auto loan originations in Q4 2024 reached 6.2 million, representing an 8% YoY growth. This growth was observed across all risk tiers, with super prime leading at 15.7% YoY growth. The increase was largely driven by Federal Reserve interest rate cuts in late 2024, rising inventories, and the return of incentives.

New vehicles made up 47% of those financed in Q4 2024, as compared to 53% used, the highest Q4 share for new vehicles since pre-pandemic times. Leasing share continued to approach pre-pandemic levels, rising to 26% in Q1 2025.

The 60+ DPD delinquency rate increased by 5 basis points YoY in Q1 2025 to 1.38%. This rate exceeds the peak delinquency rate of 1.33% observed in Q1 2009, although the rate of growth has recently slowed.

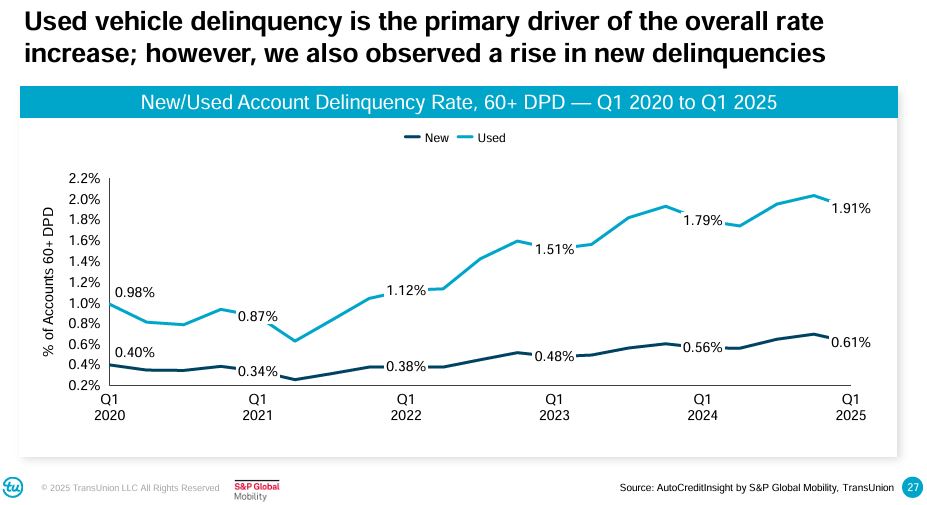

Of little surprise, used auto loans are more than three times higher in concentration than new autos. What is significant is almost 1% higher than Q1 of 2020, normally referred to as the pre-pandemic period.

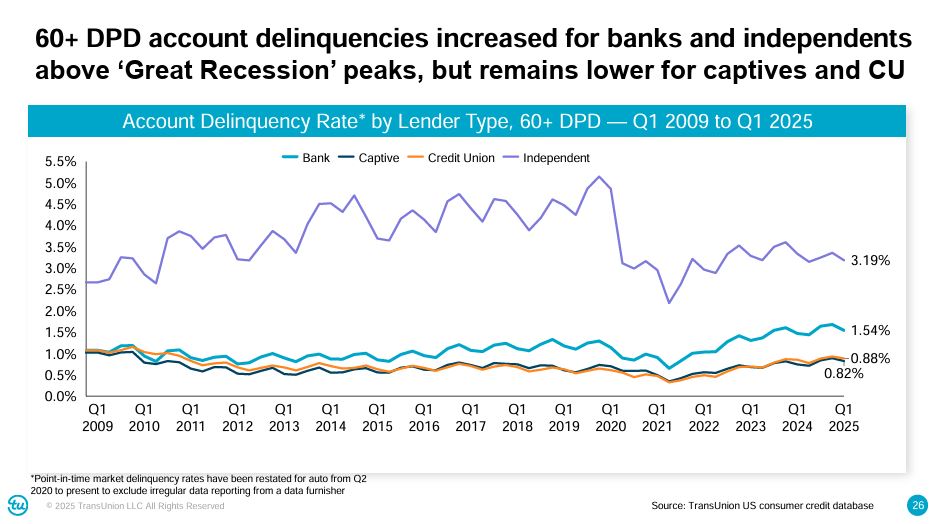

While the captive lenders carry the bulk of the delinquency burden, their numbers are still lower than the pre-pandemic era but noticeably resemble those of the Great Recession era. Credit Unions and Independent lenders while still showing elevated levels, are still reporting to the credit bureaus delinquency rates far below the banks and captives.

Overall, new vehicle loan vintages continue to show consistent performance compared to pre-pandemic periods (2018/2019). However, when broken down by risk tiers, recent new vehicle vintages have elevated delinquency levels, particularly for prime and below tiers.

About TransUnion (NYSE: TRU)

TransUnion is a global information and insights company with over 13,000 associates operating in more than 30 countries. We make trust possible by ensuring each person is reliably represented in the marketplace. We do this with a Tru™ picture of each person: an actionable view of consumers, stewarded with care. Through our acquisitions and technology investments we have developed innovative solutions that extend beyond our strong foundation in core credit into areas such as marketing, fraud, risk and advanced analytics. As a result, consumers and businesses can transact with confidence and achieve great things. We call this Information for Good® — and it leads to economic opportunity, great experiences and personal empowerment for millions of people around the world.

http://www.transunion.com/business

TransUnion Report – Q1 25’ Auto Loan Delinquency The Highest Since 2009 – TransUnion Report – Q1 25’ Auto Loan Delinquency The Highest Since 2009 – TransUnion Report – Q1 25’ Auto Loan Delinquency The Highest Since 2009

TransUnion Report – Q1 25’ Auto Loan Delinquency The Highest Since 2009 – Credit Union Collections – Credit Union Collectors – Delinquency – TransUnion – TransUnion – Lending – Auto Loan – Delinquency

More Stories

Husband and Wife Face Racketeering Charges in Luxury Vehicle Title Fraud

Fraud is Top-of-Mind for Nearly Nine-in-Ten Auto Dealers

🎯 Meet Your 2026 Summit Keynote Speaker: Jovan Glasglow