Charge offs Down, 30- and 180-Day Delinquencies Holding Well

–

With the 4th quarter and end of the year just weeks away, the 3rd quarter of the year showed some mixed signals. Auto loan originations slowed, bankruptcies climbed and modifications have reached record levels. Otherwise, there are some bright spots in the data that suggest that perhaps the worst of the delinquency is over.

As always, the National Credit Union Administration’s (NCUA) 5300 FPR financials report for Q3 of 2025 came out with the quarter just about over. Better late than never. What I had predicted as a possibly worse year end than 2024, may turn out to have been a false alarm!

–

Portfolio Balances: Slow Progress

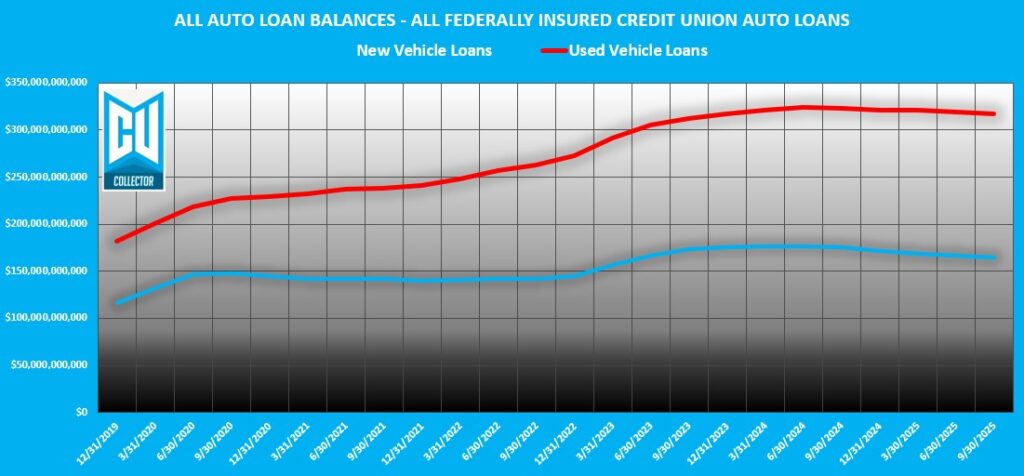

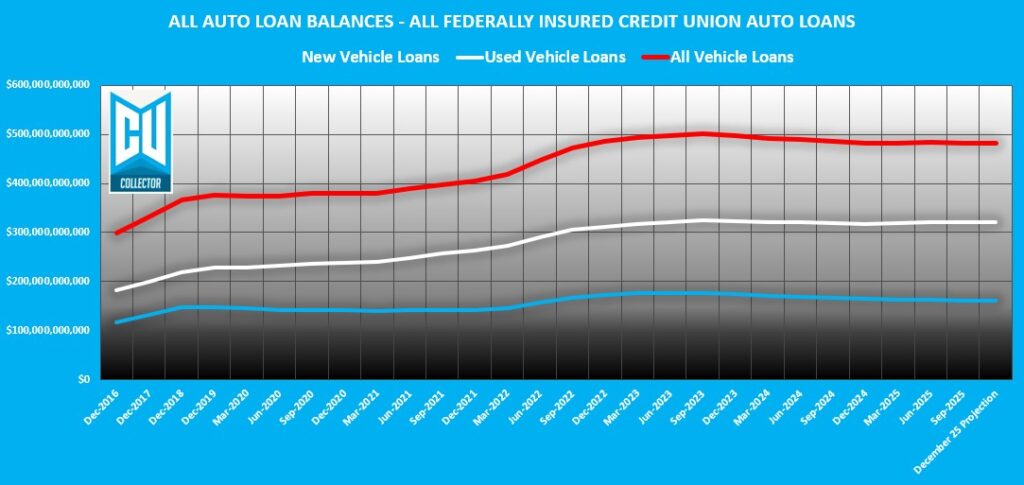

Following 2024’s loan balance wipeout, Q2 had ended with some hope of increased loan production, but unfortunately, it ended -$1.1B lower than Q2 at $482B, as I had predicted.

Unfortunately, the area where the largest reductions occurred were in New Auto, which now accounts for only 33% of the aggregate credit union auto loan portfolios. This level of concentration has been going down approximately 1% per year since 2023 when it was 35%.

The significance in this lies in risk and future loan losses which will be clearly illustrated in both delinquency and charge-off data later. Overall, credit union auto loan balances are still improved over year end 2024 by $919M.

Looking forward, I do not see new auto coming back anytime by year end and predict an additional decrease of $184M ending the year at $481.2B, down slightly from 2024’s $481.4B.

–

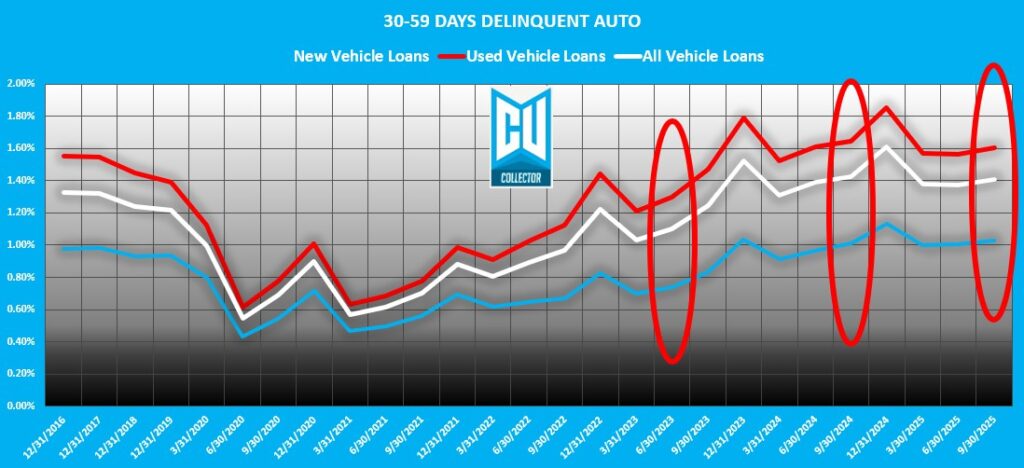

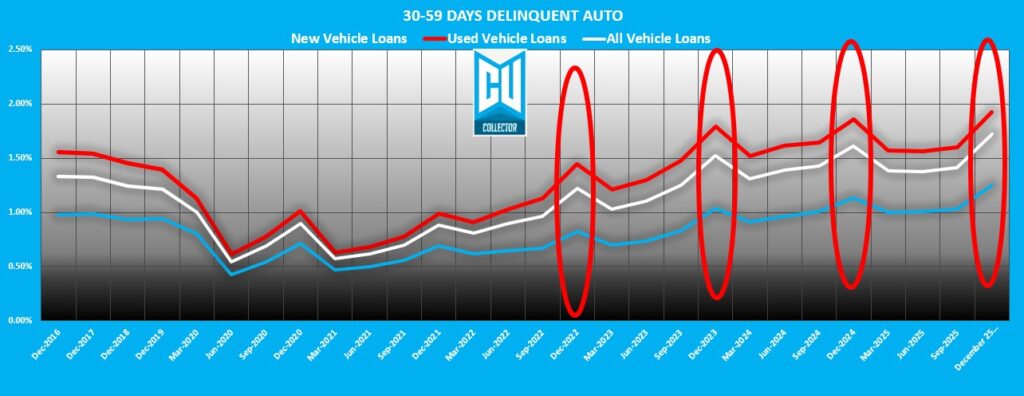

30-Day Delinquencies: Holding the Line

Q3’s 30-59 days bucket finished at a combined $6.8B, 1.41%. This slight increase of 3/10 of a basis point is over $100M lower than in the same time last year, which is a good sign. So far, this category has held very steady all year.

I had predicted that it would end at $7.3B and was clearly way off!

Looking at the four-year average 4th quarter increase in this category, if I stuck with the four-year 22% increase average, we would finish at $8.2B. Considering the most recent trends, I have cut back the average to two years which brings in a more reasonable possible finish of $7.4B.

–

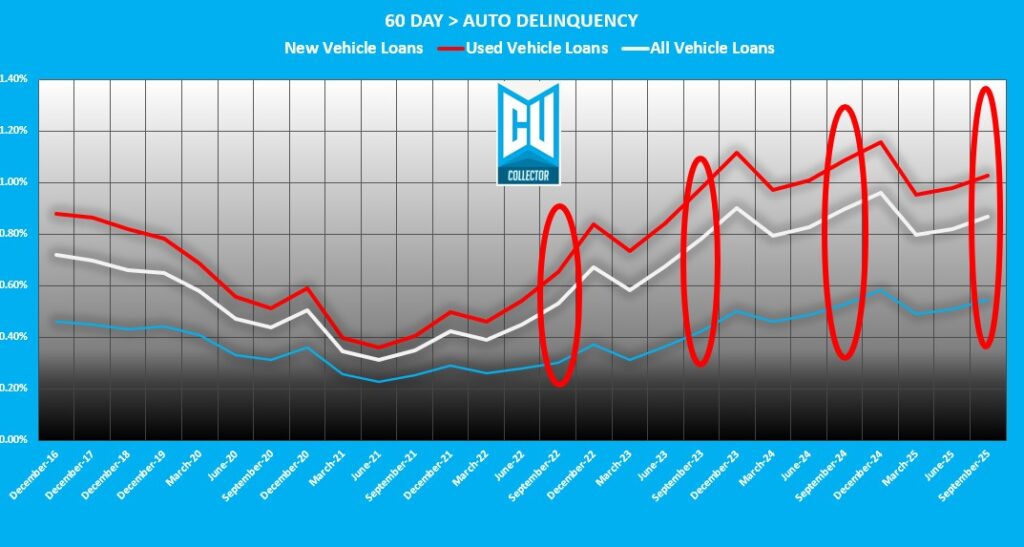

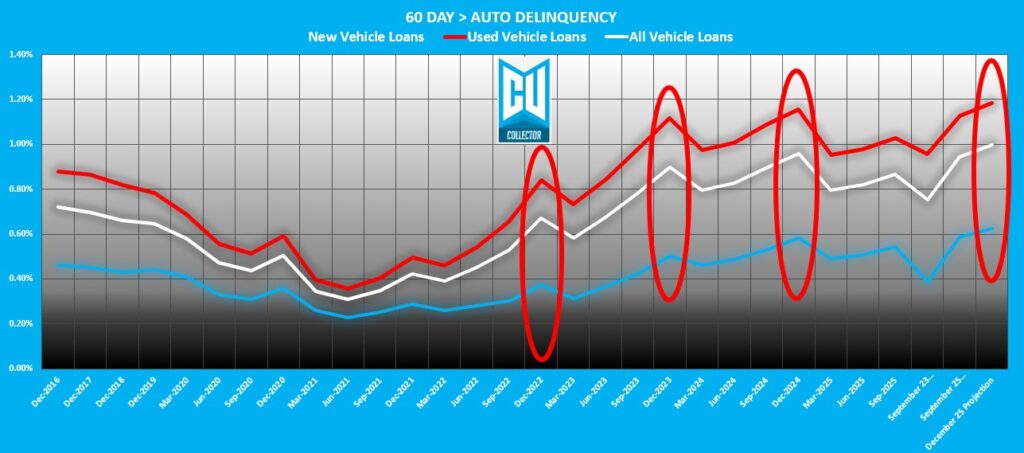

60+ Day Delinquencies: The Big Show

Last September, I had predicted that 60 day plus delinquency would finish at $4.3B and was fortunately off by $140M. Unfortunately, it did rise by $210M, finishing with a reportable delinquency ratio of 0.87%.

Looking ahead, as the 4th quarter tends to do, I believe the increase will continue and reportable delinquency will finish at $4.8B with a delinquency ratio of 1.01%. This would be a $223M increase over December of 2024.

–

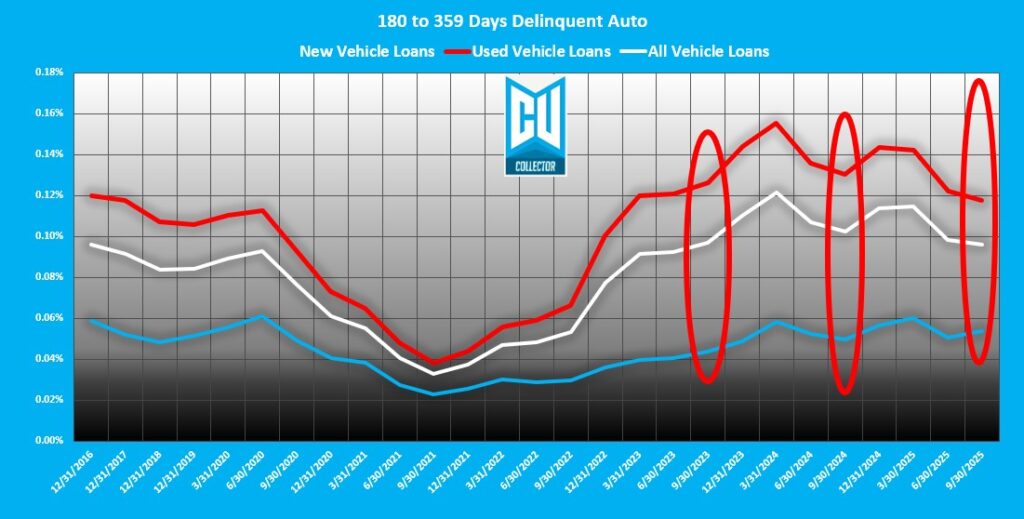

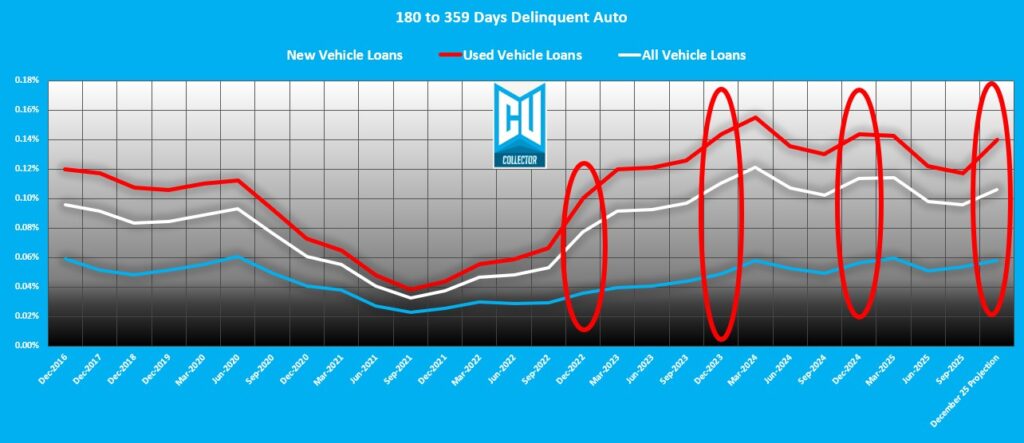

180+ Days Delinquent: The Bone Yard

Remarkably, this tranche has shown significant progress over the year. With a quarter over quarter decrease of $11M in Q3 vs. Q2 and another $76M in Q2 vs Q1, at $463M, it is the lowest its been since Q2 of 2023.

This category is usually full of a ton of bankruptcies, repos, and deficiency balances. Any reductions here are a sign of continued improvement in delinquency management. Regardless, seasonality will have its way here and I predict that this bucket will finish at $511M, which is actually progress when compared to Q 4 of 2024 as well as Q1 of 2025.

Great job everyone!

–

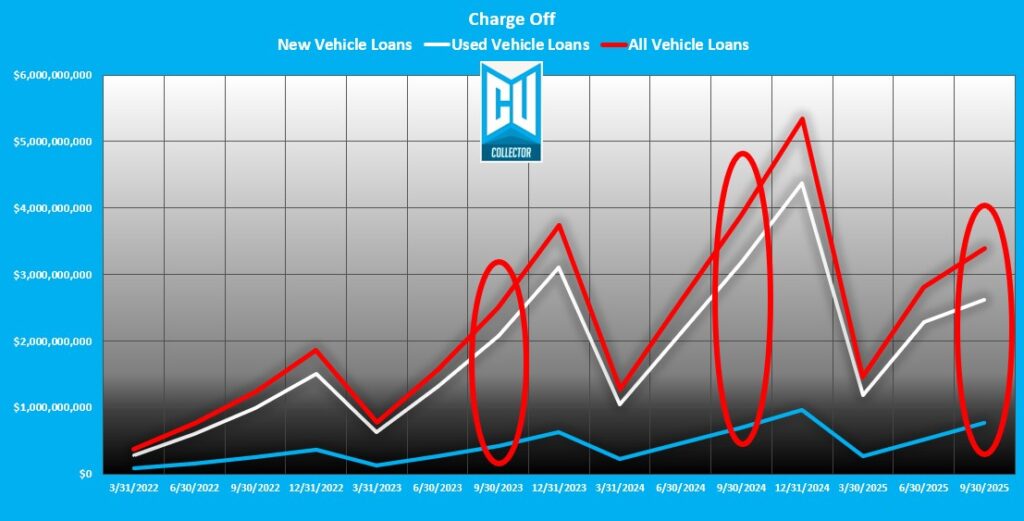

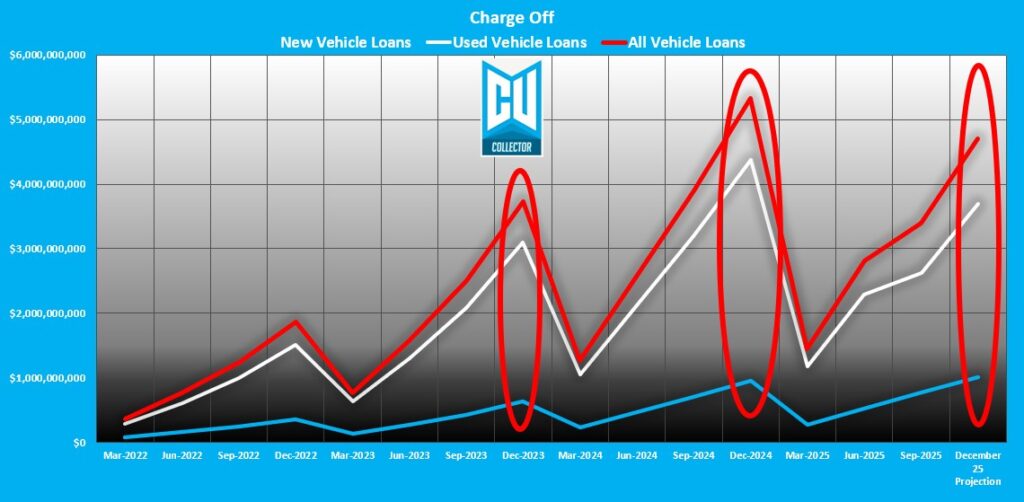

Charge-Offs: The Final Flush

With charge off being an aggregate count, you can measure it against the prior quarter, but to get a better sense of where it is going, I feel its best to look back at the same time last year. In Q3 of 2024, charged off auto loans stood at $3.89B. With Q3 of 2025 finishing at $3.39B, you can see some progress is being made.

Despite this progress, as the aggregate nature of charge off, the 4th quarter will show an increase. The good news is, I predict that it will finish at $4,7B. That’s $628M lower than it did in 2024.

This isn’t all bad. I suspect that credit unions are beginning to take a more conservative and realistic approach to charge-off and are being more aggressive in realizing their losses.

–

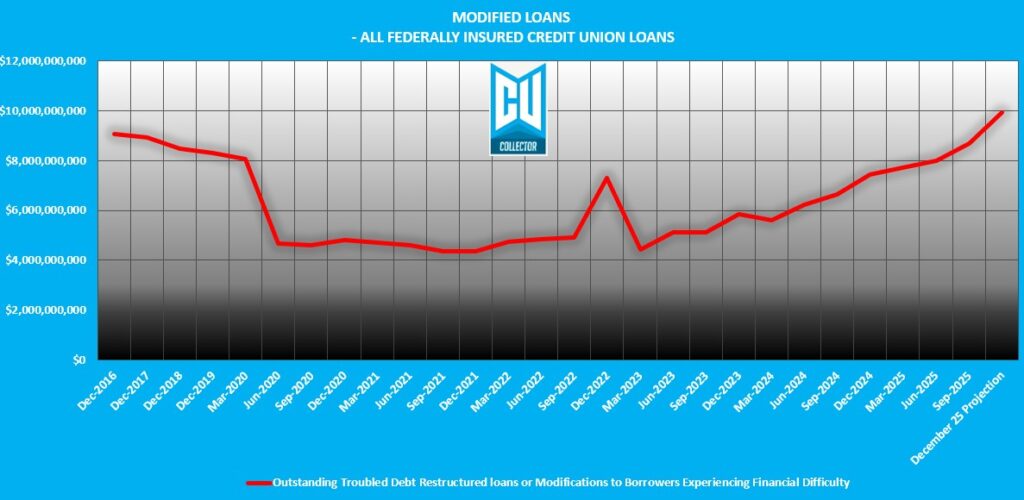

Loan Modifications: Record Highs

One thing for certain is that the credit union industry has been leaning into loan modifications pretty heavily over the past few years. So much so, that the level of mod’s granted now exceed where they were in Q4 2017.

With Q3 2024 finishing with a reported $8.7B in modified loans and the holiday season upon us, I predict that this will continue to climb and finish at $9.9B and will break Covid era numbers and every aggregate number provided by the NCUA that only goes back to 2016.

NCUA data on this does not differentiate one loan type from another and this does not count bread and butter everyday extensions. Regardless, it gives a pretty good snapshot of the overall health of credit union portfolios and the means credit unions are using to avoid charge off losses.

Unfortunately, recidivism rates on delinquency from modified loans tends to be very high. Most of these loans will be back on the delinquency lists in a matter of months, especially if the current bankruptcy trends continue.

–

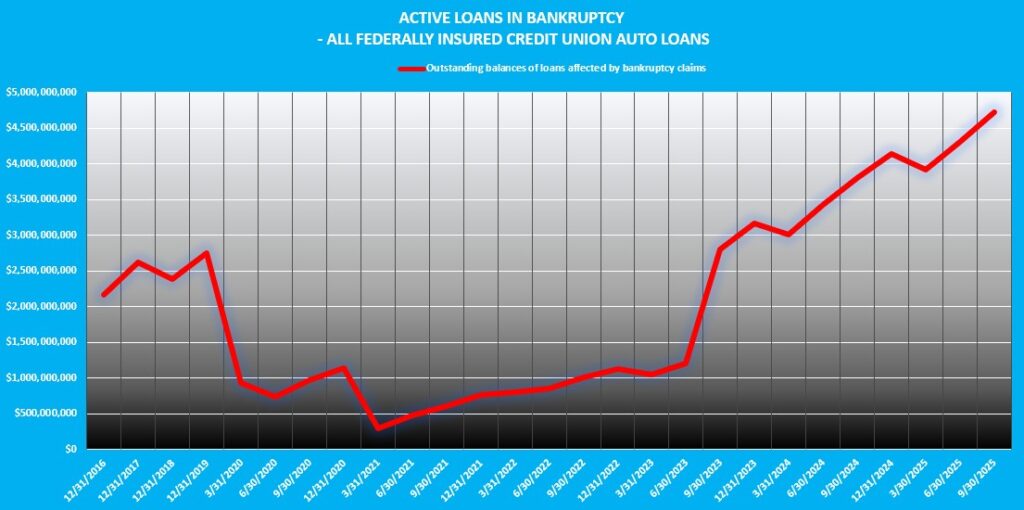

Bankruptcies – The Rising Tide

Between 2020 to 2023, bankruptcies were almost non-existent. But by Q3 of 2023, they started coming back. Now, there are $4.7B in loans effected by bankruptcies on the credit union portfolio balances.

Just like modifications, the NCUA does not differentiate the balance of these by loan product. Considering that commercial bankruptcies (chapter 11 etc.) have shown the highest number of increased filings nationally, rising credit card debts and delinquencies should have everyone on their guard for consumers to follow soon behind.

Considering bankruptcies are slow moving ships and tend to take months or years to discharge, I’ll opt out of any predictions other than I would not be surprised to see a rush of new filings in Q1 2026.

–

Light at the End of the Tunnel?

Q3 has turned out to be something of a surprise to me. Charge offs are down and 30 and 180 day delinquencies are holding well. Despite this, credit card balances are up $4B over the past three quarters and likely to rise more before the end of the year.

Will rising bankruptcies and the record number of modified loans become the next collections headaches? As of Q3, it appears that the line in delinquent auto loans is being held.

Is this the end of near record breaking auto repossessions across the lending spectrum? Perhaps, but even though there seems to be some light at the end of the tunnel, it is no time to celebrate. Who knows what next year holds in store, but until then, keep up the good fight everyone!

–

Download the Data Here!

–

Best of luck!

Kevin Armstrong

Publisher

–

Related Articles;

Q2 2025 Credit Union Auto Loan Delinquency – A Slow but Rising Tide

Q1 2025 Credit Union Auto Loan Delinquency – Buckle Up Buttercup

The Calm Before the Storm – 1st Quarter 24’ Credit Union Auto Loan Delinquency

Credit Union Auto Loan Delinquency Climb Continues

Credit Union Auto Loan Delinquency Surges

Credit Union Auto Loan Delinquency Pattern Back to Normal

Q3 2025 Credit Union Auto Loan Delinquency – Light at the End of the Tunnel? – Q3 2025 Credit Union Auto Loan Delinquency – Light at the End of the Tunnel? – Q3 2025 Credit Union Auto Loan Delinquency – Light at the End of the Tunnel?

Q3 2025 Credit Union Auto Loan Delinquency – Light at the End of the Tunnel? – NCUA – Delinquency – Lending – Credit Union Collections – Credit Union Collectors – Repossession – Wholesale – Auto Loan

More Stories

🎯 Meet Your 2026 Summit Keynote Speaker: Jovan Glasglow

Credit Unions at a Crossroads: Shifts, Risks, and Opportunities — Part 1

Year End 2025 Trans Union Auto Loan Delinquency Snapshot