Repossessions and losses are rising; both higher in Dec-2025 vs. Dec-2024 and pre-pandemic Dec-2019.

–

It’s no surprise that 2025 was a year with some dramatic delinquency, losses and repossession in the subprime auto loan market. But according to asset backed security (ABS) data, the pain appears far from over.

–

Data Sources

Detail derived from proprietary database of 28.5 million unique auto loans covering 109 months of activity (Dec-2016 to Dec-2025). Each loan has up to 72 data elements for each reporting month. Dataset: 814 million rows x 72 columns … most extensive, readily available, collection of auto loan-level detail available for benchmarking and exploration. Data source: 16,958 files submitted to SEC by 20 auto lenders. Active lenders listed at end of article.

Two credit buckets are used in analysis: Below Prime (>= 300 <=660) and Prime (>660 <=850). Scores outside these ranges are classified as “no score.”

Punchline: Over past several years, Below Prime auto loan delinquency and losses became a growing concern. 2025 started with record high Below Prime delinquency and each month continued to set new highs. Repossessions and losses are rising; both higher in Dec-2025 vs. Dec-2024 and pre-pandemic Dec-2019.

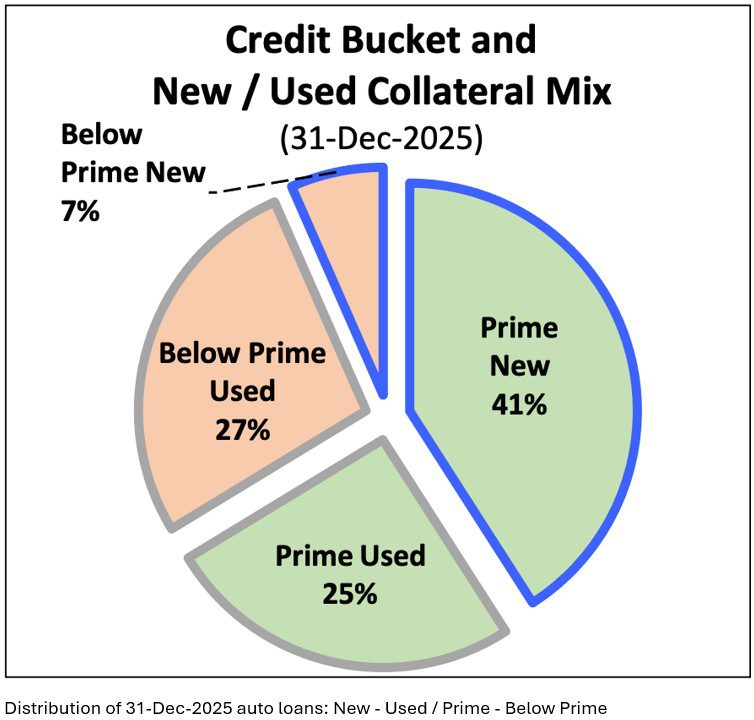

Pie chart below depicts mix of 7.7 million outstanding loans in database, based on credit bucket (Prime – green/ Below Prime – red) and collateral type (new – blue border / used – gray border). Vast majority of Below Prime obligors finance used vehicles.

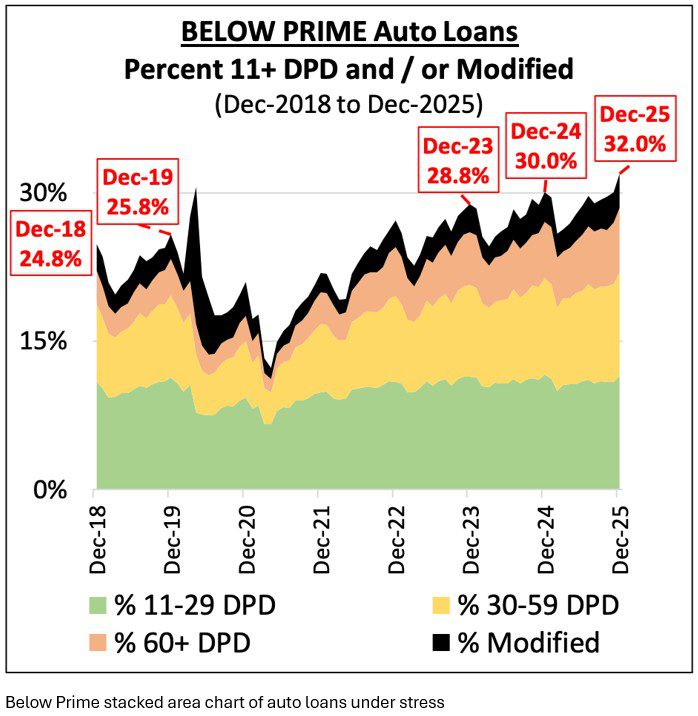

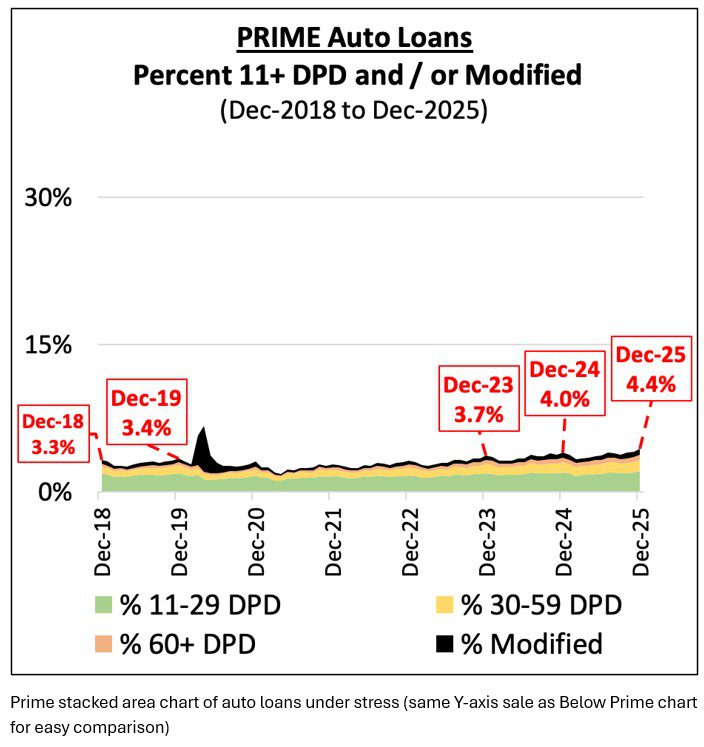

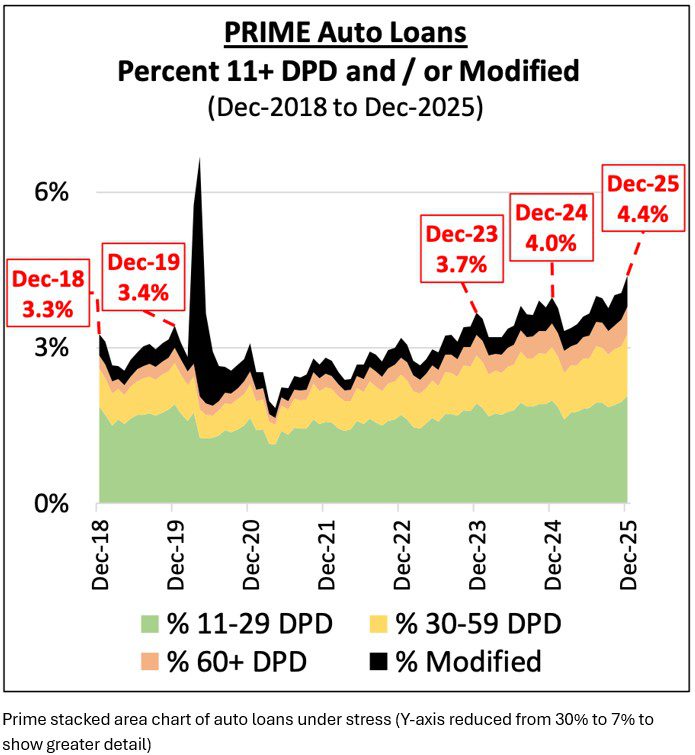

Three stacked area charts below show loans under stress trend from Dec-2018 to Dec-2025 for Below Prime bucket and Prime bucket. Top two charts use same Y-axis for easy comparison of Below Prime to Prime. Bottom chart zooms in on Prime loans by reducing Y-axis range from 30% to 7%.

In Dec-2025, Below Prime accounts remained under considerably more stress than in pre-pandemic period; 24% (618 bp) higher than Dec-2019 and 29% (714 bp) higher than Dec-2018.

Percent of Prime accounts under stress continues to gradually grow.

–

–

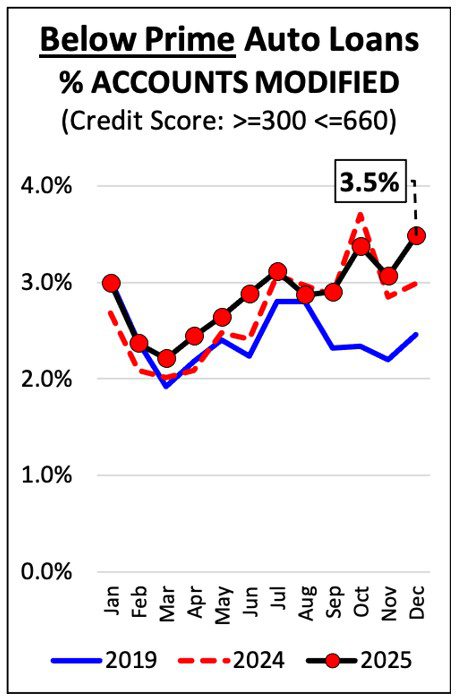

Below chart shows trend of Below Prime auto loans modified, comparing each month in 2025 to 2024 and pre-pandemic 2019. Notice the Oct spike in both 2024 and 2025. In 2024, hurricanes (Helene and Milton) drove spike in loan modifications … The Oct- and Dec-2025 spikes are driven in large part by Exeter (42% of total modifications).

Trend of Below Prime auto loans modified

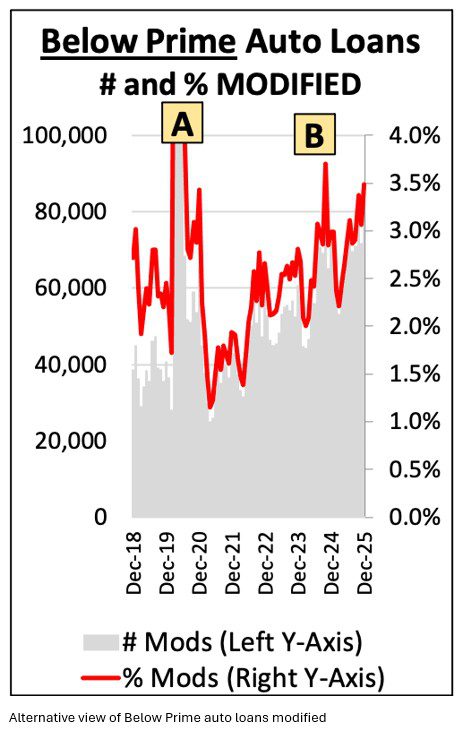

Alternative view of Below Prime loan modification trends. Chart shows all months / years from Dec-2018 to Dec-2025 … Chart footnotes: [A] Y-axes do not capture full modification spike near start of pandemic (Apr-2020: 227,000 modifications, 13.8% of outstanding auto loans). [B] Reflects hurricane driven spike in loan modifications.

Loan modification annual peaks and valleys are evident. While any given month the percent of loans modified may seem small or innocuous, over time there is a build up … as shown in the second chart below.

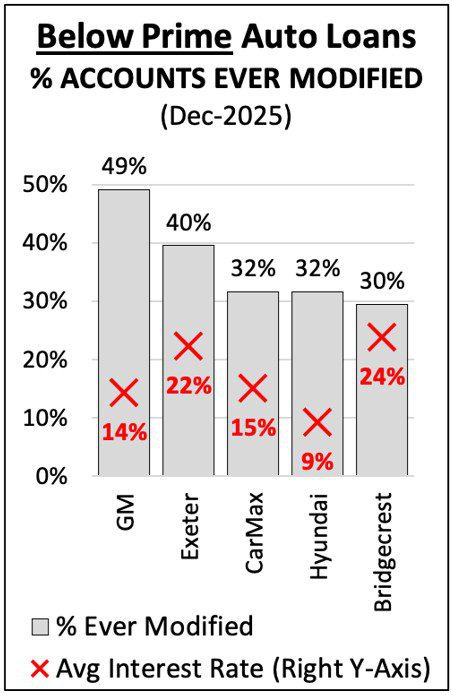

Next chart reflects lenders with greatest percent of Below Prime accounts currently outstanding that were ever modified. Obligors incur hundreds of dollars of incremental cost for modifications that are loan extensions (90%+ of loan modifications are extensions) … the higher the interest rate, the higher the cost.

Auto loans outstanding in Dec-2025 that were ever modified; avg loan interest rate of those loans

Below Prime delinquency is at, or above, record high levels based on data from multiple sources (e.g., NY Fed, Fitch Rating, FFIEC Call Reports, Experian, Equifax, TransUnion, etc.).

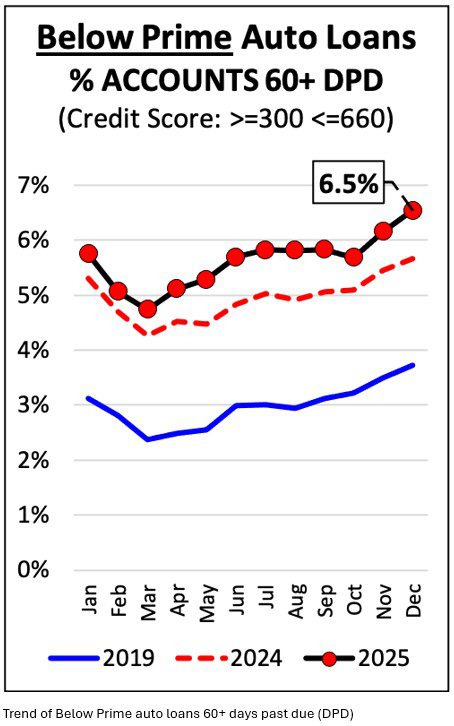

Following chart reflects 60+ days past due (DPD) delinquency rates based on number of Below Prime loans outstanding in dataset … Numbers continue to represent record high rates.

Dec-2025 60+ DPD rate at 6.5% is 16% (88 bp) above Dec-2024, and 76% (282 bp) higher than pre-pandemic Dec-2019. Lenders with highest 60+ rates for Dec were: Santander (7.9%), Bridgecrest (7.8%), and Exeter (6.7%).

Note: The dip in 60+ in Oct appears to have been driven in large part by loan extensions among the three lenders noted above. Additional detail regarding flow rates and impact of loan modifications on the flow rates is available.

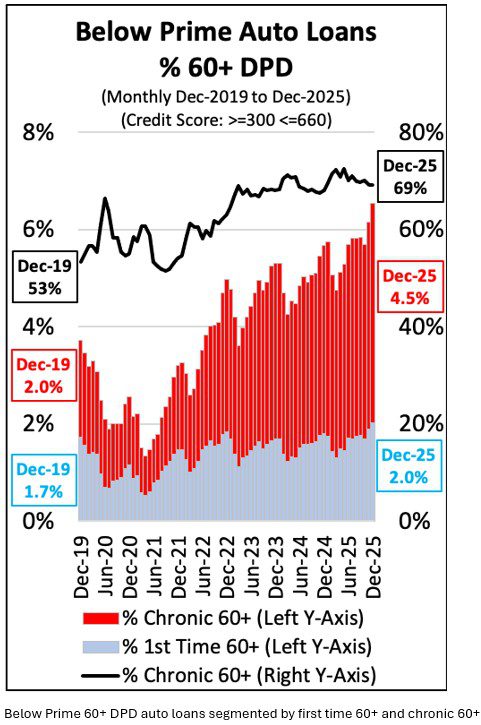

Following stacked column chart splits Below Prime 60+ delinquency rates into two segments: Percent 1st Time 60+ (blue bars) and percent Chronic 60+ (red bars). Combination of these two segments reflects total percent 60+ delinquency for each month (6.5%, Dec-2025).

Black line depicts portion of 60+ that is “chronic”, which increased from 53% (Dec-2019) to 69% (Dec-2025).

In aggregate, 76%+ of auto loans that ever-became 60+ DPD are eventually charged off

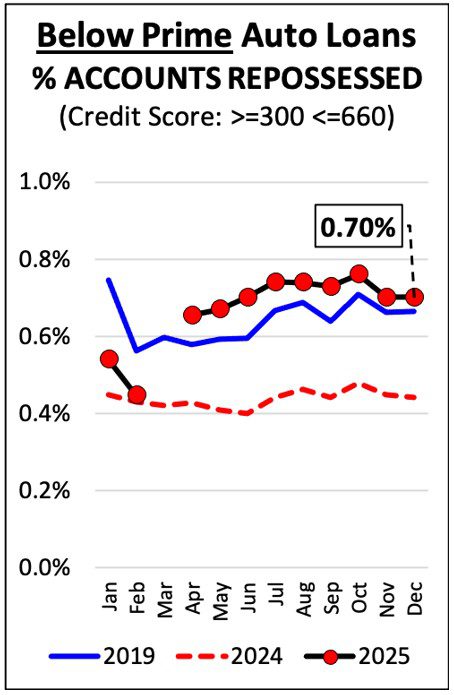

Following chart reflects Below Prime first-time repossession rate. Numerator: Number of first-time repossessions in month. Denominator: Total number of auto loans outstanding at month end.

Dec-2025 repossession rate at 0.70% is 59% (26 bp) above Dec-2024, and 5% (4 bp) higher than pre-pandemic Dec-2019. The high right of repossessions in 2019 (blue line) was driven by Santander. March-2025 data point removed from trend line given Exeter’s SEC-submitted error correction action resulting in a significant March-2025 spike (not shown). Lenders with highest repossession rates for Dec were: Bridgecrest (1.05%), Santander (0.81%), and Exeter (0.76%).

Trend of Below Prime repossessions

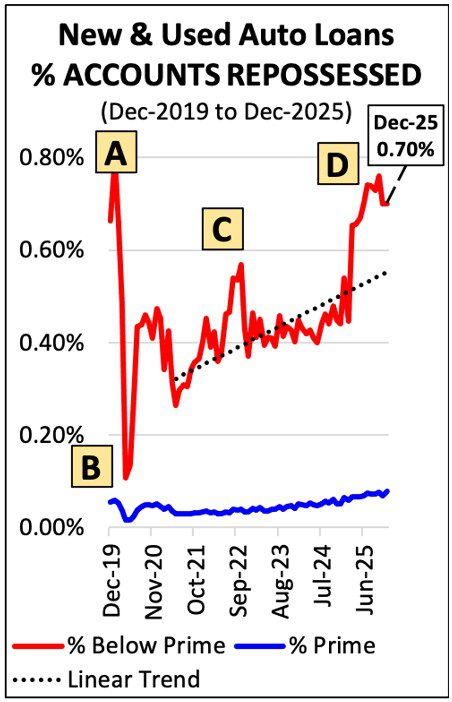

In terms of repossessions, vast majority (82% in Dec) involve obligors with Below Prime credit scores, at time of loan origination (excl loan without a credit score).

Chart below displays monthly first-time repossession rate of Below Prime (red line) and Prime (blue line) accounts from ABS database. Punch line … There is an undeniable, rising rate of repossessions since the pandemic pause; and, repossessions of Below Prime accounts display an erratic (saw-tooth like) month-to-month pattern.

Chart footnotes: [A] Pre-pandemic Santander-driven spike. [B] Industry-wide pandemic pause in repossessions. [C] Spike driven by Exeter’s rapid growth in repossession production leading up to Nov-2022 when it suddendly ceased reporting nearly all repossessions on form ABS-EE exhibit 102. [D] Second spike driven by Exeter’s return to reporting repossessions on a monthly basis. Chart excludes Exeter’s reporting of nearly 86K repossessions in Mar-2025, but it does include their repossessions from May forward.

Trend of Prime and Below Prime Repossessions(all months Dec-2019 to Dec-2025)

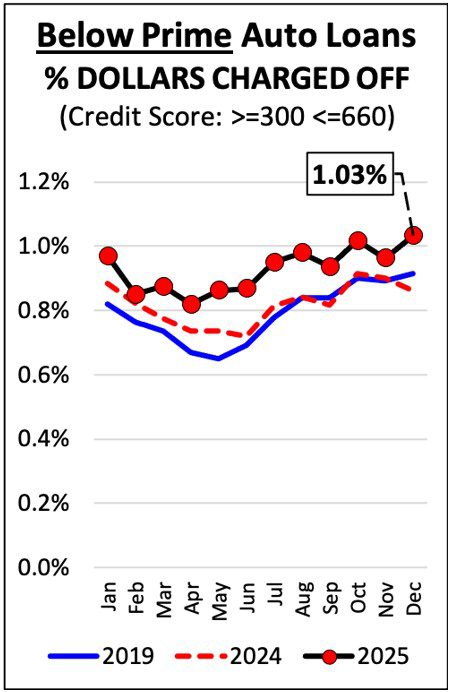

The final chart, created from the ABS dataset, reflects gross charge-off rates. Numerator: Gross dollars charged-off in month. Denominator: Total dollars outstanding at month end.

Dec-2025 Below Prime gross charged off dollars at 1.03% are 20% (17 bp) above Dec-2025, and 13% (12 bp) higher than pre-pandemic Dec-2019. Bridgecrest had highest Below Prime gross charged off rate in Dec-2025 (1.47%), followed by Exeter (1.13%) and Santander (1.09%).

Trend of Below Prime gross charged-off dollars as % of dollars outstanding

Prudent lenders continually search for and test actions to mitigate delinquencies / losses, support positions with facts, and benchmark.

–

ABS Data Pool

The currently active publicly offered ABS include the following banks, finance companies, and manufacturer captives: Ally Bank (AART), Bridgecrest Acceptance Corporation (BLAST), Capital One (COPAR), CarMax Business Services (CAOT & CMXS), Carvana (CRVNA), Exeter Finance (EART & ESART), Fifth Third Bank (FTAT), Ford Motor Credit Company (FCAOT), AmeriCredit Financial Services d/b/a GM Financial (GMCAR & AMCAR), American Honda Finance Corporation (HAROT), Hyundai Capital America (HART), Mercedes-Benz Financial Services (MBART), Nissan Motor Acceptance Company (NAROT), Santander Consumer USA (SDART & DRIVE), Toyota Motor Credit Corporation (TAOT), VW Credit (VALET), and World Omni Financial Corp (WOART & WOSAT).

Active lenders excluded this month, as data not yet available: BMW Financial Services (BMWOT).

February 1, 2026 – Extracted from 101-page monthly report of U.S. auto loan detail.

–

The Author

Commercial and Consumer Auto Finance Industry Knowledge

Full monthly report (98-pages of auto loan information) is $1,500 per month; additional queries and analysis available.

–

Related Article

Below Prime Auto Loans … 2025 a Year of Record Highs! – Below Prime Auto Loans … 2025 a Year of Record Highs! – Below Prime Auto Loans … 2025 a Year of Record Highs!

Below Prime Auto Loans … 2025 a Year of Record Highs! – Repossession – Repossess – Repossession – Lending – Subprime Auto Loans – Subprime Auto Loans – Auto Loan – Delinquency

More Stories

Husband and Wife Face Racketeering Charges in Luxury Vehicle Title Fraud

Fraud is Top-of-Mind for Nearly Nine-in-Ten Auto Dealers

Dead Man’s Signature Foils Title Wash Scheme