Proposed Ruling Would Automatically Block Many Collections Calls

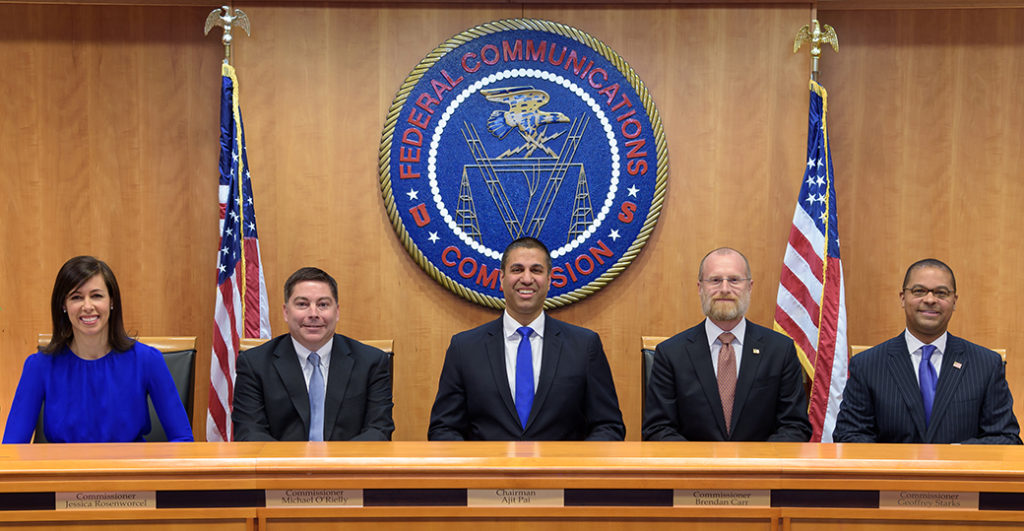

4 June 2019 – It isn’t often that the Credit Union National Association (CUNA), the American Bankers Association (ABA) and the ACA International agree to much, but the FCC’s proposal to allow telephone companies to block unwanted calls via an algorithm has caused concern for everyone in the financial services and healthcare industries that the unintended consequences would knowingly, block many collection calls.

On May 30, a total of ten trade groups urged that the Federal Communications Commission (FCC) to seek feedback before moving forward on its proposal to allow telephone companies to block unwanted calls.

The FCC’s draft declaratory ruling, expected to be voted on during the agency’s June 6 meeting, would permit voice service providers to enroll customers automatically in a call-blocking program that is “based on any reasonable analytics designed to identify unwanted calls.” The ability for customers to opt out of the program would be required. If adopted, the ruling would be effective immediately.

While not explicitly stated, the participation of the ACA International (fka; American Collectors Association) makes very clear the deepest concerns that the definition of “unawanted calls” and their own estimate that more than half of all calls that would be blocked would be collections calls, include calls from banks, credit unions and debt collectors of all types. This program, if implemented as is, could render most collections calls, except those opted out of the program, useless. The impact on delinquency, losses and the lost recoveries could be catastrophic to the entire financial services industries.

The participating trade associations expressed their concern that legitimate bank and credit union calls are currently being incorrectly labeled as spam or nuisance and may be blocked under the declaratory ruling. “Public safety alerts, fraud alerts, data security breach notifications, product recall notices, healthcare and prescription reminders and power outage updates all could be inadvertently blocked under the draft declaratory order, among other time-sensitive calls,” the group said in their letter.

Read the Draft Declaratory Ruling

Illustrating the FCC’s high degree of ambivalence to the inclusion of collections calls is evidenced in the Declaratory Ruling in Section II.9 where they state; “These sources do not generally differentiate between legal and illegal calls, wanted and unwanted, but they do offer some description of the calls. For example, over 30% of the calls reported by Hiya are classified as “general spam” and not fraud or other illegal activity, and approximately 20% are “telemarketing.” More than half of the top 20 spam callers identified by YouMail are categorized as debt collection callers. And First Orion projects that 44.6% of calls to mobile phones will be scam calls in 2019, and that neighbor spoofing will increase to the point where nine out of ten scam calls will be from a familiar area code in 2019.”

The trade groups joining forces in the joint letter were; ACA International, The American Bankers Association, the American Association of Healthcare Administrative Management, American Financial Services Association, Consumer Bankers Association, Credit Union National Association, Independent Community Bankers of America, Mortgage Bankers Association, National Association of Federally-Insured Credit Unions, and National Retail Federation.

Facebook Comments