Market Insights – 10/21/25

Wholesale Prices, Week Ending October 18th, 2025

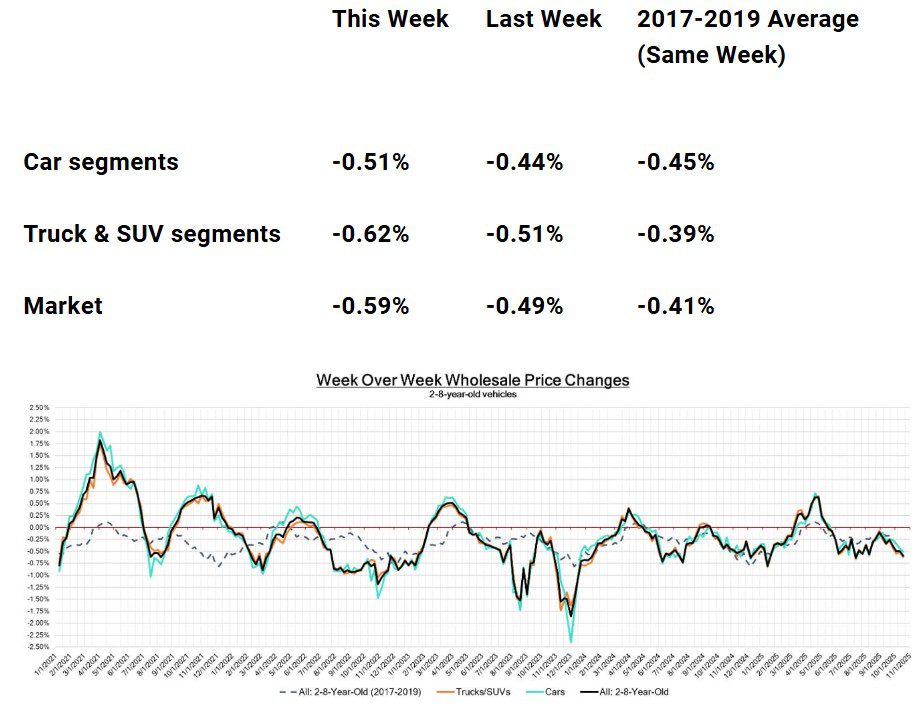

Wholesale prices declined -0.59% last week, reflecting a steeper pace of seasonal depreciation as fall market softness deepened. Conversion rates held unevenly across the lanes, with strong results for clean, late-model units offset by selective bidding and lower returns on aging and higher-mileage inventory. Demand for traditional gas vehicles remained steady, while EV pricing and 2025-model values continued to face downward pressure amid heightened buyer caution.

_

Click any Image to enlarge

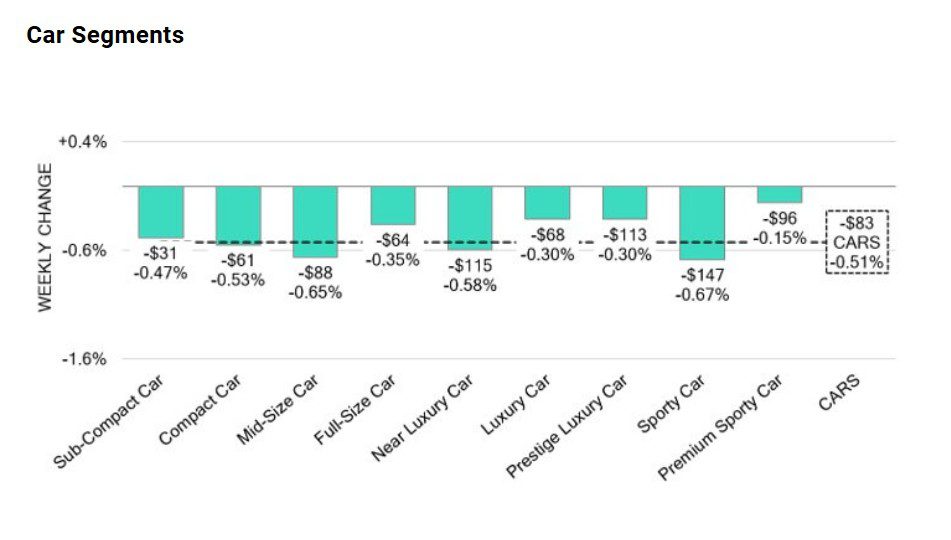

- On a volume-weighted basis, the overall Car segment decreased -0.51% For reference, in the previous week, cars decreased -0.44%.

- The 0-to-2-year-old Car segments were down -0.38% and 8-to-16-year-old Cars decreased -0.61%.

- All nine Car segments reported a decrease in values last week.

- The 2-to-8-year-old Sporty Car segment saw depreciation accelerate last week, with values falling -0.67%, compared to an average weekly decline of -0.27% over the prior four weeks. In contrast, 0-to-2-year-old models experienced a milder decrease of -0.34%, while 8-to-16-year-old vehicles posted a mid-range decline of -0.48%.

- In sharp contrast, the Premium Sporty Car segment remained notably stable, recording only a -0.15% decline last week—closely in line with its average weekly depreciation of -0.10% over the past four weeks.

–

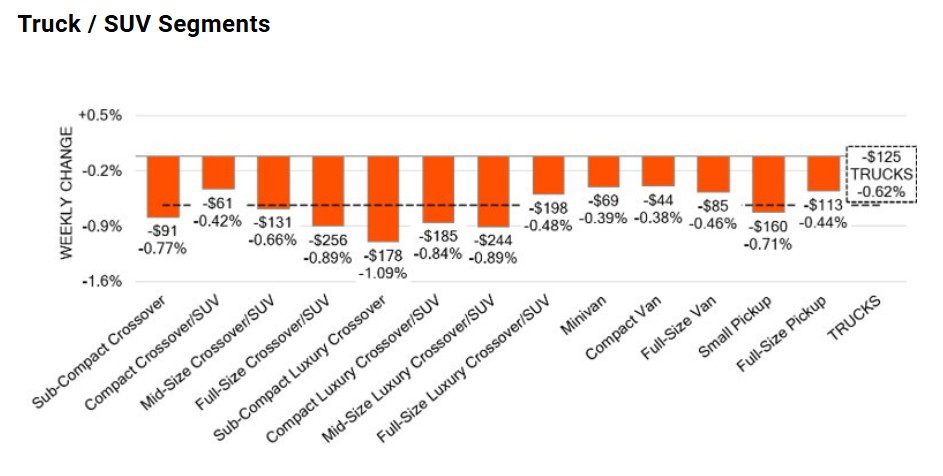

- The volume-weighted, overall Truck segment decreased -0.62% compared to the decrease seen the prior week of -0.51%.

- The 0-to-2-year-old models saw an average decrease of -0.61% and the 8-to-16-year-old models experienced an average decrease of -0.46%.

- All thirteen Truck segments reported a decrease in values.

- Depreciation accelerated last week for Mid-Size Luxury Crossovers/SUVs. Values for 0-to-2-year-old models declined -0.82%, compared to -0.55% the previous week—representing the largest single-week drop for the segment since January 2024. Similarly, 2-to-8-year-old models experienced a sharper decline of -0.89%, up from the prior week’s -0.55% depreciation and marking their steepest drop since July 2024.

- The Sub-Compact Luxury Crossover/SUV segment saw values fall by more than 1%, marking the second time in the past three weeks that depreciation in this category has exceeded the 1% threshold.

_

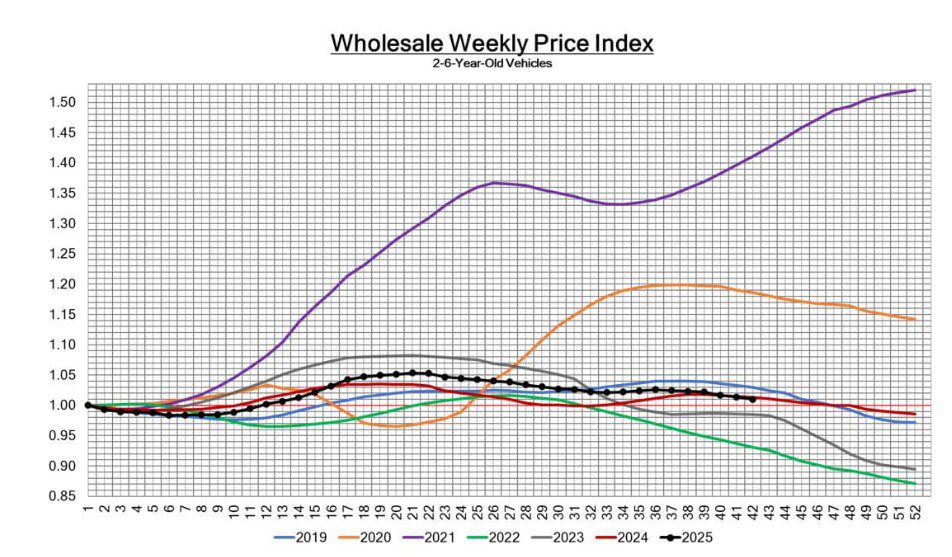

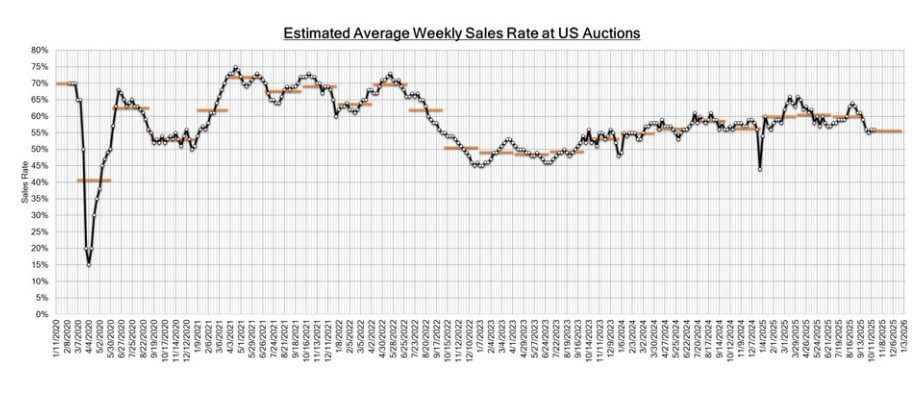

Weekly Wholesale Price Index

The graph below looks at trends in wholesale prices of 2- to 6-year-old vehicles, indexed to the first week of the year. The index is computed keeping the average age of the mix constant to identify market movements.

_

Wholesale

Wholesale prices continued to soften last week, consistent with typical late-October seasonality. The Car segment declined -0.51%, while Trucks/SUVs slipped -0.62%, a slightly faster pace than the prior week. Compact and Mid-Size Cars led to depreciation, while Premium Sporty Cars remained comparatively stable. Among trucks, luxury crossovers and mid-size SUVs posted the largest declines amid ongoing supply pressure.

Auction conversion held steady at 56%, indicating steady but selective dealer participation. Clean, low-mileage units continued to command strong bids, while EVs and older SUVs lagged, trading below book values. Overall, market conditions remained orderly, with pricing trends aligned to seasonal expectations as the industry moves deeper into Q4.

As always, our team of analyst are focused on the keeping their eyes on the market for developing trends and gathering insight.

Wholesale Auction Prices Softening – Wholesale Auction Prices Softening – Wholesale Auction Prices Softening

Wholesale Auction Prices Softening – Black Book – Remarketing – Wholesale – Credit Union Collections

More Stories

Husband and Wife Face Racketeering Charges in Luxury Vehicle Title Fraud

Fraud is Top-of-Mind for Nearly Nine-in-Ten Auto Dealers

Below Prime Auto Loans … 2025 a Year of Record Highs!