Consumer 30+DPD increased to 4.49% (17 bps); 60+DPD increased to 1.71% (11 bps)

–

On January 22nd, credit reporting giant TransUnion released their December 2025 Credit Industry Snapshot Summary. Breaking down all the loan segments by type, they reveal year end auto loan delinquency, that has remained almost unchanged from 2024. So, what does this tell us about what 2026 will look like?

Read The Entire Report Here!

–

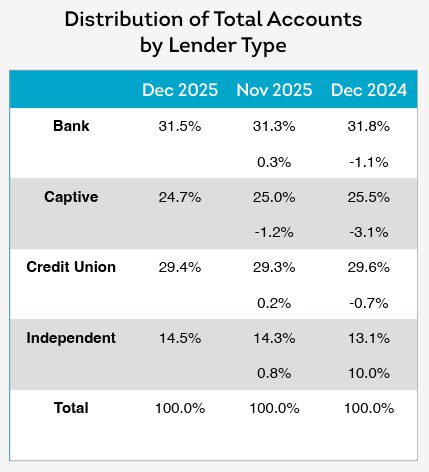

Distribution

Despite a November to December growth of .1%, the credit union share of new auto loans funded was down .2% from year end 2024.

–

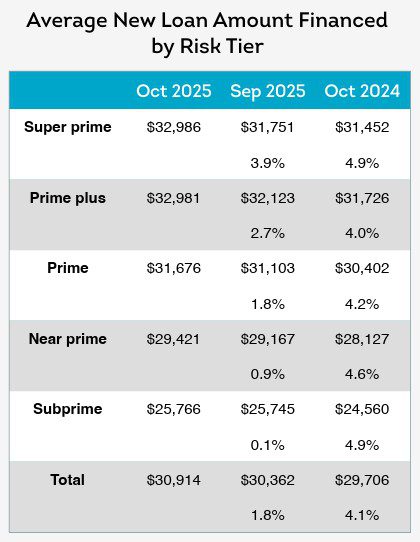

New Loan Sizes

Broken down by credit tier, it is consistent; the average loan amount continues to grow. IN just one month (November to December) it increased to $30,914 (from $30,362). Year over year, it’s up almost $1,200 going from $29,706 in December 2024 to 2025.

–

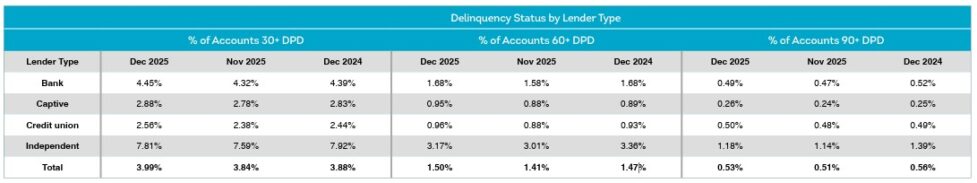

Delinquency by Credit Tier

2025 ended with a lot of focus on subprime lending and its rising delinquency rates. While 2025 ended 3.8% than 2024, it rose from 9.06% in November to a whopping 9.44% in December.

–

Credit Union Auto Delinquency

Bad news; auto loan delinquency made no progress at year end 2025. 30 + day delinquency rose 0.18% from November to finish at 2.56%. The 60 day + tranche rose 0.03% over 2024 and 0.08% since November.

The good news; the 90 + day delinquent rate was almost flat.

Additional State Level Delinquency Data is Available Here!

–

–

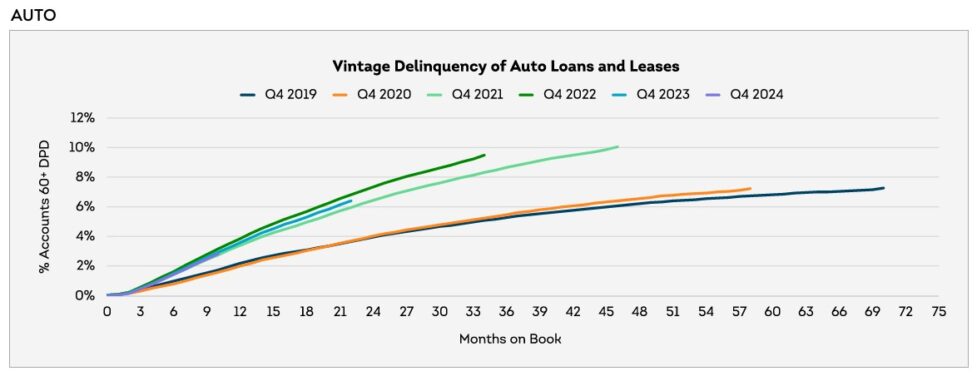

Vintage Analysis

With only 12 months’ 60 day + delinquency data available on the 2024 book of new auto loans, the jury may still be out, but it appears to be moving inline with the 2021 and 2023 books of business. What does stand out is the 2022 book of business which is clearly the worst performer of the five-year sample.

–

Summary

The executive report provided by Trans Union paints an overall picture of some stagnancy in loan originations and loan amounts that show no signs of relief to the consumer. Delinquency is appearing at this rate to be stubbornly high overall. The outliers being credit unions and captives.

–

–

Related Article:

TransUnion – 2026 Loan Delinquency Forecast

–

About TransUnion

(NYSE: TRU) TransUnion is a global information and insights company with over 13,000 associates operating in more than 30 countries. We make trust possible by ensuring each person is reliably represented in the marketplace. We do this with a Tru™ picture of each person: an actionable view of consumers, stewarded with care. Through our acquisitions and technology investments we have developed innovative solutions that extend beyond our strong foundation in core credit into areas such as marketing, fraud, risk and advanced analytics. As a result, consumers and businesses can transact with confidence and achieve great things. We call this Information for Good® — and it leads to economic opportunity, great experiences and personal empowerment for millions of people around the world. transunion.com/business

Year End 2025 Trans Union Auto Loan Delinquency Snapshot – Year End 2025 Trans Union Auto Loan Delinquency Snapshot – Year End 2025 Trans Union Auto Loan Delinquency Snapshot

Year End 2025 Trans Union Auto Loan Delinquency Snapshot – Credit Union Collections – Credit Union Collectors – Lending – Delinquency – TransUnion – TransUnion – Auto Loan

More Stories

Husband and Wife Face Racketeering Charges in Luxury Vehicle Title Fraud

Fraud is Top-of-Mind for Nearly Nine-in-Ten Auto Dealers

🎯 Meet Your 2026 Summit Keynote Speaker: Jovan Glasglow