EDITORIAL

When I started writing this story, I assumed that the presses focus on violence and litigation in the repossession industry was unusually high. After some investigation, I’m not sure it isn’t but, I do know that the industry has long been under the microscope of the press and the public who have always watched with great skepticism. While this brief history is in no way all inclusive, I do feel it provides some level of perspective as we trudge through this recession and the potential changes that confront all collectors and collection industry professionals in the years to come.

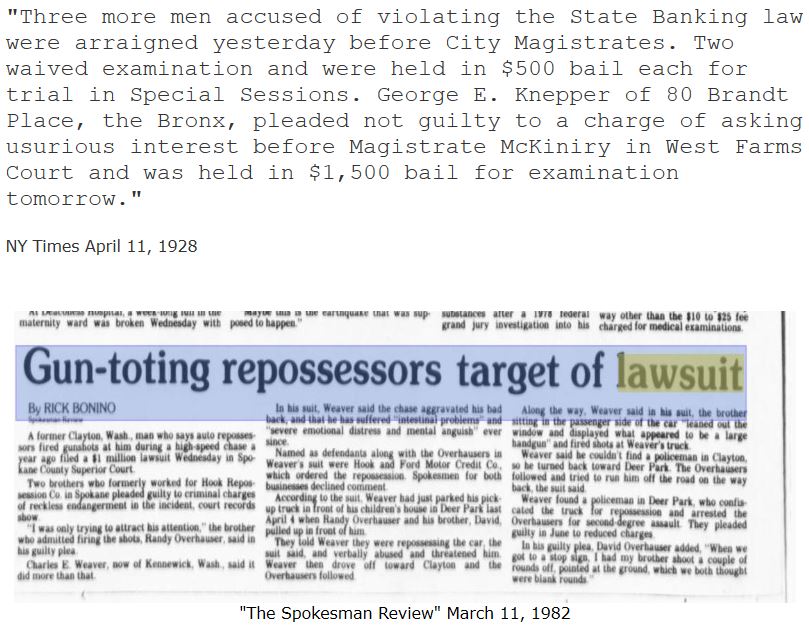

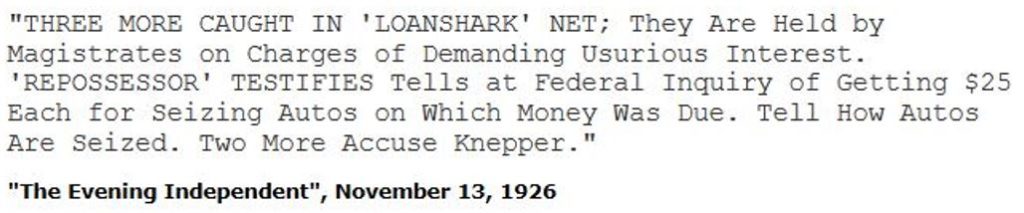

As long as there have been auto loans, there have been repossessors. The press has always had both a curious fascination with the business as well as a critical view of it. As far back as 1926, editors have been critical of the self help repossession methods and have characterized recovery agents as thugs and vigilantes. Throughout the history of repossessions lawsuits and demands from both the public and the press for the reigning in of the repossession industry has been sought after. Incidents of death and injury have always persisted and regardless of whatever the future holds for the industry, the action of repossession will always lend itself to violence.

Interviews

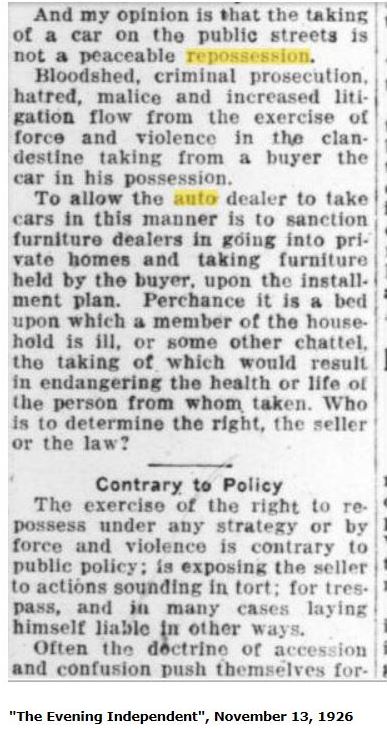

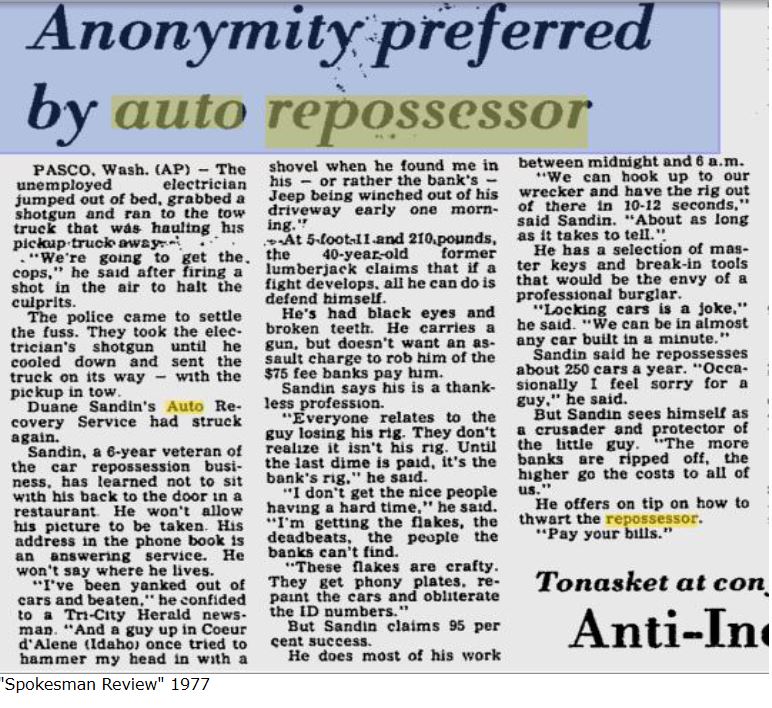

I think it must be human nature to want to have attention drawn to themselves regardless of their endeavor. That is not to say there is anything wrong with a recovery agent being proud of their job and their profession. I was an agent and am proud of the work I did as should every recovery agent be proud of the sacrifices and risks they take. Regardless of how many interviews and documentaries, the recovery industry will never be understood by those who have never walked in the shoes. Despite this and the fact adjusters are frequently despised and can find themselves in danger on and off the job by angry debtors, there is and always have been agents who allow themselves to be interviewed and filmed on the job and allow members of the press to accompany them in their work.

Litigation

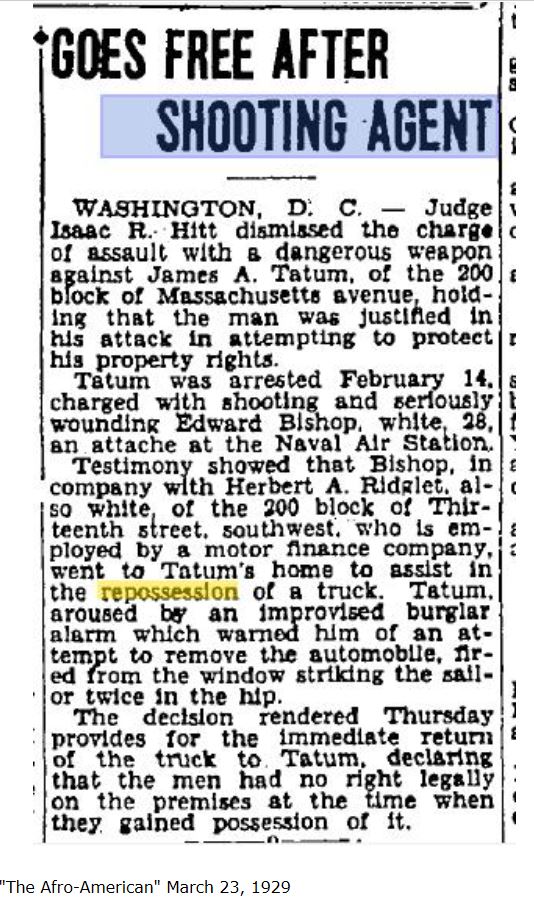

As the result of unregulated collections and repossession activity and the new found availability of credit to the public in the 1920’s, a sudden reality of the consequences of default hit the public and emerged as news for the press. As perceived wrong doings and impropriety occurred, the specter of the tort lawsuit emerged and became a precedent that would assail the industry eternally.

While much of these lawsuits were valid and rightful, they seemed to vary dependent upon the locale. Urban centers seemed to be less sensitive to such issues whereas the term “usury” and the biblical and moral implications of it were frequently associated with any type of lending.

Odd enough, the repossession of farming equipment, cattle, livestock and farms predates automobile repossession but it is in its retail nature that it’s scorn truly took roots.

Violence

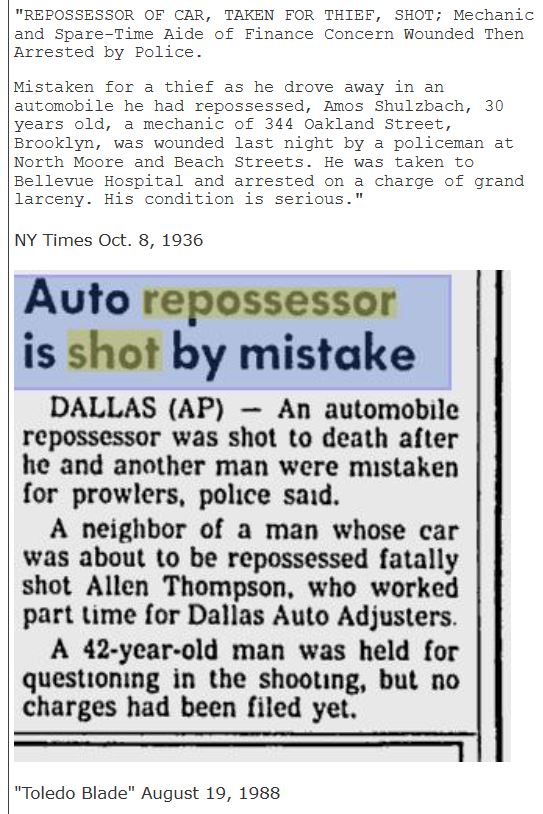

Guns and cars are and always have been part of America, and it should be of little surprise that as one would attempt to deprive one of the latter, the first would come into play.

In the industries early days, repossessors were frequently just local car thieves hired by lenders or car dealers to perform the function. And since their methods were identical, both the police and debtors have always been and still are prone to assaulting or shooting recovery agents.

Death and repossession go back as far as the early 1920’s and, just as today, there are those who feel it’s what agents deserve for “creeping around in the middle of the night like thieves.”

While we all watch the changes that occur around us, it is important to keep in mind the long history of the repossession and collections industry and how it has prevailed under sharp criticism through the years. While we may feel that we are in unique times, and perhaps we are, only history will say just how unique they are.

Kevin Armstrong

Originally Published 2010

Facebook Comments